Decoding “Sound” Stock Prices: A Pop Culture Take on Wall Street

Stock price s o u n – Ever heard someone on CNBC casually drop the phrase “sound financial footing”? It sounds like something straight out of a 1950s sitcom, right? But in the wild, wild west of the stock market, understanding what “sound” really means for a company’s stock price is crucial. This ain’t your grandpappy’s penny stock game; we’re diving deep into the meaning, the misinterpretations, and the rollercoaster ride of deciphering “sound” stock prices.

Stock Price Fluctuations and “Sound”

The term “sound,” when applied to a company’s financial health, implies stability, profitability, and a low risk of failure. Think of it like a perfectly tuned engine – purring smoothly and ready for the long haul. A “sound” stock price, therefore, reflects investor confidence in this perceived stability. However, the market’s perception of “soundness” can be incredibly subjective and volatile, influenced by everything from quarterly earnings reports to breaking news headlines.

For example, a company consistently exceeding earnings expectations might be deemed to have a “sound” stock price, while a company facing unexpected lawsuits or regulatory hurdles might see its stock price plummet, losing its “sound” reputation overnight.

Investor sentiment plays a huge role. If the market believes a company is on solid ground, even minor dips in the stock price might be seen as buying opportunities. Conversely, negative sentiment can quickly turn a seemingly “sound” stock into a risky investment.

The symphony of the stock price s o u n d, a constant hum of opportunity and risk, resonates differently for each investor. Understanding this sound requires careful listening, and sometimes, specific research, like checking the current performance of companies such as rashtriya chemicals & fertilizers stock price to gain perspective. Ultimately, the stock price s o u n d guides us towards mindful investment decisions, aligning our actions with our inner wisdom.

| Interpretation of “Sound” | Financial Indicators | Impact on Stock Price | Pop Culture Analogy |

|---|---|---|---|

| Strong Fundamentals | High revenue, consistent profits, low debt | Generally stable, upward trend | Beyoncé’s career: consistently successful, always in demand. |

| Stable Growth | Moderate revenue growth, manageable debt, positive cash flow | Steady appreciation, less volatility | A reliable sitcom: consistent ratings, loyal fanbase. |

| Resilient to Market Downturns | Low correlation with market indices, diversified revenue streams | Less susceptible to major drops | The Marvel Cinematic Universe: always finds a way to keep the franchise relevant. |

| Overvalued | High stock price relative to earnings, potential bubble | Vulnerable to sharp corrections | A fleeting meme: super popular for a short time, then forgotten. |

Analyzing the Context of “Sound” Stock Prices

Source: vstarstatic.com

While “sound” evokes a sense of security, it’s crucial to remember that it’s a relative term. What one investor considers “sound,” another might view as risky. A “sound” stock price might be misleading if it’s based on short-term gains, ignoring underlying weaknesses in the company’s long-term prospects.

Terms like “stable,” “healthy,” and “robust” are often used interchangeably with “sound,” but each carries slightly different connotations. “Stable” implies consistency, “healthy” suggests good financial health, and “robust” points to resilience. However, the perception of these terms is still subjective and depends heavily on context.

Bias plays a significant role. Confirmation bias, for instance, can lead investors to interpret information in a way that confirms their pre-existing beliefs about a stock’s “soundness.” This can lead to ignoring warning signs or overestimating the value of a stock.

- Strong balance sheet

- Positive cash flow

- Competitive advantage

- Experienced management team

- Positive industry outlook

The Impact of News and Events on “Sound” Stock Prices

Source: vstarstatic.com

The stock market is a highly reactive beast. Positive news, like a successful product launch or exceeding earnings expectations, can send a stock price soaring, reinforcing its “soundness” in the eyes of investors. Conversely, negative news, such as a product recall or a major scandal, can trigger a sharp decline, shattering the perception of a “sound” stock.

Macroeconomic events, such as interest rate hikes or unexpected recessions, can also impact the perception of a “sound” stock price. Higher interest rates, for example, can increase borrowing costs for companies, potentially affecting profitability and investor confidence.

