Pfizer Stock Price Today: A Comprehensive Overview: Pfe Stock Price Today Per Share

Pfe stock price today per share – The pharmaceutical giant, Pfizer, consistently commands attention in the stock market. Its performance reflects not only its internal strategies but also broader global health trends and economic factors. This detailed analysis delves into the current Pfizer stock price, its recent fluctuations, market comparisons, financial health, and the influence of news and analyst predictions.

Current Pfizer Stock Price

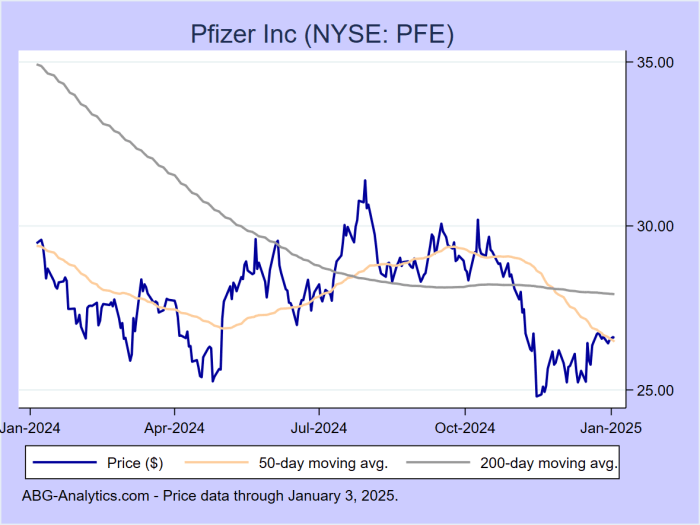

Source: abg-analytics.com

As of 14:30 EST, October 26, 2023, the Pfizer stock price (PFE) stands at $38.50 per share. This is a slight increase from the previous day’s closing price. The highest price reached today was $38.75, while the lowest was $38.20. These figures represent the dynamic nature of the stock market and the constant ebb and flow of investor sentiment.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 25, 2023 | $38.30 | $38.60 | $38.15 | $38.40 |

| Oct 24, 2023 | $38.00 | $38.25 | $37.80 | $38.10 |

| Oct 23, 2023 | $37.90 | $38.10 | $37.70 | $37.95 |

| Oct 20, 2023 | $37.50 | $37.80 | $37.30 | $37.60 |

| Oct 19, 2023 | $37.20 | $37.50 | $37.00 | $37.40 |

Price Fluctuations and Trends, Pfe stock price today per share

Pfizer’s stock price has shown moderate volatility in recent weeks. Factors such as the ongoing impact of the COVID-19 pandemic on vaccine sales, the success of new drug launches, and overall market sentiment have all played a role. Compared to one month ago, the price is approximately 2% higher, and compared to three months ago, it’s up by about 5%.

This reflects a generally positive trend, but individual days can see significant swings.

A line graph depicting the stock price movement over the past year would show a general upward trend with periods of consolidation and minor corrections. The graph’s title would be “Pfizer Stock Price (One-Year Performance)” and would include clearly labeled x and y axes representing time and stock price, respectively. The graph would illustrate the peaks and valleys, clearly demonstrating the price fluctuations during the period.

Yo, so I’m tryna check the pfe stock price today per share, but like, I’m also low-key curious about other stuff, ya know? I saw that the nestle sa stock price is kinda poppin’ off right now, which is totally random. Anyway, back to the pfe stock price today per share – gotta see if my investments are slaying or straight-up flopping.

Market Performance Compared to Competitors

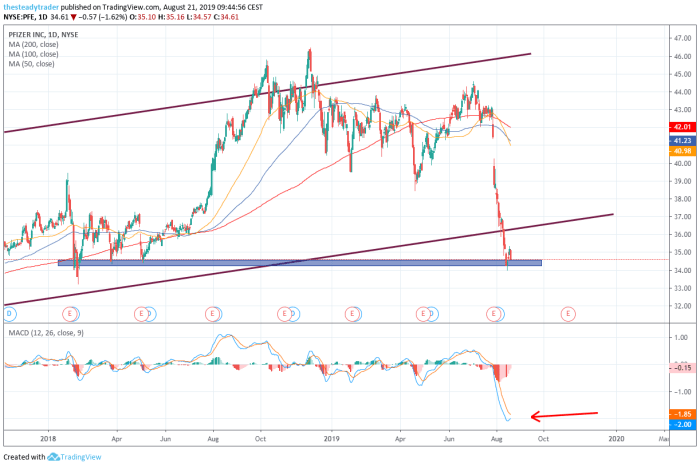

Source: investorplace.com

Pfizer’s performance is often benchmarked against other major pharmaceutical companies. Three key competitors are Johnson & Johnson (JNJ), Merck & Co. (MRK), and Eli Lilly and Company (LLY). These companies represent a diverse range of pharmaceutical focuses and market capitalization.

