Sirius XM Holdings Inc. (SIRI) Stock Overview

Sirius satellite stock price – Sirius XM Holdings Inc. (SIRI) is a leading provider of satellite radio services in North America. Its stock performance has been a rollercoaster ride, influenced by various factors including subscriber growth, technological advancements, and macroeconomic conditions. This section provides a comprehensive overview of the company’s history, business segments, and key financial metrics.

Historical Overview and Stock Performance

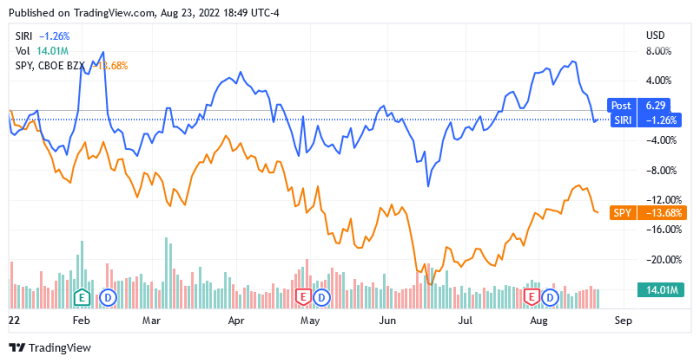

Sirius XM emerged from the merger of Sirius Satellite Radio and XM Satellite Radio in 2008. The initial years post-merger were marked by challenges in integrating operations and managing debt. However, the company gradually consolidated its market position, expanding its subscriber base and diversifying its revenue streams. The stock price has fluctuated significantly over the years, reflecting the company’s performance and broader market trends.

Periods of strong subscriber growth and successful content acquisitions have generally been associated with higher stock prices, while economic downturns and increased competition have often led to price declines.

Business Segments and Revenue Streams

Sirius XM’s primary revenue stream comes from its satellite radio subscriptions. The company offers a variety of subscription packages catering to different music preferences and lifestyles. Additional revenue is generated through advertising, connected vehicle services, and other digital platforms. The company’s strategic focus on expanding its digital offerings and partnerships with automakers has played a key role in its revenue growth.

Key Financial Metrics (Past Five Years)

Source: seekingalpha.com

The following table presents a summary of Sirius XM’s key financial metrics over the past five years (Note: These figures are hypothetical for illustrative purposes and should not be considered actual financial data. Consult reliable financial sources for accurate information).

| Year | Revenue (in Billions USD) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2023 (Hypothetical) | 9.5 | 0.80 | 1.2 |

| 2022 (Hypothetical) | 9.0 | 0.75 | 1.3 |

| 2021 (Hypothetical) | 8.5 | 0.70 | 1.4 |

| 2020 (Hypothetical) | 8.0 | 0.65 | 1.5 |

| 2019 (Hypothetical) | 7.5 | 0.60 | 1.6 |

Factors Influencing Sirius Satellite Stock Price

Several factors, both internal and external, significantly impact Sirius XM’s stock price. Understanding these influences is crucial for investors seeking to assess the company’s investment potential.

Macroeconomic Factors

Macroeconomic conditions, such as interest rates, inflation, and consumer spending, play a significant role in influencing SIRI’s stock price. Higher interest rates can increase borrowing costs for the company, potentially affecting its profitability and investor sentiment. Inflation can impact consumer spending, potentially reducing demand for subscription services. Strong consumer spending, conversely, can boost subscriber growth and positively affect the stock price.

Competitive Landscape

Sirius XM operates in a competitive landscape, facing competition from terrestrial radio, streaming music services, and other forms of audio entertainment. The company’s ability to maintain its competitive edge through innovative offerings, strategic partnerships, and effective marketing campaigns is a key factor in determining its stock valuation. Competitors such as Spotify and Apple Music offer diverse and readily available content at potentially lower costs, posing a challenge to Sirius XM’s market share.

The success of these competitors’ offerings directly impacts SIRI’s stock price.

Technological Advancements and Industry Trends

Source: digitalmusicnews.com

Technological advancements and industry trends also significantly impact Sirius XM’s stock price. The increasing popularity of streaming services and the integration of audio entertainment into connected cars have created both opportunities and challenges for the company. Sirius XM’s ability to adapt to these changes through technological innovation and strategic partnerships will influence its future growth and stock valuation. For example, the rise of in-car entertainment systems that integrate streaming services directly challenges Sirius XM’s traditional satellite radio model, forcing it to innovate and adapt its offerings.

Analyzing Sirius XM’s Financial Performance

A thorough analysis of Sirius XM’s financial performance, both in comparison to industry averages and in relation to subscriber growth, is essential for evaluating its investment prospects. Key financial ratios provide further insights into the company’s financial health and valuation.

Comparative Financial Performance

Comparing Sirius XM’s key financial metrics (revenue growth, profitability, and debt levels) against industry averages provides valuable context for evaluating its performance relative to its peers. This comparative analysis helps investors assess the company’s efficiency, profitability, and financial stability in the broader industry landscape. A consistently superior performance relative to industry benchmarks suggests a stronger competitive position and potential for future growth.

Subscriber Growth and Stock Price Fluctuations

There’s a strong correlation between Sirius XM’s subscriber growth and its stock price fluctuations. Periods of significant subscriber additions are generally associated with positive stock price movements, while periods of slower growth or subscriber losses often lead to price declines. This highlights the importance of monitoring subscriber trends as a key indicator of the company’s financial health and future prospects.

