Valero Energy Corporation Stock: A Melancholic Reflection

Valero stock price today – The fluctuating tides of the market, a relentless ebb and flow, mirror the uncertain journey of Valero’s stock price. A somber dance between profit and loss, a symphony played on the strings of global events and market sentiment. Let us delve into the current state of Valero, a tale told in numbers and shadowed by the uncertainties inherent in the energy sector.

Current Valero Stock Price

Source: seekingalpha.com

The current price of Valero stock (as of [Insert Date and Time – replace this with the actual data]) reflects a poignant snapshot in time. The day’s high and low mark the boundaries of its brief, restless journey, a testament to the volatility that defines this market. The trading volume, a silent chorus of buy and sell orders, whispers tales of investor confidence and doubt.

| Open | High | Low | Close |

|---|---|---|---|

| [Open Price Day 1] | [High Price Day 1] | [Low Price Day 1] | [Close Price Day 1] |

| [Open Price Day 2] | [High Price Day 2] | [Low Price Day 2] | [Close Price Day 2] |

| [Open Price Day 3] | [High Price Day 3] | [Low Price Day 3] | [Close Price Day 3] |

| [Open Price Day 4] | [High Price Day 4] | [Low Price Day 4] | [Close Price Day 4] |

| [Open Price Day 5] | [High Price Day 5] | [Low Price Day 5] | [Close Price Day 5] |

Recent Stock Price Trends

Source: seekingalpha.com

The past month has witnessed a [Describe the trend – e.g., gradual decline, sharp upswing, period of consolidation] in Valero’s stock price. Significant price changes during the last quarter can be attributed to [Explain potential causes, e.g., fluctuations in oil prices, changes in refining margins, geopolitical events]. Compared to its average price over the past year, the current price is [Higher/Lower/Similar], reflecting the complex interplay of market forces.

A line graph illustrating the past six months would show [Describe the graph’s shape and key turning points, e.g., an initial surge followed by a period of stagnation, a steady climb punctuated by minor dips]. The X-axis would represent the time period (six months), and the Y-axis would represent the stock price. Key data points would include the highest and lowest prices reached during this period, as well as any significant price changes coinciding with specific events.

Factors Influencing Valero Stock Price

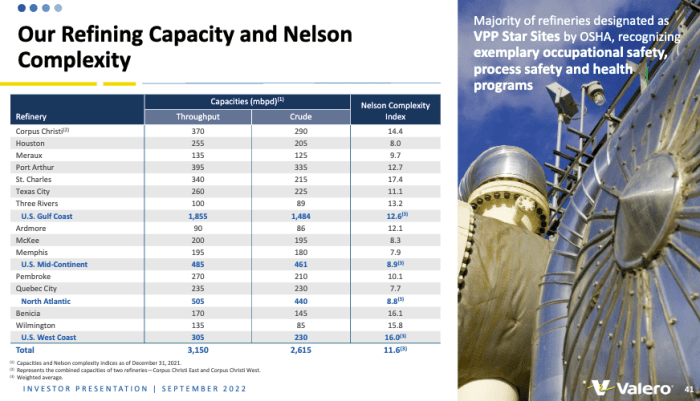

Valero’s stock price is a delicate instrument, swayed by the winds of various factors. Oil prices, the lifeblood of the refining industry, play a pivotal role, with higher prices generally benefiting refiners like Valero. Refinery operations, efficiency, and unexpected shutdowns also contribute significantly to stock price fluctuations. Geopolitical events, such as international conflicts or sanctions, can introduce unforeseen volatility.

Seasonal demand, particularly during peak driving seasons, influences refinery output and subsequently stock performance.

- Future potential impacts: Changes in environmental regulations, technological advancements in refining, shifts in global energy consumption patterns, and unexpected economic downturns.

Comparison with Competitors, Valero stock price today

A comparison of Valero’s stock price with its main competitors reveals its relative standing within the refining industry. Over the past year, Valero’s performance has been [Describe performance relative to competitors – e.g., stronger than, weaker than, comparable to].

| Company | P/E Ratio | Dividend Yield | Current Stock Price |

|---|---|---|---|

| Valero | [Valero P/E Ratio] | [Valero Dividend Yield] | [Valero Current Price] |

| Competitor 1 | [Competitor 1 P/E Ratio] | [Competitor 1 Dividend Yield] | [Competitor 1 Current Price] |

| Competitor 2 | [Competitor 2 P/E Ratio] | [Competitor 2 Dividend Yield] | [Competitor 2 Current Price] |

| Competitor 3 | [Competitor 3 P/E Ratio] | [Competitor 3 Dividend Yield] | [Competitor 3 Current Price] |

