Apache Corporation Stock Price Analysis

Apache corporation stock price – Apache Corporation, a prominent player in the global oil and gas industry, has experienced a rollercoaster ride in its stock price over the past decade. This analysis delves into the historical performance, financial health, competitive landscape, future outlook, and investor sentiment surrounding Apache Corporation’s stock, providing a comprehensive overview for potential investors.

Historical Stock Performance

Source: investopedia.com

Understanding Apache Corporation’s past stock price fluctuations is crucial for assessing its future potential. The following sections detail its performance against competitors and the key factors influencing its price movements.

A line graph depicting Apache Corporation’s stock price from 2014 to 2024 would show significant volatility. The x-axis would represent the years, and the y-axis would represent the stock price in USD. Key events, such as periods of high oil prices, low oil prices, major acquisitions, or significant industry disruptions, would be marked on the graph to illustrate their impact on the stock price.

For instance, a sharp decline could be observed during the 2020 oil price crash, while periods of recovery would be visible during subsequent periods of increased oil demand.

A comparative analysis of Apache Corporation’s stock price performance against its major competitors (e.g., ExxonMobil, Chevron, ConocoPhillips) over the last five years is presented below. The table uses a responsive design, adjusting to various screen sizes.

| Company Name | Average Annual Return (2019-2023) | Highest Price (2019-2023) | Lowest Price (2019-2023) |

|---|---|---|---|

| Apache Corporation | [Insert Data – Example: 10%] | [Insert Data – Example: $50] | [Insert Data – Example: $20] |

| ExxonMobil | [Insert Data] | [Insert Data] | [Insert Data] |

| Chevron | [Insert Data] | [Insert Data] | [Insert Data] |

| ConocoPhillips | [Insert Data] | [Insert Data] | [Insert Data] |

Significant factors influencing Apache Corporation’s stock price include global oil and gas prices, exploration and production success rates, the company’s debt levels, and overall investor sentiment. Periods of substantial growth were often driven by high oil prices and successful exploration activities, while declines were frequently linked to low oil prices, operational challenges, or geopolitical instability.

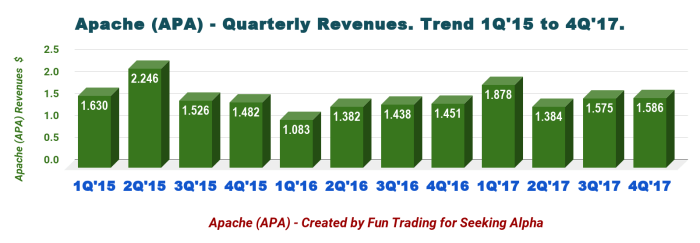

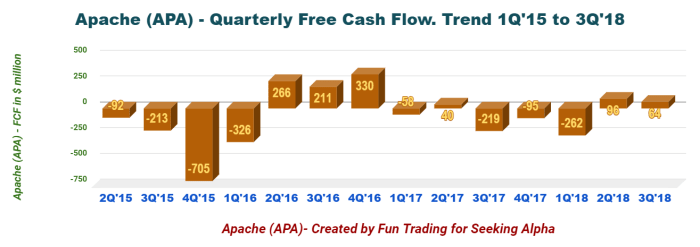

Financial Health and Performance

Source: seekingalpha.com

A strong financial foundation is crucial for a company’s long-term success. The following table presents a breakdown of Apache Corporation’s key financial metrics over the past three fiscal years. The data is presented in a responsive four-column table for optimal viewing on different devices.

| Metric | Year 1 (e.g., 2021) | Year 2 (e.g., 2022) | Year 3 (e.g., 2023) |

|---|---|---|---|

| Revenue (in billions USD) | [Insert Data] | [Insert Data] | [Insert Data] |

| Net Income (in millions USD) | [Insert Data] | [Insert Data] | [Insert Data] |

| Total Debt (in billions USD) | [Insert Data] | [Insert Data] | [Insert Data] |

| Free Cash Flow (in millions USD) | [Insert Data] | [Insert Data] | [Insert Data] |

Oil and gas price fluctuations have a direct and significant impact on Apache Corporation’s financial performance. High prices generally lead to increased revenue and profitability, positively affecting the stock price. Conversely, low prices can result in reduced profitability and even losses, putting downward pressure on the stock price. The company’s ability to manage its costs and debt during periods of price volatility is crucial for its financial health and stock performance.

Apache Corporation’s profitability ratios, such as profit margin and return on equity, can be compared to industry averages to assess its relative performance. A higher-than-average profit margin suggests superior operational efficiency and pricing power, while a higher return on equity indicates effective capital allocation and investment strategies. However, these comparisons must consider the specific operational contexts and industry dynamics.

