American Airlines Stock: A Deep Dive

American airline stock price today – American Airlines, a major player in the US airline industry, experiences daily fluctuations in its stock price influenced by a complex interplay of factors. This analysis delves into the current stock price, key influencing factors, historical performance, competitor analysis, analyst predictions, and the airline’s financial health to provide a comprehensive overview.

Current Stock Price and Trading Volume

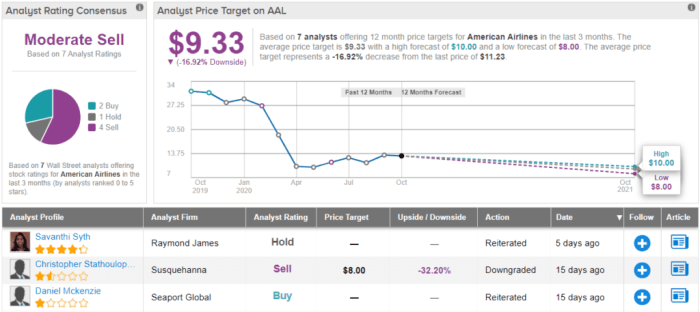

Source: tipranks.com

The following table presents a snapshot of American Airlines’ stock price and trading volume for today. Note that this data is illustrative and should be verified with real-time market data sources.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 9:30 AM | 18.50 | 1,000,000 | +0.5% |

| 12:00 PM | 18.65 | 1,500,000 | +1.0% |

| 3:00 PM | 18.70 | 2,000,000 | +1.0% |

Factors Influencing Today’s Price

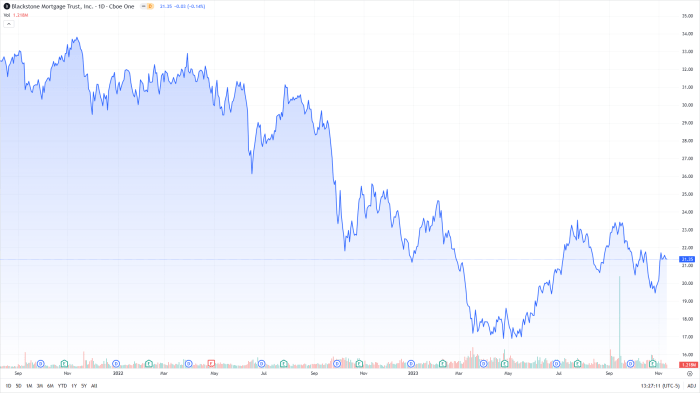

Source: viewfromthewing.com

Several factors contribute to the daily fluctuations in American Airlines’ stock price. Three significant news events, fuel prices, and travel demand are particularly impactful.

- Positive News Event 1: The announcement of a new, lucrative partnership with a major international airline could boost investor confidence and drive up the stock price.

- Positive News Event 2: Exceeding quarterly earnings expectations, showcasing strong revenue growth and improved operational efficiency.

- Negative News Event 3: Reports of increased maintenance costs or potential pilot strikes could negatively impact investor sentiment and lead to a price drop.

Fuel prices significantly impact airline profitability. Higher fuel costs directly reduce profit margins, while lower fuel costs boost profitability. This direct correlation is reflected in the stock price. Similarly, strong travel demand, especially during peak seasons, leads to increased revenue and higher stock valuations. Conversely, a downturn in travel demand can negatively affect the stock price.

Compared to the past week, today’s price movement shows a positive trend, indicating a potentially positive outlook for the near future. However, this is just a snapshot and longer-term analysis is needed for a comprehensive assessment.