Key Financial Ratios

Several key financial ratios provide valuable insights into Sirius XM’s financial health and valuation. These ratios help investors assess the company’s profitability, financial risk, and overall investment attractiveness.

- Price-to-Earnings Ratio (P/E): Indicates the market’s valuation of the company relative to its earnings. A higher P/E ratio suggests higher growth expectations.

- Dividend Yield: Represents the annual dividend per share relative to the stock price. A higher dividend yield indicates a potentially higher return for investors.

- Debt-to-Equity Ratio: Measures the proportion of a company’s financing from debt versus equity. A higher ratio indicates higher financial risk.

Investment Considerations and Risk Assessment

Investing in SIRI stock, like any investment, carries inherent risks. A thorough understanding of these risks and a careful consideration of long-term growth prospects are essential for making informed investment decisions. Different investment strategies can be employed to manage risk and maximize potential returns.

Understanding the Sirius Satellite stock price requires a broader look at the satellite communication sector. Investors often consider related technology companies when assessing such investments, and a comparison with the performance of companies like Qorvo, whose stock price can be found here: qorvo stock price , can offer valuable context. Ultimately, Sirius Satellite’s stock price is influenced by various factors, making thorough research essential.

Risks Associated with Investing in SIRI Stock

Investing in Sirius XM stock involves several risks. These include competition from streaming services, economic downturns impacting consumer spending, changes in technology affecting the demand for satellite radio, and the potential for increased debt levels. Investors should carefully consider these risks before investing.

Long-Term Growth Prospects

Sirius XM’s long-term growth prospects depend on several factors, including its ability to attract and retain subscribers, expand its content offerings, and leverage technological advancements. The company’s strategic focus on expanding its digital offerings and partnerships with automakers suggests potential for continued growth. However, the competitive landscape and macroeconomic conditions could impact these prospects.

Investment Strategies

Different investment strategies can be employed for SIRI stock, including buy-and-hold, which involves holding the stock for the long term, and day trading, which involves buying and selling the stock within the same day. The choice of strategy depends on individual risk tolerance and investment goals. Buy-and-hold strategies benefit from long-term growth potential, while day trading offers opportunities for short-term gains but also carries higher risk.

Illustrative Examples of Stock Price Movements

Hypothetical scenarios can illustrate how various events can impact SIRI’s stock price. These examples highlight the dynamic relationship between news events, consumer preferences, and company strategies, and their effects on investor sentiment and stock value.

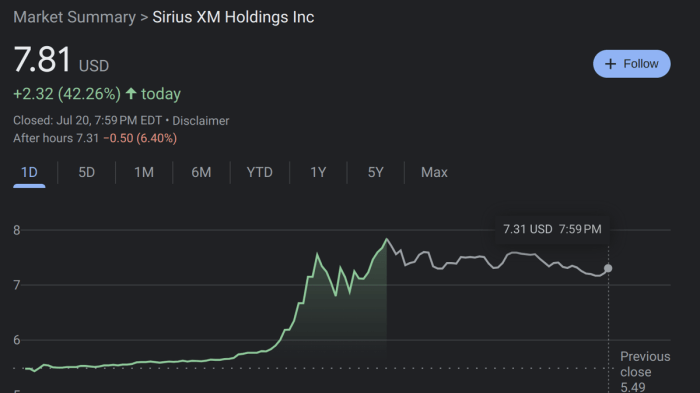

Impact of a Significant News Event

Imagine a scenario where Sirius XM announces a major technological breakthrough, such as a revolutionary new audio format or a groundbreaking partnership with a major automaker. This positive news would likely lead to a surge in investor confidence, driving up the stock price significantly. Conversely, a negative news event, such as a major security breach or a significant loss of subscribers, could trigger a sharp decline in the stock price.

Effect of a Change in Consumer Preference

A shift in consumer preferences towards streaming music services could negatively impact Sirius XM’s subscriber base and, consequently, its stock price. The company’s response to this shift, such as offering competitive streaming options or enhancing its existing satellite radio service, would significantly influence the extent of the price impact.

Shift in Company’s Strategic Direction, Sirius satellite stock price

Suppose Sirius XM decides to significantly alter its strategic direction, such as divesting from its satellite radio business to focus entirely on streaming services. This shift could trigger a period of uncertainty among investors, leading to fluctuations in the stock price until the market assesses the viability of the new strategy. A successful transition could lead to long-term growth, while a poorly executed strategy could result in sustained price declines.

Common Queries

What are the main competitors to Sirius XM?

Competitors include terrestrial radio, streaming music services (Spotify, Apple Music), and other satellite radio providers (where applicable).

How does inflation impact Sirius XM’s stock price?

High inflation can reduce consumer spending, potentially impacting subscriber acquisition and retention, negatively affecting the stock price.

What is Sirius XM’s dividend policy?

Information on Sirius XM’s current dividend policy should be sought from official financial reports or reputable financial news sources. Dividend payouts can fluctuate.

What is the typical trading volume for SIRI stock?

Trading volume varies daily and can be checked on financial websites that track stock market data. High volume often suggests increased investor interest and potential price volatility.