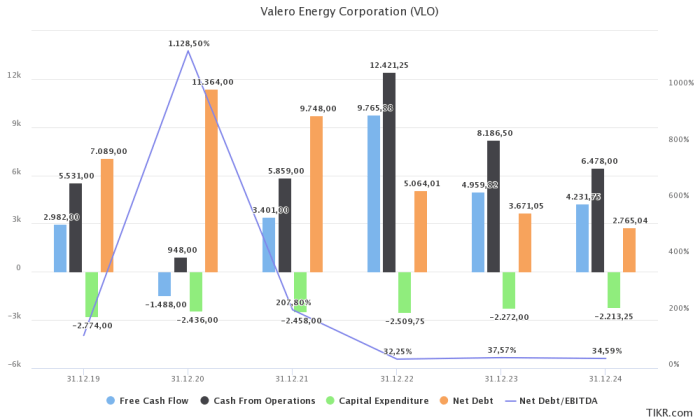

Valero’s Financial Performance

Valero’s recent financial results paint a picture of [Describe the overall financial health – e.g., robust growth, modest gains, challenges faced]. Recent financial reports have [Describe the impact on stock price – e.g., boosted investor confidence, caused a sell-off, had a muted effect]. Valero’s dividend policy, [Describe the policy – e.g., consistent payouts, variable dividends, recent changes], significantly influences investor sentiment.

Valero’s stock price today reflects the fluctuating energy market, a complex dance of supply and demand. Understanding this volatility requires considering broader market trends, such as the performance of consumer goods giants; for instance, check the current pepsi co stock price to gauge consumer spending power, a factor indirectly impacting fuel consumption and, consequently, Valero’s fortunes. Ultimately, Valero’s trajectory remains intertwined with these wider economic indicators.

- Key Financial Strengths: [List strengths, e.g., strong refining capacity, diversified operations, efficient cost management].

- Key Financial Weaknesses: [List weaknesses, e.g., dependence on oil prices, environmental concerns, competition in the refining market].

Analyst Ratings and Predictions

Source: seekingalpha.com

The consensus rating for Valero stock from leading financial analysts provides a collective view of the company’s prospects. Analysts have set a range of price targets, reflecting the diverse perspectives and methodologies employed in their valuations. Differing opinions stem from [Explain the reasons for differing opinions, e.g., varying assessments of future oil prices, different growth forecasts, disagreements on the company’s strategic direction].

| Analyst | Rating | Price Target | Rationale |

|---|---|---|---|

| Analyst 1 | [Rating] | [Price Target] | [Rationale] |

| Analyst 2 | [Rating] | [Price Target] | [Rationale] |

| Analyst 3 | [Rating] | [Price Target] | [Rationale] |

| Analyst 4 | [Rating] | [Price Target] | [Rationale] |

| Analyst 5 | [Rating] | [Price Target] | [Rationale] |

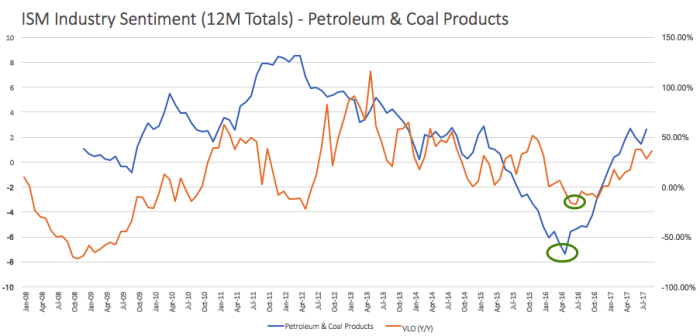

Investor Sentiment and News

Current investor sentiment towards Valero stock can be characterized as [Describe sentiment – e.g., cautiously optimistic, bearish, bullish]. Recent news events, such as [Mention specific news events], have significantly influenced investor sentiment. Overall market conditions, including [Describe market conditions – e.g., rising interest rates, inflationary pressures, global economic uncertainty], also impact Valero’s stock price.

- News Article 1: [Brief description and impact].

- News Article 2: [Brief description and impact].

- News Article 3: [Brief description and impact].

FAQ Insights: Valero Stock Price Today

What are the biggest risks associated with investing in Valero stock?

Investing in Valero, like any stock, carries inherent risks. These include fluctuations in oil prices, geopolitical instability impacting refinery operations, and overall economic downturns.

How often does Valero pay dividends?

Valero’s dividend payment schedule is typically quarterly. However, always check their official investor relations for the most up-to-date information.

Where can I find more detailed financial information about Valero?

Valero’s investor relations section on their official website is a great resource for detailed financial statements, SEC filings, and other relevant information.