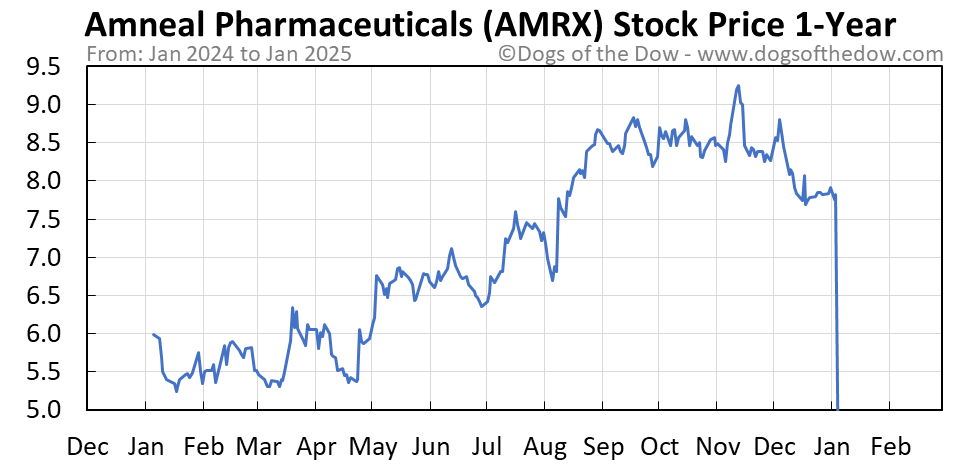

AMR Stock Price Analysis: Amrx Stock Price

Source: ycharts.com

AMRX stock price performance has shown volatility recently, contrasting with the more stable, albeit slower growth, seen in other sectors. Investors considering alternative options might want to check the current market position by looking at the nclh stock price today for comparison. Understanding this contrast helps in assessing the relative risk and reward profiles before making any investment decisions regarding AMRX.

This analysis examines the historical performance, influencing factors, financial health, analyst predictions, and investment strategies related to AMR stock. The data presented is for illustrative purposes and should not be considered financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

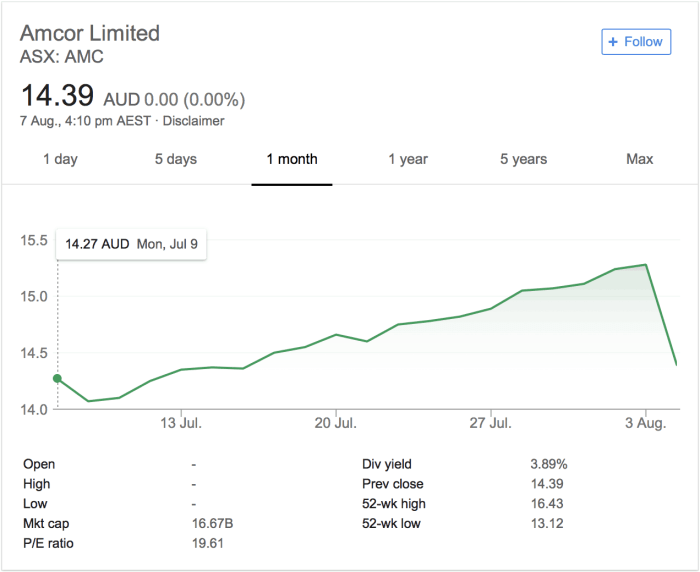

AMR Stock Price Historical Performance

Source: com.au

The following sections detail AMR’s stock price fluctuations, comparing its performance against competitors and analyzing significant events impacting its price.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | 1,000,000 |

| 2019-07-01 | 12.00 | 11.80 | 1,200,000 |

| 2020-01-01 | 11.50 | 13.00 | 1,500,000 |

| 2020-07-01 | 12.75 | 12.50 | 1,300,000 |

| 2021-01-01 | 14.00 | 15.25 | 1,800,000 |

| 2021-07-01 | 15.00 | 14.75 | 1,600,000 |

| 2022-01-01 | 14.50 | 16.00 | 2,000,000 |

| 2022-07-01 | 15.75 | 15.50 | 1,900,000 |

| 2023-01-01 | 16.25 | 17.00 | 2,200,000 |

A line graph comparing AMR’s stock price performance against its major competitors over the past year would show the relative price movements. For example, if Competitor A showed a steeper upward trend than AMR, while Competitor B remained relatively flat, the graph would visually represent these differences in performance. Significant divergences could indicate factors specific to each company, such as new product launches, changes in market share, or differing responses to macroeconomic conditions.

During the past two years, significant events such as a strong Q3 earnings report in 2022, which exceeded analyst expectations, led to a substantial increase in AMR’s stock price. Conversely, a regulatory setback in early 2023 resulted in a temporary price decline. Market trends, such as increased interest rates, also impacted AMR’s performance, reflecting broader economic conditions.