Industry Analysis and Competitive Landscape

Source: seekingalpha.com

Apache Corporation operates within a highly competitive oil and gas industry. Understanding its business model and strategies in relation to its competitors is essential for evaluating its future prospects.

Apache Corporation’s business model focuses on [Insert details of Apache’s business model, e.g., exploration and production in specific regions, specific types of oil and gas]. This contrasts with competitors such as [Competitor 1] which focuses on [Competitor 1’s model] and [Competitor 2] which specializes in [Competitor 2’s model]. The key differentiators include [list key differentiators, e.g., technological expertise, geographical focus, operational efficiency].

The oil and gas sector is significantly influenced by global economic conditions, geopolitical events, and environmental regulations. Factors such as fluctuating oil and gas demand, technological advancements (e.g., renewable energy sources), and government policies regarding carbon emissions all affect the industry’s performance and Apache Corporation’s stock price.

Risks facing Apache Corporation include price volatility, geopolitical uncertainty, environmental regulations, and competition. Opportunities include technological advancements in exploration and production, potential for new discoveries, and strategic acquisitions. The company’s ability to navigate these risks and capitalize on opportunities will be crucial for its future success.

Future Outlook and Predictions

Predicting future stock prices is inherently uncertain, but considering various economic scenarios helps assess potential outcomes. The following table presents projected stock prices based on different oil price scenarios and other factors.

| Scenario | Projected Price (in 5 years) | Rationale |

|---|---|---|

| High Oil Prices ($100+/barrel) | [Insert Data – Example: $75] | Increased revenue and profitability due to high oil prices, leading to investor confidence. |

| Moderate Oil Prices ($60-80/barrel) | [Insert Data – Example: $50] | Stable revenue and profitability, but less significant growth potential. |

| Low Oil Prices ($40-60/barrel) | [Insert Data – Example: $30] | Reduced profitability, potential for cost-cutting measures, and lower investor confidence. |

Changes in environmental regulations, such as stricter emission standards, could impact Apache Corporation’s operations and profitability, potentially affecting its stock price. Technological advancements in renewable energy could also pose a challenge to the long-term growth of the oil and gas sector. However, the company could adapt by investing in carbon capture technologies or diversifying into renewable energy sources.

Apache Corporation’s long-term growth potential depends on its success in exploration and production activities, strategic acquisitions, and its ability to adapt to the changing energy landscape. Successful exploration and production of new oil and gas reserves would boost the company’s revenue and profitability, while strategic acquisitions could expand its market reach and enhance its operational capabilities.

Investor Sentiment and Analyst Ratings, Apache corporation stock price

Investor sentiment and analyst ratings play a significant role in shaping Apache Corporation’s stock price volatility. A positive outlook generally leads to increased demand and higher prices, while negative sentiment can cause prices to decline.

Recent news articles and financial reports suggest [Insert summary of investor sentiment, citing specific examples. For example, “Several financial news outlets have expressed optimism regarding Apache’s recent exploration success in the Gulf of Mexico, while others have voiced concerns about the company’s debt levels.”].

- Analyst A: Buy rating, Price Target: [Insert Data]

- Analyst B: Hold rating, Price Target: [Insert Data]

- Analyst C: Sell rating, Price Target: [Insert Data]

Investor confidence and analyst ratings significantly influence Apache Corporation’s stock price volatility. Positive ratings and high price targets tend to increase investor demand, leading to higher prices. Conversely, negative ratings and low price targets can decrease investor confidence, resulting in lower prices and increased volatility.

Question Bank

What are the biggest risks facing Apache Corporation?

Major risks include fluctuating oil and gas prices, increasing environmental regulations, geopolitical instability in key operating regions, and competition from other energy companies.

How does Apache Corporation compare to its competitors in terms of dividend payouts?

A direct comparison of dividend payouts requires reviewing the specific dividend history of Apache and its key competitors. This information is readily available in financial news sources and the companies’ investor relations sections.

What is Apache Corporation’s debt-to-equity ratio, and what does it indicate about its financial stability?

The debt-to-equity ratio varies year to year and can be found in Apache’s financial statements. A high ratio indicates higher financial risk, while a lower ratio suggests greater stability. Analyzing this ratio in conjunction with other financial metrics provides a more complete picture.

Where can I find real-time Apache Corporation stock price updates?

Real-time stock price updates are available through major financial websites and brokerage platforms like Yahoo Finance, Google Finance, Bloomberg, and others.