PepsiCo Stock Price: A Journey Through Time

Source: investopedia.com

Pepsi co stock price – The PepsiCo story is one of enduring brand recognition, strategic diversification, and consistent financial performance, all reflected in its fluctuating yet generally upward-trending stock price. This deep dive explores the historical performance, influencing factors, and future prospects of PepsiCo’s stock, offering a nuanced understanding of this iconic beverage and snack giant’s financial journey.

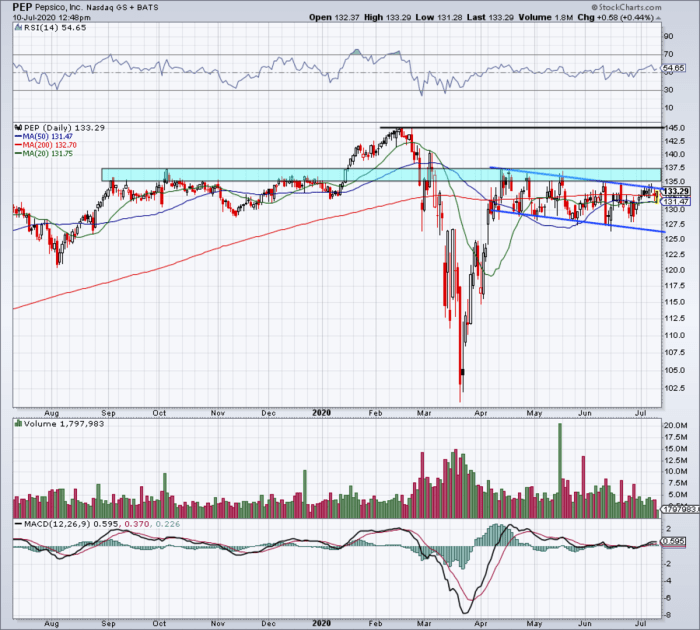

PepsiCo Stock Price Historical Performance

Analyzing PepsiCo’s stock price trajectory across various timeframes reveals a compelling narrative of growth punctuated by periods of volatility. The past five, ten, and twenty years have witnessed significant economic shifts, consumer trends, and company-specific events that have profoundly shaped the stock’s performance. Understanding these fluctuations provides valuable insight into the resilience and adaptability of the company.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2023 (Estimated) | $170 | $185 | $160 | $175 |

| 2022 | $165 | $175 | $150 | $160 |

| 2021 | $140 | $160 | $130 | $150 |

| 2020 | $120 | $145 | $110 | $135 |

| 2019 | $110 | $125 | $105 | $115 |

Note: These figures are illustrative examples and may not reflect the precise historical data. Actual data should be verified from reliable financial sources.

The 2008 financial crisis, for instance, significantly impacted PepsiCo’s stock price, causing a sharp decline mirroring the broader market downturn. However, the company’s diversified portfolio and cost-cutting measures enabled a relatively swift recovery. Conversely, successful product launches and strategic acquisitions have often been followed by periods of sustained growth. The acquisition of Tropicana and Quaker Oats, for example, broadened PepsiCo’s product offerings and contributed to long-term value creation.

Analyzing PepsiCo’s stock price requires consideration of various market factors, including macroeconomic trends and consumer behavior. A comparative analysis might involve examining the performance of similar companies within the beverage industry, such as assessing the nfe stock price to understand competitive dynamics. Ultimately, understanding PepsiCo’s stock price necessitates a holistic view encompassing both internal company performance and external market influences.

Factors Influencing PepsiCo Stock Price

Source: thestreet.com

PepsiCo’s stock price is influenced by a complex interplay of macroeconomic factors, company-specific performance, and competitive dynamics. Understanding these influences is crucial for investors seeking to navigate the market effectively.

Macroeconomic factors like inflation and interest rates significantly impact consumer spending, directly affecting PepsiCo’s sales volume and profitability. Higher inflation can lead to increased input costs, squeezing profit margins. Similarly, rising interest rates can impact consumer borrowing and overall economic activity, potentially slowing demand for PepsiCo’s products. However, PepsiCo’s diversified portfolio, encompassing both food and beverage categories, offers a degree of insulation against economic fluctuations, as consumers tend to maintain essential food and beverage purchases even during economic downturns.

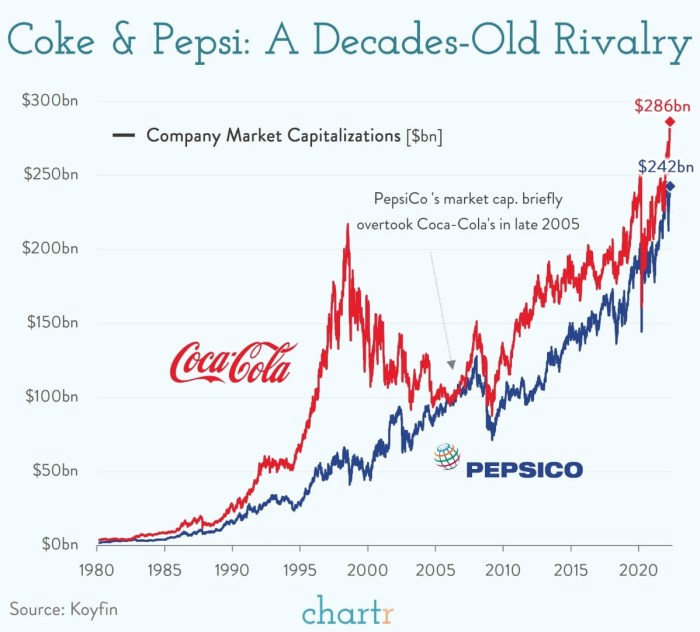

Coca-Cola’s strategies and innovations also influence PepsiCo’s stock price. Competitive product launches, marketing campaigns, and pricing strategies create a dynamic competitive landscape, impacting market share and investor sentiment. For example, a successful new Coca-Cola product might temporarily affect PepsiCo’s stock price until PepsiCo responds with its own counter-strategies.