Company-specific announcements are pivotal. Earnings reports, product launches, and mergers and acquisitions can all dramatically shift investor sentiment and the perceived “soundness” of a stock price.

For example, imagine a hypothetical scenario: Company X, known for its innovative gadgets, announces a groundbreaking new product. Initially, the stock price surges, reflecting the market’s confidence in the company’s future. However, if the product launch faces unexpected delays or negative reviews, the stock price could plummet, quickly erasing its initial gains.

Visualizing “Sound” Stock Prices

Source: videvo.net

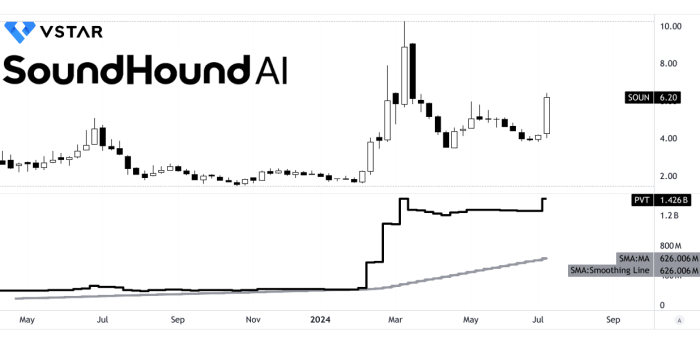

A “sound” stock price, visually, might be represented by a chart showing a steady upward trend with minimal volatility. Consolidation periods – periods of sideways trading – might also be interpreted as a sign of stability. However, even seemingly “sound” charts can hide underlying risks.

Head and shoulders patterns, for example, are often seen as bearish reversal patterns, suggesting a potential decline, even if the overall trend has been positive. Similarly, gaps in the price chart – sudden jumps or drops – can indicate significant news or events that might not be immediately apparent.

Let’s imagine a hypothetical scenario: Company Y’s stock price shows a gradual upward trend over several months. However, a closer examination reveals a series of increasingly larger price gaps, indicating potentially volatile underlying factors that might jeopardize its perceived “soundness.”

Investor Behavior and “Sound” Stock Prices, Stock price s o u n

Different investor profiles interpret “sound” stock prices differently. Long-term investors might focus on fundamental analysis and long-term growth, while day traders might prioritize short-term price movements and technical indicators. This difference in perspective can lead to vastly different investment decisions, even when evaluating the same stock.

Herd behavior and market psychology heavily influence the perception of “sound” stock prices. If a large number of investors perceive a stock as “sound,” others may follow suit, creating a self-fulfilling prophecy. Conversely, a sudden shift in sentiment can lead to a panic sell-off, even if the underlying fundamentals remain strong.

Investors prioritizing “sound” stock prices often make decisions based on risk aversion and a preference for stability. Others might focus on potential for high returns, even if it means accepting higher risk. This contrast highlights the subjective nature of “soundness” in stock market evaluations.

- Overconfidence bias

- Confirmation bias

- Anchoring bias

- Herd behavior

- Availability heuristic

Helpful Answers: Stock Price S O U N

What are some common red flags that suggest a stock price might not be as “sound” as it appears?

High debt-to-equity ratios, declining revenue, consistent losses, negative cash flow, and significant insider selling can all signal underlying problems, even if the stock price initially seems stable.

How can I differentiate between a truly “sound” stock and one experiencing temporary stability?

Look beyond the price. Analyze the company’s fundamentals (revenue, earnings, debt), its competitive landscape, and its long-term growth prospects. Temporary stability can mask underlying issues that may eventually lead to a price decline.

Does a “sound” stock price guarantee future returns?

Absolutely not. Past performance is not indicative of future results. Even a seemingly “sound” stock can underperform due to unforeseen circumstances or market shifts.

What role does emotional bias play in the perception of a “sound” stock price?

Fear and greed significantly impact investor decisions. Overconfidence in a rising market can lead to overlooking red flags, while fear can cause panic selling even when fundamentals remain strong.