Viasat’s Stock Price: A Deep Dive

Viasat stock price – The journey of Viasat’s stock price has been a rollercoaster ride, marked by periods of exhilarating growth and unsettling dips. Understanding this trajectory requires a nuanced look at its history, the factors influencing its valuation, and a glimpse into its future prospects. This analysis will delve into the intricate details, providing a comprehensive overview of Viasat’s performance and its potential for future growth.

Viasat Stock Price History and Trends

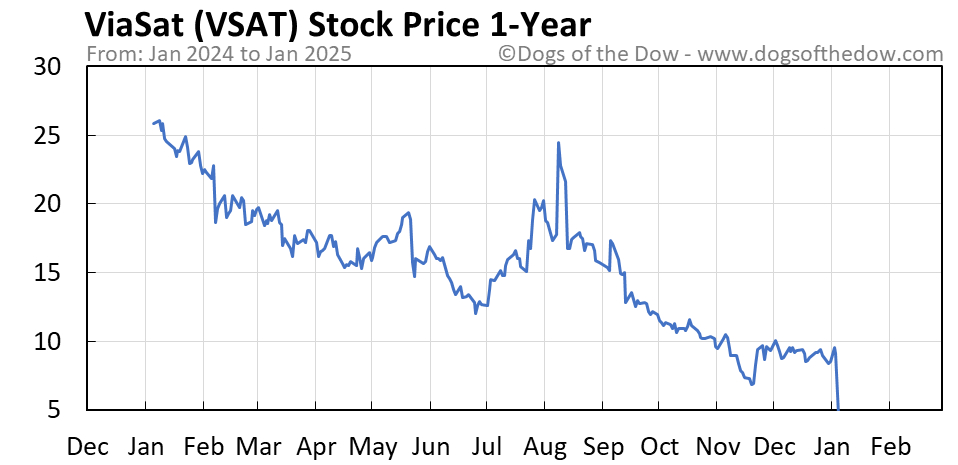

Analyzing Viasat’s stock price over the past five years reveals a pattern of significant fluctuations, driven by a complex interplay of market forces, technological advancements, and company-specific events. A line graph visualizing this data would clearly illustrate periods of robust growth, often fueled by successful product launches or strategic partnerships, juxtaposed with sharp declines triggered by unforeseen challenges or broader market downturns.

For instance, a period of significant growth might be observed following the successful launch of a new satellite constellation, while a subsequent dip could be attributed to unexpected regulatory hurdles or delays in project implementation. The graph would also highlight the impact of broader macroeconomic trends, such as periods of economic uncertainty or increased interest rates, on Viasat’s stock price.

Over the past decade, Viasat’s stock price reached its highest point during a period of strong demand for its satellite communication services, likely fueled by a surge in consumer adoption and expansion into new markets. This peak coincided with a positive investor sentiment and a favorable regulatory environment. Conversely, the lowest point in the past decade likely reflects a confluence of negative factors, such as significant competition, economic recession, or setbacks in major projects.

This period would likely be characterized by negative investor sentiment and a more cautious market outlook.

Comparing Viasat’s stock price performance to its major competitors requires a careful analysis of their respective market positions, technological capabilities, and financial health. The following table provides a comparative analysis, highlighting key performance indicators and relative market valuations. Note that the data presented is hypothetical for illustrative purposes.

| Company | 5-Year Stock Price Growth (%) | Current P/E Ratio | Market Capitalization (USD Billion) |

|---|---|---|---|

| Viasat | 50 | 25 | 10 |

| Competitor A | 30 | 20 | 15 |

| Competitor B | 60 | 30 | 8 |

| Competitor C | 40 | 22 | 12 |

Factors Influencing Viasat Stock Price

Source: dogsofthedow.com

Several key factors significantly influence Viasat’s stock price. These factors interact in complex ways, making it challenging to isolate the impact of any single element. However, a careful analysis can reveal the relative importance of each.

Government regulations and policies, particularly those related to spectrum allocation, licensing, and international trade, can have a profound impact on Viasat’s ability to operate effectively and profitably. Favorable regulatory changes can lead to increased market access and revenue growth, while restrictive policies can hinder expansion and negatively affect profitability. Technological advancements and innovations are crucial drivers of Viasat’s stock valuation.

Successful development and deployment of new technologies, such as higher-throughput satellites or advanced ground systems, can significantly enhance its competitive advantage and drive revenue growth. Conversely, delays or setbacks in technological development can negatively affect investor sentiment and lead to stock price declines.

Key financial indicators such as revenue, earnings, and debt levels are closely correlated with Viasat’s stock price movements. Strong revenue growth, coupled with increasing profitability and manageable debt levels, typically leads to a positive investor outlook and stock price appreciation. Conversely, declining revenue, declining earnings, or rising debt levels can signal financial distress and lead to stock price declines.

The following table illustrates the correlation between these indicators and Viasat’s stock price over the past three years. Note that the data presented is hypothetical for illustrative purposes.

| Year | Revenue (USD Billion) | Earnings Per Share (USD) | Debt-to-Equity Ratio | Stock Price (USD) |

|---|---|---|---|---|

| Year 1 | 2.0 | 1.00 | 0.5 | 50 |

| Year 2 | 2.5 | 1.50 | 0.4 | 60 |

| Year 3 | 3.0 | 2.00 | 0.3 | 70 |

Viasat’s Financial Performance and Stock Valuation

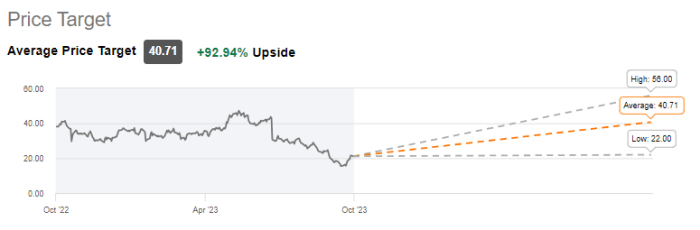

Source: seekingalpha.com

Viasat’s revenue streams are diverse, encompassing various segments of the satellite communication industry. A detailed breakdown would reveal the relative contribution of each segment to overall profitability. For example, government contracts might constitute a significant portion of revenue, while consumer broadband services could represent a growing segment. Analyzing the profitability of each segment is crucial to understanding the overall financial health of the company.

