Parker Hannifin Stock Price Analysis: Stock Price Parker Hannifin

Stock price parker hannifin – Parker Hannifin Corporation (PH) is a global leader in motion and control technologies. This analysis delves into the factors influencing PH’s stock price, examining its financial performance, investor sentiment, and future prospects. We will explore historical performance, key influencing factors, and potential future trajectories.

Parker Hannifin Company Overview

Parker Hannifin is a diversified manufacturing company specializing in motion and control technologies. Its products are used in a wide range of industries, including aerospace, industrial automation, and mobile equipment. The company operates through two main segments: Industrial and Aerospace. The Industrial segment focuses on products for diverse industrial applications, while the Aerospace segment caters to the aerospace and defense sectors.

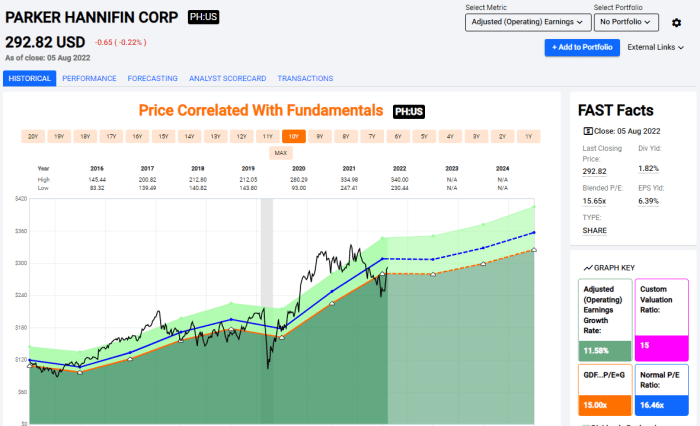

Parker Hannifin’s market position is strong, reflecting its technological expertise and extensive global reach. Its major product lines include hydraulic and pneumatic systems, filtration systems, seals, and electromechanical components. Historically, Parker Hannifin’s stock performance has generally mirrored broader economic trends, with periods of strong growth interspersed with periods of consolidation or decline. The stock has demonstrated resilience through various economic cycles, showing a long-term upward trajectory.

Significant Events Impacting Parker Hannifin Stock Price

Source: seekingalpha.com

Several significant events have shaped Parker Hannifin’s stock price over the years. These include both internal company developments and external macroeconomic factors.

- 2008 Financial Crisis: The global financial crisis significantly impacted Parker Hannifin’s stock price, leading to a sharp decline due to reduced demand across various sectors.

- Acquisitions and Divestments: Strategic acquisitions and divestments have influenced the stock price, with successful acquisitions generally boosting investor confidence and leading to price increases.

- Technological Advancements: The adoption of new technologies and the company’s ability to innovate has impacted the stock price, with successful innovations driving growth and investor interest.

- Changes in Industry Regulations: Changes in industry regulations, such as environmental regulations, can impact the company’s operations and consequently its stock price.

Factors Influencing Parker Hannifin’s Stock Price, Stock price parker hannifin

Source: alamy.com

Parker Hannifin’s stock price performance often reflects broader industrial trends. Understanding the movement of similar industrial stocks is crucial for a comprehensive analysis; for instance, examining the current p a t h stock price can offer insights into sector-wide sentiment. Ultimately, however, a thorough evaluation of Parker Hannifin’s specific financial health and future prospects remains paramount for accurate stock price prediction.

Several key factors influence Parker Hannifin’s stock price. These factors can be categorized into economic indicators, industry trends, competitor actions, and the company’s own performance.