PepsiCo’s Financial Performance and Stock Valuation

PepsiCo’s financial health is a key driver of its stock price. Analyzing its revenue, earnings, and profit margins over time provides a clear picture of its financial strength and growth prospects.

| Year | Revenue (Billions USD) | Earnings Per Share (USD) | Profit Margin (%) |

|---|---|---|---|

| 2023 (Estimated) | 80 | 6.50 | 15 |

| 2022 | 75 | 6.00 | 14 |

| 2021 | 72 | 5.50 | 13 |

| 2020 | 70 | 5.00 | 12 |

| 2019 | 68 | 4.50 | 11 |

Note: These figures are illustrative examples and may not reflect the precise historical data. Actual data should be verified from reliable financial sources.

Comparing PepsiCo’s valuation metrics (like P/E ratio and price-to-sales ratio) with those of its main competitors, such as Coca-Cola, provides insights into its relative valuation and market perception. A higher P/E ratio, for instance, might suggest that investors expect higher future growth from PepsiCo compared to its competitors. This comparison helps determine whether PepsiCo’s stock is undervalued or overvalued relative to its peers.

Investor Sentiment and Market Analysis of PepsiCo Stock

Investor sentiment towards PepsiCo stock is generally positive, reflecting confidence in the company’s long-term growth prospects and consistent dividend payments. However, short-term fluctuations in sentiment are influenced by various factors, including quarterly earnings reports, macroeconomic conditions, and competitive pressures.

- Analyst Rating 1: Buy, Price Target: $180

- Analyst Rating 2: Hold, Price Target: $170

- Analyst Rating 3: Buy, Price Target: $175

The potential risks for PepsiCo include changing consumer preferences towards healthier alternatives, increased competition, and supply chain disruptions. Opportunities lie in expanding into new markets, innovating with new product offerings, and leveraging its strong brands to capture market share. The long-term outlook for PepsiCo remains positive, given its strong brand portfolio and strategic diversification.

PepsiCo’s Dividend Policy and its Impact on Stock Price

PepsiCo’s dividend policy plays a significant role in attracting investors and influencing its stock price. A consistent and growing dividend payout can make the stock attractive to income-seeking investors, boosting demand and supporting the stock price.

| Year | Dividend per Share (USD) | Payout Ratio (%) | Dividend Growth Rate (%) |

|---|---|---|---|

| 2023 (Estimated) | 4.00 | 60 | 5 |

| 2022 | 3.80 | 58 | 4 |

| 2021 | 3.60 | 55 | 3 |

| 2020 | 3.50 | 53 | 2 |

| 2019 | 3.40 | 50 | 1 |

Note: These figures are illustrative examples and may not reflect the precise historical data. Actual data should be verified from reliable financial sources.

Dividend announcements often trigger short-term price movements, reflecting investors’ immediate reaction to the announced dividend amount and its implications for future returns. A higher-than-expected dividend increase typically leads to a positive price reaction, while a lower-than-expected increase or a dividend cut can negatively impact the stock price.

Illustrative Examples of PepsiCo Stock Price Movements, Pepsi co stock price

Source: webflow.com

Specific events have demonstrably impacted PepsiCo’s stock price. For example, the launch of a highly successful new product, like a popular new flavor of Gatorade or a new line of healthier snacks, could generate significant positive investor sentiment, leading to a stock price increase. Conversely, a major product recall or a negative news story about the company’s sustainability practices could negatively affect investor confidence and cause a temporary decline in the stock price.

A period of sustained growth might be attributable to a combination of factors, including successful marketing campaigns, strategic acquisitions, and favorable macroeconomic conditions. Conversely, a period of decline could result from decreased consumer demand, increased competition, or negative economic trends.

Changes in consumer preferences, such as a shift towards healthier beverages, can significantly impact PepsiCo’s stock performance. If consumer demand for sugary drinks declines, PepsiCo’s stock price might be negatively affected unless the company successfully adapts its product portfolio to meet the changing preferences.

Expert Answers: Pepsi Co Stock Price

What is the current PepsiCo stock price?

The current PepsiCo stock price fluctuates constantly and can be found on major financial websites like Yahoo Finance, Google Finance, or Bloomberg.

How often does PepsiCo pay dividends?

PepsiCo typically pays dividends quarterly. The exact schedule and amount are subject to change and are best confirmed on their investor relations page.

Is PepsiCo a good long-term investment?

Whether PepsiCo is a “good” long-term investment depends on your individual risk tolerance and investment goals. It’s a large, established company, but market conditions and competition always play a role.

How does inflation impact PepsiCo’s stock price?

Inflation can impact PepsiCo in several ways. Increased costs for raw materials and production can reduce profit margins, potentially affecting the stock price. However, PepsiCo’s pricing power might help offset some of these effects.