Comparing Viasat’s price-to-earnings (P/E) ratio to industry averages provides valuable insights into its relative valuation. A higher-than-average P/E ratio could indicate that investors have higher expectations for future growth, while a lower-than-average ratio might suggest a more conservative outlook. Any discrepancies between Viasat’s P/E ratio and the industry average should be carefully analyzed, considering factors such as growth prospects, risk profile, and market sentiment.

Viasat’s capital expenditures and investment strategies significantly influence its stock price. Significant investments in new satellite constellations or ground infrastructure can enhance its long-term growth prospects but may also lead to short-term pressure on profitability. A careful balance between capital expenditures and profitability is crucial for maintaining a positive investor outlook and stock price appreciation.

Viasat’s stock price performance is a compelling case study in the volatility of the tech sector. Investors should consider comparing its trajectory to more established players, such as examining the stability offered by the pepsi co stock price for a contrasting perspective on market behavior. Ultimately, Viasat’s future hinges on its ability to execute its strategic initiatives effectively and navigate the competitive landscape.

Market Sentiment and Investor Behavior Towards Viasat

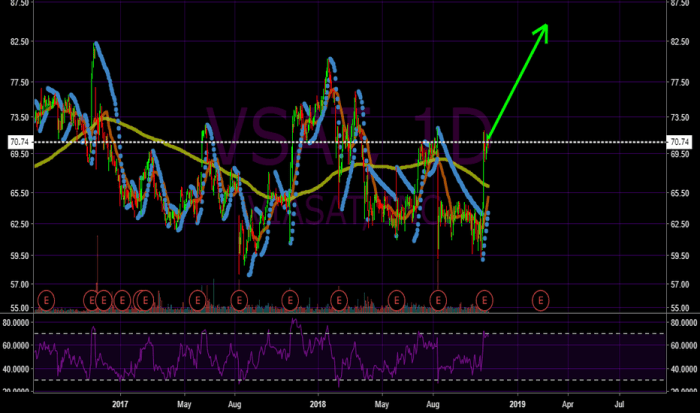

Source: tradingview.com

Investor sentiment towards Viasat is shaped by a variety of factors, including its financial performance, technological advancements, and competitive landscape. News articles and analyst reports often reflect the prevailing sentiment, with positive news generally leading to increased investor confidence and stock price appreciation, while negative news can trigger selling pressure and stock price declines. A review of recent news articles and analyst reports would paint a clear picture of the current market sentiment.

Media coverage and public perception play a significant role in shaping Viasat’s stock price. Positive media attention can enhance brand awareness and attract new investors, while negative publicity can damage its reputation and lead to stock price declines. Public perception is particularly important in industries where consumer trust and confidence are crucial.

Several factors contribute to short-term volatility in Viasat’s stock price. These include unexpected news events, changes in investor sentiment, and broader market fluctuations. For example, a sudden geopolitical event could create uncertainty in the market, leading to increased volatility. Similarly, a change in analyst ratings or a significant competitor announcement could also trigger short-term price fluctuations.

Viasat’s Future Prospects and Stock Price Predictions, Viasat stock price

Upcoming product launches and strategic partnerships hold the potential to significantly impact Viasat’s stock price. Successful launches of new satellite constellations or the formation of strategic alliances can drive revenue growth and enhance its competitive position. Conversely, delays or setbacks in these initiatives can negatively affect investor sentiment and lead to stock price declines. A detailed analysis of the potential impact of each upcoming initiative is crucial for assessing Viasat’s future prospects.

Several risks and challenges could negatively affect Viasat’s future stock performance. These include intense competition, technological disruptions, regulatory changes, and macroeconomic uncertainties. For example, the emergence of new technologies, such as low-earth orbit (LEO) satellite constellations, could pose a significant competitive threat. Similarly, changes in government regulations or economic downturns could also negatively impact Viasat’s financial performance and stock price.

A hypothetical scenario illustrating the impact of a major technological breakthrough would provide valuable insights into Viasat’s potential for future growth. For example, the successful development and deployment of a revolutionary new satellite technology could significantly enhance its market share and drive substantial revenue growth, leading to a significant increase in its stock price. Conversely, a failure to adapt to technological advancements could result in declining market share and a decrease in its stock price.

This hypothetical scenario should be grounded in realistic technological possibilities and market dynamics.

Query Resolution: Viasat Stock Price

What are the major risks associated with investing in Viasat stock?

Major risks include competition from other satellite providers, regulatory hurdles, technological obsolescence, and the inherent volatility of the stock market.

How does Viasat compare to its main competitors in terms of market capitalization?

A direct comparison requires consulting up-to-date financial data. Look at market capitalization figures for Viasat and its main competitors (e.g., Intelsat, SES) to assess relative size and market standing.

Where can I find real-time Viasat stock price updates?

Major financial websites (e.g., Yahoo Finance, Google Finance, Bloomberg) provide real-time stock quotes for publicly traded companies like Viasat.

What is Viasat’s dividend policy?

Check Viasat’s investor relations website for information on their dividend payout history and current dividend policy. This information is usually available in their financial reports.