| Factor | Description | Positive Impact | Negative Impact |

|---|---|---|---|

| Economic Indicators (GDP Growth, Inflation) | Overall economic health directly impacts industrial activity and demand for Parker Hannifin’s products. | Strong GDP growth and moderate inflation lead to increased demand and higher stock prices. | Recessions or high inflation reduce demand and negatively impact stock prices. |

| Industry Trends (Automation, Electrification) | Shifts in manufacturing trends towards automation and electrification impact the demand for Parker Hannifin’s specific product lines. | Strong growth in automation and electrification boosts demand for related products. | Slowdown or decline in these trends can reduce demand and negatively affect stock prices. |

| Competitor Actions (New Product Launches, Pricing Strategies) | Actions of competitors, such as new product launches or aggressive pricing, affect market share and profitability. | Successful product differentiation and competitive pricing strategies lead to increased market share and higher stock prices. | Loss of market share due to competitor actions can negatively impact stock prices. |

| Company Performance (Earnings, Revenue Growth) | The company’s financial performance is a primary driver of stock price. | Strong earnings and revenue growth increase investor confidence and lead to higher stock prices. | Weak earnings and revenue decline negatively impact investor confidence and lead to lower stock prices. |

Financial Performance and Stock Valuation

Analyzing Parker Hannifin’s recent financial reports reveals key insights into its financial health and valuation. Comparing these metrics to industry averages provides context for understanding its performance relative to its competitors.

| Year | Revenue (Billions USD) | Net Income (Billions USD) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|---|

| 2022 | (Insert Data) | (Insert Data) | (Insert Data) | (Insert Data) |

| 2021 | (Insert Data) | (Insert Data) | (Insert Data) | (Insert Data) |

| 2020 | (Insert Data) | (Insert Data) | (Insert Data) | (Insert Data) |

| 2019 | (Insert Data) | (Insert Data) | (Insert Data) | (Insert Data) |

| 2018 | (Insert Data) | (Insert Data) | (Insert Data) | (Insert Data) |

Note: Insert actual financial data from reliable sources such as Parker Hannifin’s financial reports or reputable financial news websites.

Investor Sentiment and Market Analysis

News articles, analyst reports, and institutional investor actions significantly influence Parker Hannifin’s stock price. Positive news and strong analyst ratings generally boost investor confidence and drive up the stock price, while negative news or downgrades can have the opposite effect. Institutional investors, with their significant holdings, play a major role in shaping market sentiment and price movements. Overall investor confidence is a crucial determinant of stock price; high confidence leads to increased demand and higher prices, while low confidence can result in selling pressure and lower prices.

Future Outlook and Potential Stock Price Movements

Source: seekingalpha.com

Parker Hannifin’s future stock price trajectory depends on several factors, including growth opportunities, potential risks, and technological advancements. Several potential growth areas exist, including expansion into new markets and the development of innovative products. However, risks and challenges remain, including economic downturns, intense competition, and supply chain disruptions.

- Positive Factors: Continued expansion into high-growth markets, successful product innovation, and strong operational efficiency could lead to increased earnings and higher stock prices.

- Negative Factors: A global economic slowdown, increased competition, or significant supply chain disruptions could negatively impact earnings and lead to lower stock prices.

- Technological Advancements: The adoption of new technologies, such as automation and AI, could significantly impact Parker Hannifin’s operations and profitability, influencing the stock price positively or negatively depending on the company’s ability to adapt and innovate.

A Significant Stock Price Fluctuation

One example of a significant stock price fluctuation for Parker Hannifin could be linked to a specific event, such as a major acquisition or a significant earnings miss. For instance, a large acquisition could initially cause a temporary dip if investors are uncertain about the integration process, but if successful integration leads to synergies and improved earnings, the stock price would likely recover and potentially exceed previous levels.

Conversely, a significant earnings miss, potentially due to unforeseen economic conditions or supply chain issues, could trigger a sharp decline in the stock price as investor confidence erodes. The market reaction would depend on the severity of the event and the company’s response to it. A well-communicated plan to address the challenges could mitigate the negative impact, while a lack of clear communication could exacerbate the decline.

FAQ Summary

What is Parker Hannifin’s dividend yield?

The dividend yield fluctuates; check current financial reports for the most up-to-date information.

How does geopolitical instability affect PH’s stock price?

Geopolitical events can impact supply chains and global demand, leading to price volatility. Specific impacts depend on the nature and severity of the event.

What are the major competitors of Parker Hannifin?

Key competitors vary by market segment but include companies like Eaton, Emerson Electric, and Honeywell.

Where can I find real-time Parker Hannifin stock quotes?

Major financial websites (e.g., Yahoo Finance, Google Finance) provide real-time stock quotes.