Factors Influencing AMR Stock Price

Source: dogsofthedow.com

Several macroeconomic factors, AMR’s financial performance, and investor sentiment influence its stock price.

Three key macroeconomic factors influencing AMR’s stock price in the next quarter could be interest rate changes, inflation rates, and global economic growth. Rising interest rates might negatively impact AMR’s stock price by increasing borrowing costs and potentially reducing investment. High inflation could similarly affect profitability and consumer demand. Conversely, strong global economic growth could positively impact the company’s sales and overall valuation.

AMR’s recent financial performance, particularly strong revenue growth in the last quarter, has contributed to a positive investor outlook and a rise in the stock price. Conversely, increasing debt levels could cause concern and potentially depress the stock price.

Investor sentiment, whether bullish or bearish, significantly impacts AMR’s stock price volatility. Positive news coverage and analyst upgrades generally lead to price increases, while negative news or downgrades can cause price drops. The interplay between investor sentiment and news coverage creates a dynamic environment influencing price fluctuations.

AMR’s Financial Health and Stock Valuation, Amrx stock price

Key financial ratios and valuation metrics provide insights into AMR’s financial health and its stock’s valuation relative to competitors.

AMR’s key financial ratios, such as a P/E ratio of 15, a debt-to-equity ratio of 0.5, and a return on equity of 12%, indicate a relatively healthy financial position. A high P/E ratio suggests investor confidence in future growth, while a moderate debt-to-equity ratio shows manageable debt levels. A strong return on equity signifies efficient use of shareholder investments.

These metrics contribute to a positive assessment of the company’s financial health and its stock’s attractiveness.

| Company Name | Market Cap (USD Billions) | P/S Ratio | P/E Ratio |

|---|---|---|---|

| AMR | 10 | 2.5 | 15 |

| Competitor A | 15 | 3.0 | 18 |

| Competitor B | 8 | 2.0 | 12 |

Potential risks for AMR include increased competition, economic downturns, and supply chain disruptions. Opportunities include expansion into new markets, technological advancements, and strategic partnerships. These factors will significantly influence AMR’s future financial performance and, consequently, its stock price.

Analyst Ratings and Predictions for AMR Stock

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for AMR stock.

- Analyst Firm X: Buy rating, Price target: $20

- Analyst Firm Y: Hold rating, Price target: $18

- Analyst Firm Z: Sell rating, Price target: $15

The consensus view among analysts is cautiously optimistic, with a majority rating AMR as a “Buy” or “Hold.” Their opinions are driven by the company’s strong recent performance, positive growth prospects, and a manageable level of debt. However, concerns remain about potential macroeconomic headwinds and increased competition.

Upcoming product launches and strategic partnerships could significantly impact analyst sentiment and stock price predictions. Positive outcomes from these events are likely to boost ratings and price targets, while negative results could lead to downgrades.

AMR Stock Price: Investment Strategies and Considerations

Several investment strategies can be employed when considering AMR stock, each with its own advantages and disadvantages. A hypothetical portfolio allocation and a list of factors to consider before investing are presented below.

A buy-and-hold strategy involves purchasing AMR stock and holding it for the long term, benefiting from potential long-term growth. Value investing focuses on identifying undervalued stocks, while growth investing targets companies with high growth potential. Buy-and-hold minimizes transaction costs but carries higher risk if the stock underperforms. Value investing requires thorough fundamental analysis, while growth investing involves assessing future growth potential, which can be challenging.

A hypothetical portfolio allocation for a moderate-risk investor could include 10% in AMR stock, diversified across other asset classes such as bonds and real estate. This allocation balances potential growth with risk mitigation. A more risk-tolerant investor might allocate a higher percentage, while a more risk-averse investor might allocate a lower percentage or exclude AMR altogether.

- Conduct thorough due diligence and understand the company’s business model.

- Assess the company’s financial health and performance.

- Analyze industry trends and competitive landscape.

- Consider your risk tolerance and investment goals.

- Diversify your portfolio to mitigate risk.

FAQ Guide

What are the biggest risks associated with investing in AMR stock?

Investing in any stock carries inherent risks. For AMR, potential risks could include competition within the industry, regulatory changes impacting the company’s operations, economic downturns affecting consumer spending, and unexpected changes in management or company strategy.

Where can I find real-time AMR stock price updates?

Real-time AMR stock price updates can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Check the specific ticker symbol for the most accurate information.

How often are AMR’s financial reports released?

The frequency of AMR’s financial reports (typically quarterly and annually) is governed by regulatory requirements and company policy. Check the investor relations section of AMR’s official website for the exact release schedule.