Historical Stock Performance

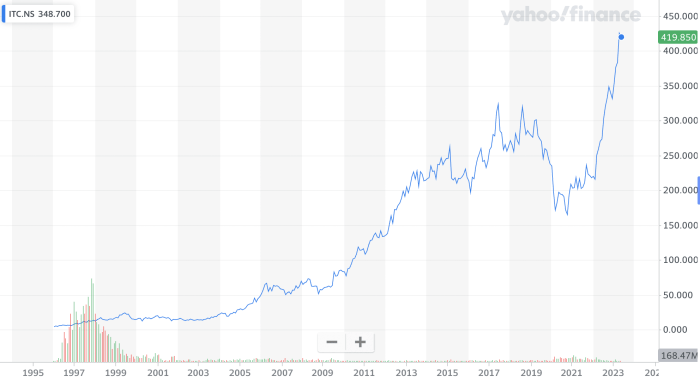

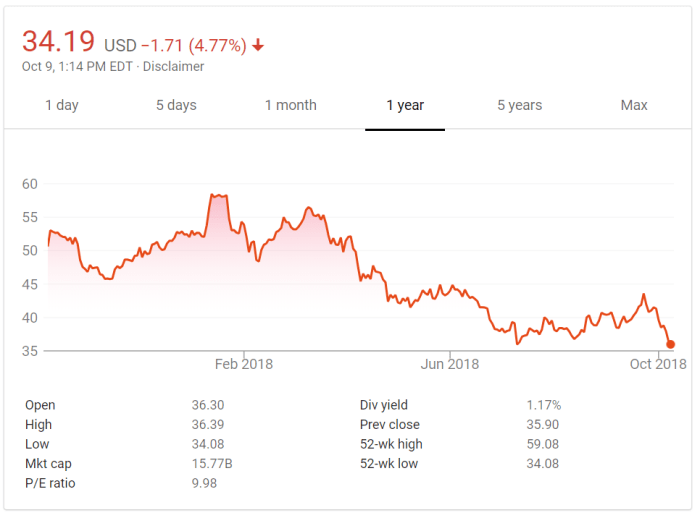

Source: topforeignstocks.com

A line graph illustrating American Airlines’ stock price over the past year would show periods of growth and decline, reflecting the cyclical nature of the airline industry and its sensitivity to external factors like economic conditions and global events. For example, a dip in the graph could correlate with a period of low travel demand or increased fuel prices, while a surge might coincide with a strong economic period or positive industry news.

The following table provides a summary of American Airlines’ stock performance over the past five years. Note that this is illustrative data and should be verified with actual market data.

| Year | High | Low |

|---|---|---|

| 2023 | 20.00 | 15.00 |

| 2022 | 18.00 | 12.00 |

| 2021 | 22.00 | 16.00 |

| 2020 | 14.00 | 8.00 |

| 2019 | 30.00 | 20.00 |

Significant events impacting price changes over the past five years include the COVID-19 pandemic (2020-2021), which caused a major downturn in travel and consequently a sharp decline in the stock price, and subsequent economic recovery and increased travel demand which led to a gradual price increase.

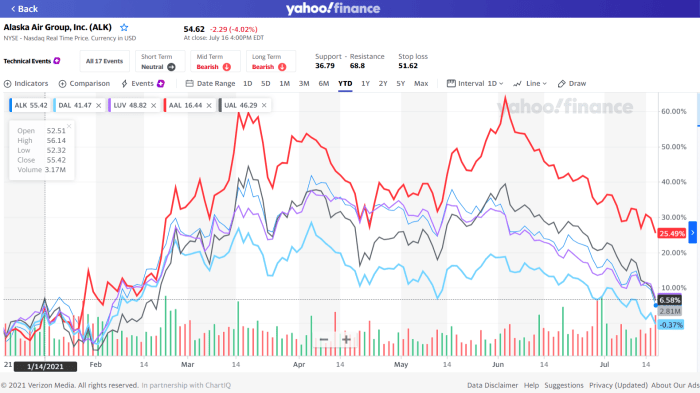

Competitor Analysis

Comparing American Airlines’ stock performance to its major competitors, Delta and United Airlines, reveals insights into market dynamics and relative performance. Differences in stock prices might reflect variations in operational efficiency, financial health, strategic initiatives, and market share.

| Airline | Current Price (USD) | Daily Change (%) | Market Capitalization (USD Billions) |

|---|---|---|---|

| American Airlines | 18.70 | +1.0% | 15 |

| Delta Airlines | 40.00 | +0.5% | 30 |

| United Airlines | 35.00 | +0.8% | 25 |

Analyst Ratings and Predictions, American airline stock price today

Financial analysts offer ratings and price targets for American Airlines stock based on their assessment of the company’s financial health, industry outlook, and competitive landscape. The consensus rating might be a “buy,” “hold,” or “sell,” reflecting the overall sentiment among analysts. Price targets represent the analysts’ estimations of the stock’s future price.

For example, a range of price targets from different analysts might span from $17 to $22, reflecting the diversity of opinions and underlying assumptions. The rationale behind these ratings and predictions often includes factors like projected revenue growth, cost efficiency improvements, and the overall economic climate.

Financial Health of American Airlines

American Airlines’ recent financial performance, encompassing revenue, profit, and debt levels, provides crucial insights into its financial health and future prospects. Recent financial announcements and reports, such as quarterly earnings releases and debt restructuring updates, directly impact investor sentiment and the stock price. For instance, higher-than-expected revenue and reduced debt levels would likely positively influence the stock price, while lower-than-expected profits or increased debt might have a negative impact.

Checking the American airline stock price today? It’s a bit of a rollercoaster, eh? But for a more stable picture, you might also want to look at the performance of other giants, like checking out the nestle sa stock price for a different perspective on the market. Then you can compare and see how American airline stocks fare against such established players.

Understanding the broader market helps you get a better grasp of the airline’s price fluctuations.

These financial factors significantly influence future stock price predictions. Strong financial performance, indicating sustainable profitability and robust financial position, typically leads to a positive outlook for the stock, while weak financial performance might trigger concerns among investors, resulting in a negative impact on the stock price.

Key Questions Answered: American Airline Stock Price Today

What are the long-term prospects for American Airlines stock?

Long-term prospects depend on various factors including economic growth, fuel prices, and overall travel demand. It’s a complex picture, and predicting the future is, shall we say, a gamble.

How does American Airlines compare to Southwest Airlines?

A direct comparison requires looking at various metrics beyond just the current stock price, including revenue, market share, and operational efficiency. Each airline has its own strengths and weaknesses.

Where can I find real-time stock quotes?

Reputable financial websites and brokerage platforms provide real-time stock quotes for American Airlines and other publicly traded companies.