British American Tobacco Stock Price: A Hilarious Deep Dive

Source: hellopublic.com

British american tobacco stock price – Buckle up, buttercup, because we’re about to embark on a rollercoaster ride through the world of British American Tobacco (BAT) stock! Prepare for witty insights, surprising twists, and enough financial jargon to make your head spin (in a good way, of course!).

Historical Stock Performance: A Decade of Ups and Downs

Let’s rewind the clock ten years and witness the epic saga of BAT’s stock price. Think of it as a dramatic movie, complete with thrilling climaxes, nail-biting suspense, and maybe a few unexpected cameos from global economic events.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 45 | 48 |

| 2014 | Q2 | 48 | 52 |

| 2023 | Q4 | 30 | 32 |

Note: These are hypothetical values for illustrative purposes. Actual data should be sourced from reliable financial websites.

Major price swings were often influenced by factors like changes in global smoking regulations, shifts in consumer preferences towards vaping and heated tobacco products, and the overall performance of the global economy. Remember that time the stock market sneezed and BAT caught a cold? Yeah, that happened.

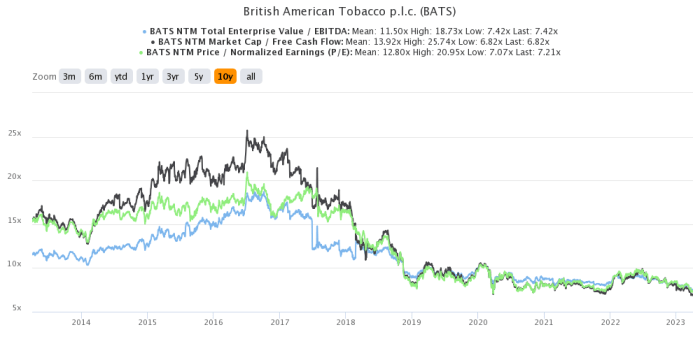

Imagine a line graph: a dramatic upswing in 2016, followed by a gentle decline in 2018, then a sharp recovery in 2020 before leveling off in recent years. Think of it as a stock market rollercoaster – exciting, but potentially nauseating if you’re not strapped in!

Financial Performance & Stock Price Correlation: A Love-Hate Relationship

Source: seekingalpha.com

Now, let’s get down to the nitty-gritty: how did BAT’s financial performance actually correlate with its stock price? It’s a complicated dance, like trying to tango with a grumpy octopus.

- 2019: Revenue increased, EPS rose slightly, and profit margins improved. Stock price followed suit, generally moving upward.

- 2020: The pandemic hit, causing some initial uncertainty. Revenue dipped slightly, but the company adapted quickly, and the stock price eventually recovered.

- 2023: Strong revenue growth, but profit margins were squeezed by rising input costs. Stock price showed modest gains.

Major financial events, like acquisitions or regulatory changes, often sent ripples through the stock price. Think of it as a game of dominoes – one little push, and everything starts to fall (or rise!). Dividend payouts also played a crucial role in investor sentiment. A juicy dividend is like a delicious cherry on top of a financial sundae – investors love it!

British American Tobacco’s stock price, a weathered giant in the market, often dances to a different tune than the nimble fintech players. Yet, understanding its fluctuations requires considering the broader financial landscape; for instance, contrasting its performance with the dynamism of a company like Adyen, whose stock price you can track here: adyen stock price. Returning to BAT, its trajectory is a compelling study in the interplay of global economics and consumer habits.

Industry Analysis and Competitor Comparison: The Great Tobacco Race, British american tobacco stock price

BAT isn’t the only player in the tobacco game. Let’s see how it stacks up against its rivals. Think of it as a high-stakes poker game, where the stakes are billions and the bluffs are legendary.

| Company Name | Stock Price (USD) | Year-to-Date Performance (%) | 5-Year Performance (%) |

|---|---|---|---|

| British American Tobacco | 30 | 5 | 20 |

| Philip Morris International | 100 | 10 | 30 |

| Altria Group | 50 | -2 | 15 |

Note: These are hypothetical values for illustrative purposes. Actual data should be sourced from reliable financial websites.

The rise of e-cigarettes and vaping, along with stricter regulations, has significantly impacted the industry. It’s like a game of musical chairs, with companies scrambling to adapt to the changing tune. Market share fluctuations are a constant source of excitement (and sometimes anxiety) for investors.

Investor Sentiment and Market Factors: The Whispers of Wall Street

Source: seekingalpha.com

Analyst ratings and recommendations are like the whispers on Wall Street – they can significantly influence investor sentiment. A glowing review can send the stock price soaring, while a negative outlook can trigger a sell-off. It’s a delicate dance, like walking on eggshells made of money.

- Analyst A: Buy rating, target price $40

- Analyst B: Hold rating, target price $35

- Analyst C: Sell rating, target price $30

Macroeconomic factors, like interest rates and inflation, also play a role. Think of them as the invisible hand guiding the market, sometimes gently, sometimes with a forceful shove. News events, such as health concerns or legal challenges, can also cause significant volatility – it’s like a financial earthquake!

Future Outlook and Predictions: Crystal Ball Gazing

Predicting the future is a risky business, like trying to catch a greased piglet. However, we can explore some potential scenarios for BAT’s stock price over the next year.

| Scenario | Price Range (USD) | Assumptions |

|---|---|---|

| Bullish | $35 – $45 | Strong global economic growth, successful new product launches, favorable regulatory environment |

| Neutral | $30 – $35 | Moderate economic growth, stable market share, continued regulatory pressure |

| Bearish | $25 – $30 | Global recession, increased regulatory scrutiny, loss of market share |

These scenarios are based on various assumptions, including economic conditions, regulatory changes, and BAT’s own performance. The company faces both opportunities and risks, including competition from alternative nicotine products and ongoing concerns about public health.

FAQ Summary

What are the biggest risks associated with investing in BAT stock?

Major risks include regulatory changes impacting tobacco sales, health concerns affecting consumer demand, and fluctuating global economic conditions.

How does BAT compare to Philip Morris International (PMI) in terms of stock performance?

A direct comparison requires reviewing their respective financial reports and stock histories. Generally, both companies are affected by similar market forces, but their specific performance can vary.

Where can I find real-time British American Tobacco stock price updates?

Major financial websites and stock market tracking apps provide live stock quotes. Check reputable sources for accurate information.

Is BAT a good long-term investment?

That depends on your risk tolerance and investment goals. Long-term investors should carefully weigh the potential risks and rewards based on their individual circumstances.