NuScale Power: A Deep Dive into Stock Performance

Nuscale power stock price – NuScale Power, a pioneer in small modular reactor (SMR) technology, presents a compelling investment opportunity within the evolving nuclear energy landscape. This analysis explores the company’s history, technology, financial performance, competitive positioning, and potential future stock price movements, offering a comprehensive perspective for investors considering NuScale Power.

NuScale Power Company Overview

Source: nanalyze.com

NuScale Power Corporation, established in 2007, is a leading developer of SMR technology. Its business model centers on designing, licensing, and deploying these advanced reactors, offering a safer, more efficient, and potentially more cost-effective alternative to traditional large-scale nuclear power plants. NuScale’s innovative SMR design utilizes a passive safety system, significantly reducing the risk of accidents. The modular nature allows for flexible deployment and scalability, adapting to diverse energy needs.

Key partnerships include those with Fluor Corporation for engineering, procurement, and construction, and various utilities and government entities worldwide, securing vital project development and deployment.

| Project Name | Location | Status | Partner(s) |

|---|---|---|---|

| Carbon Free Power Project (CFPP) | Idaho National Laboratory (INL), USA | Under Construction (First commercial SMR deployment) | Utah Associated Municipal Power Systems (UAMPS) |

| Romania Project | Romania | Pre-construction/Development | Nuclearelectrica |

| Other potential projects | Various locations (USA, Poland, etc.) | Planning/Early Development | Various partners |

Factors Influencing NuScale Power Stock Price

Source: tipranks.com

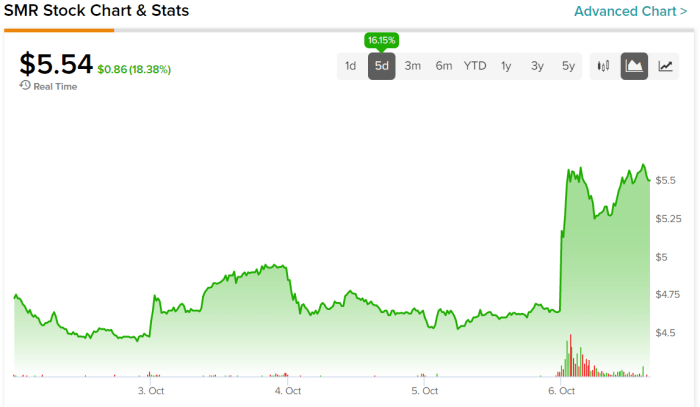

Several factors significantly influence NuScale’s stock price. Macroeconomic conditions, such as interest rate fluctuations and inflation, impact investor sentiment towards growth stocks. Government regulations and policies concerning nuclear energy, including licensing processes and subsidies, directly affect NuScale’s operational environment and future prospects. Furthermore, investor sentiment and overall market trends play a crucial role. Finally, NuScale’s performance relative to competitors in the renewable energy sector, especially other SMR developers, also impacts its valuation.

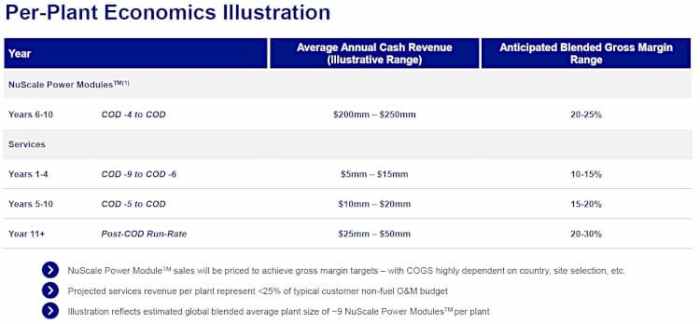

Financial Performance and Valuation

Analyzing NuScale’s financial statements reveals its revenue growth trajectory and profitability. Key financial ratios, such as the price-to-earnings (P/E) ratio and return on equity (ROE), provide insights into the company’s financial health and potential for future returns. Valuation methods, including discounted cash flow (DCF) analysis and comparable company analysis, are employed to estimate the intrinsic value of NuScale’s stock.

| Year | Revenue (USD Millions) | Earnings Per Share (USD) |

|---|---|---|

| 2023 (Projected) | Data not available publicly yet | Data not available publicly yet |

| 2022 | Data not available publicly yet | Data not available publicly yet |

| 2021 | Data not available publicly yet | Data not available publicly yet |

| 2020 | Data not available publicly yet | Data not available publicly yet |

| 2019 | Data not available publicly yet | Data not available publicly yet |

Market Analysis and Future Outlook

The market for SMRs is experiencing significant growth, driven by increasing demand for clean energy and concerns about climate change. NuScale’s technology is well-positioned to capitalize on this market opportunity. However, challenges remain, including regulatory hurdles, construction timelines, and competition from other SMR developers and renewable energy sources. Positive catalysts could include successful project completion, securing additional contracts, and favorable regulatory developments.

Negative catalysts might involve cost overruns, regulatory delays, or negative investor sentiment towards nuclear energy.

NuScale’s Competitive Landscape, Nuscale power stock price

Source: marketbeat.com

NuScale competes with other SMR developers and traditional large-scale nuclear power plant manufacturers. NuScale’s key differentiators include its passive safety system, modular design, and established partnerships. These factors contribute to its competitive advantage, potentially leading to a higher stock valuation compared to competitors. However, intense competition and technological advancements could pose challenges.

- Passive safety system reducing operational risks.

- Modular design enabling flexible deployment and scalability.

- Strong partnerships securing project development and financing.

Illustrative Scenarios for Stock Price Movement

Three scenarios illustrate potential stock price movements over the next year. These scenarios are based on various assumptions regarding project milestones, regulatory approvals, market conditions, and investor sentiment. The visual representation would be three lines on a graph representing stock price over time. A bullish scenario would show a steep upward trend, a neutral scenario would show a relatively flat line with minor fluctuations, and a bearish scenario would show a downward trend.

- Bullish Scenario: Successful completion of the CFPP project, securing several new contracts, and positive regulatory developments could lead to a significant increase in stock price, driven by increased investor confidence and market demand.

- Neutral Scenario: Moderate progress on existing projects, some contract wins, but also challenges in securing additional funding or regulatory delays could lead to relatively stable stock prices, reflecting a balance between positive and negative factors.

- Bearish Scenario: Significant delays in project timelines, cost overruns, negative regulatory decisions, or broader negative sentiment towards nuclear energy could result in a decline in stock price.

FAQ Insights: Nuscale Power Stock Price

What are the major risks associated with investing in NuScale Power?

Keeping an eye on the Nuscale Power stock price is interesting, especially considering the potential of small modular reactors. It’s worth comparing its performance to other companies in the energy sector, like checking the nfg stock price for a different perspective on market trends. Ultimately, though, the Nuscale Power stock price will depend on its own technological advancements and market adoption.

Major risks include regulatory delays, technological challenges, competition from other SMR developers, and fluctuations in the broader energy market. Geopolitical events and public perception of nuclear energy also play a role.

How does NuScale’s technology differ from traditional nuclear reactors?

NuScale’s SMRs are significantly smaller and safer than traditional reactors. Their modular design allows for flexible deployment and reduces the overall risk associated with large-scale nuclear power plants.

Where can I find NuScale’s financial statements?

NuScale’s financial statements are typically available on their investor relations website and through major financial data providers like the SEC’s EDGAR database.

What is the current market capitalization of NuScale Power?

The current market capitalization fluctuates and should be checked on a reputable financial website that provides real-time market data.