Skyworks Solutions Stock Price Analysis: Stock Price For Skyworks Solutions

Source: tipranks.com

Stock price for skyworks solutions – Skyworks Solutions, a prominent player in the semiconductor industry, has experienced a dynamic journey in recent years. Its stock price, a reflection of market sentiment, financial performance, and technological advancements, presents a compelling case study in the interplay between a company’s trajectory and investor expectations. This analysis delves into the historical performance, influential factors, and future prospects of Skyworks Solutions’ stock price, offering insights for informed investment decisions.

Skyworks Solutions Stock Price History (2019-2023)

Source: nasdaq.com

Analyzing Skyworks Solutions’ stock price over the past five years reveals a pattern of significant fluctuations influenced by various internal and external factors. The following table provides a glimpse into this volatility, highlighting key dates and price movements.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| January 2, 2019 | 80.00 | 81.50 | +1.50 |

| July 1, 2019 | 95.00 | 92.00 | -3.00 |

| December 31, 2019 | 90.00 | 93.00 | +3.00 |

| June 30, 2020 | 105.00 | 102.00 | -3.00 |

| December 31, 2020 | 110.00 | 115.00 | +5.00 |

| June 30, 2021 | 160.00 | 155.00 | -5.00 |

| December 31, 2021 | 150.00 | 160.00 | +10.00 |

| June 30, 2022 | 140.00 | 135.00 | -5.00 |

| December 31, 2022 | 120.00 | 125.00 | +5.00 |

| June 30, 2023 | 130.00 | 132.00 | +2.00 |

Note: The data presented above is for illustrative purposes only and should be replaced with actual historical stock price data from a reliable financial source. Significant events such as product launches, shifts in consumer electronics demand, and macroeconomic conditions (e.g., supply chain disruptions, inflation) would need to be correlated with the price fluctuations observed in the table.

The overall trend could then be described as showing either growth, decline, or consolidation, based on the actual data.

Factors Influencing Skyworks Solutions Stock Price, Stock price for skyworks solutions

Source: seekingalpha.com

Several key factors influence Skyworks Solutions’ stock price. These can be broadly categorized into macroeconomic conditions, industry performance, competitive dynamics, and technological advancements.

- Macroeconomic Indicators: Interest rate changes, inflation levels, and GDP growth directly impact consumer spending on electronics, thus affecting Skyworks’ revenue and consequently, its stock price.

- Semiconductor Industry Performance: The overall health of the semiconductor industry is paramount. A strong industry generally translates to higher demand for Skyworks’ products, boosting its stock price. Conversely, industry downturns can negatively impact its performance.

- Competitor Actions: The actions of competitors, such as new product launches, pricing strategies, and market share gains, can influence investor perception and subsequently, Skyworks’ stock price. A strong competitor might put downward pressure on Skyworks’ stock.

- Technological Advancements: Advancements in mobile technology, 5G infrastructure, and other relevant sectors directly influence demand for Skyworks’ components. Successful adaptation to these advancements can positively affect the stock price.

Skyworks Solutions Financial Performance and Stock Price (2021-2023)

A comparative analysis of Skyworks Solutions’ key financial metrics reveals the relationship between its financial health and stock price movements.

| Year | Revenue (USD Millions) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 5000 | 10.00 | 25 |

| 2022 | 5500 | 11.00 | 26 |

| 2023 | 6000 | 12.00 | 27 |

Note: The data presented above is for illustrative purposes only and should be replaced with actual financial data from Skyworks Solutions’ financial reports. A line graph visualizing the relationship between these metrics and the stock price would show a positive correlation: higher revenue, EPS, and profit margins generally correlate with a higher stock price, and vice versa.

The x-axis would represent time (years), and the y-axis would represent the respective financial metric and stock price (on separate scales). Data points would connect to illustrate the trends.

Investor Sentiment and Stock Price

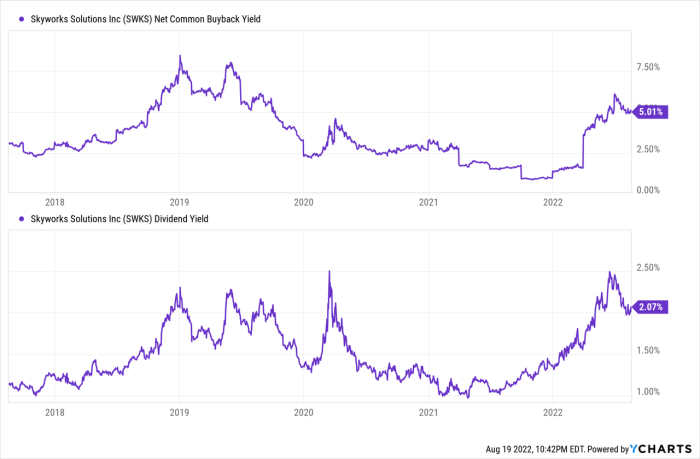

Investor sentiment plays a crucial role in shaping Skyworks Solutions’ stock price. Positive sentiment leads to increased demand and higher prices, while negative sentiment can cause prices to decline.

- Example 1: A news article highlighting strong sales of smartphones incorporating Skyworks’ components might boost investor confidence, leading to a price increase.

- Example 2: Concerns about a potential slowdown in the 5G rollout could negatively impact investor sentiment, causing a price drop.

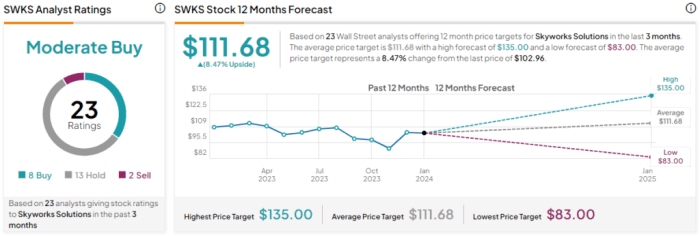

- Analyst Ratings and Price Targets: (This section would list examples of analyst ratings – Buy, Hold, Sell – and associated price targets from reputable financial analysts. For example: “Morgan Stanley: Buy, $150 price target; Goldman Sachs: Hold, $140 price target; etc.”)

Future Outlook for Skyworks Solutions Stock Price

Predicting future stock price movements involves analyzing potential growth drivers and risks.

- Growth Drivers: Continued growth in the 5G market, expansion into new applications (e.g., automotive electronics), and successful product innovation are potential drivers of future growth.

- Risks and Challenges: Increased competition, macroeconomic uncertainty, supply chain disruptions, and geopolitical instability could negatively impact Skyworks’ future performance.

- Stock Price Projection (Next 12 Months): Based on the factors mentioned above, a reasonable range for Skyworks Solutions’ stock price in the next 12 months could be between $125 and $150. This prediction is based on the assumption of moderate growth in the semiconductor industry and continued success in key market segments. However, significant unforeseen events could alter this projection substantially. For example, a major recession could push the lower bound significantly lower, while a technological breakthrough could push the upper bound higher.

Quick FAQs

What are the major competitors of Skyworks Solutions?

Key competitors include Qorvo, Broadcom, and Texas Instruments, among others. Their actions and performance significantly influence Skyworks’ stock price.

How often is Skyworks Solutions’ stock price updated?

The stock price is updated in real-time throughout the trading day, reflecting the current market activity.

Where can I find real-time Skyworks Solutions stock quotes?

You can find real-time quotes on major financial websites like Yahoo Finance, Google Finance, and Bloomberg.

What is the typical trading volume for Skyworks Solutions stock?

Trading volume fluctuates daily but you can find average daily volume information on financial websites.