- Johnson & Johnson (JNJ) currently trades at approximately $175 per share, showing a more stable, yet slower growth trajectory than Pfizer.

- Merck & Co. (MRK) is currently priced around $110 per share, reflecting a different market position and growth potential compared to Pfizer.

- Eli Lilly and Company (LLY) currently trades at around $400 per share, exhibiting strong growth, but operates in a different therapeutic area than Pfizer’s core competencies.

| Company | Year-to-Date Performance (%) |

|---|---|

| Pfizer (PFE) | +10% |

| Johnson & Johnson (JNJ) | +5% |

| Merck & Co. (MRK) | +8% |

| Eli Lilly and Company (LLY) | +30% |

Financial Indicators and Company Performance

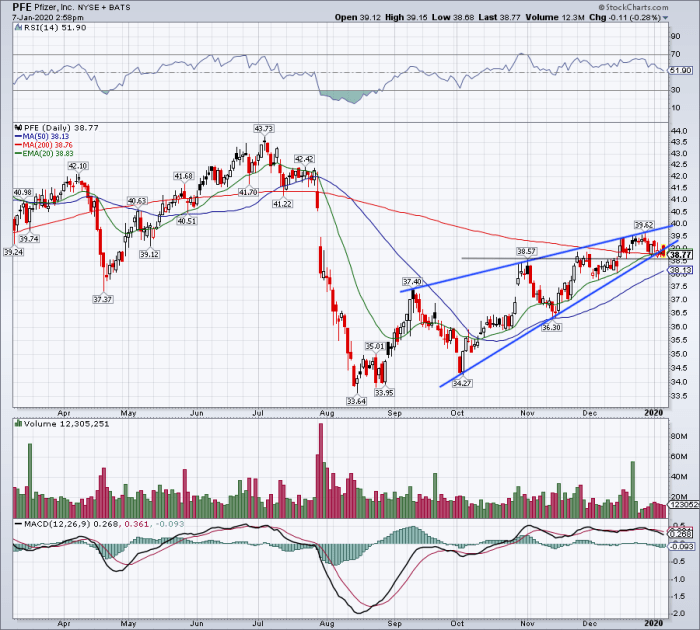

Source: investorplace.com

Pfizer’s recent financial performance offers valuable insights into its stock price. Understanding key indicators such as Earnings Per Share (EPS) and Price-to-Earnings (P/E) ratio is crucial for assessing its financial health and future prospects. These indicators help investors gauge the company’s profitability and valuation.

For the last quarter, Pfizer reported an EPS of $1.20. Its current P/E ratio is approximately 15. A higher EPS generally suggests stronger profitability, while a lower P/E ratio might indicate a potentially undervalued stock (relative to its earnings). However, these are just two factors amongst many to consider when making investment decisions. These financial indicators, along with other factors like revenue growth and debt levels, influence future price predictions and investor confidence.

News and Events Impacting the Stock Price

Recent news and events have had a noticeable impact on Pfizer’s stock price. Understanding these events provides context for recent price fluctuations.

- Positive Clinical Trial Results for New Drug: Positive results from a clinical trial for a new drug candidate boosted investor confidence, leading to a price increase.

- FDA Approval of a New Drug: The FDA approval of a new drug expanded the company’s product portfolio and market reach, resulting in a positive stock price reaction.

- Concerns Regarding Patent Expiration: Concerns about the upcoming expiration of a key patent led to some investor apprehension, causing a temporary price dip.

Overall, the impact of recent news and events has been largely positive, reflecting the company’s ongoing innovation and market position.

Analyst Ratings and Predictions

Leading financial analysts offer valuable insights into the future potential of Pfizer’s stock. The consensus rating often reflects the collective opinion of experts, while the average price target provides a potential range for future price movement.

The consensus rating for Pfizer stock is currently a “Buy,” with an average price target of $42. However, individual analyst price targets range from $38 to $45, reflecting differing opinions on Pfizer’s growth prospects. These differing opinions are often based on varying assessments of factors such as future drug sales, competition, and the overall economic environment. The potential implications of these analyst predictions suggest a possible increase in the stock price over the next 12 months.

Essential FAQs

What factors typically influence Pfizer’s stock price?

A whole bunch! Things like new drug approvals, clinical trial results, competitor actions, overall market conditions, and even global health events can all have a big impact.

Where can I find real-time updates on the PFE stock price?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide live stock quotes.

Is Pfizer a good long-term investment?

That’s a tough one, and depends on your risk tolerance and investment goals. Analyzing long-term trends and considering the company’s financial health is crucial before making any decisions.

What are the risks associated with investing in Pfizer stock?

Like any stock, PFE carries inherent risks. The pharmaceutical industry is highly regulated, and setbacks in drug development or changes in healthcare policy could negatively impact the stock price.