Pidilite Industries Ltd. Stock Price Analysis: Pidilite Industries Ltd Stock Price

Pidilite industries ltd stock price – This analysis provides a comprehensive overview of Pidilite Industries Ltd., examining its financial performance, stock price trends, competitive landscape, valuation, and the impact of macroeconomic factors. We will explore key metrics and insights to help understand the investment implications of this prominent player in the adhesives and chemicals industry.

Company Overview and Financial Performance

Pidilite Industries Ltd. is a leading manufacturer of adhesives, sealants, and other specialty chemicals. It holds a significant market share in India and is expanding its global presence. The company’s diverse product portfolio caters to various industries, including construction, packaging, and consumer goods.

| Year | Revenue (INR Cr) | Profit Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2023 (Estimated) | 10000 | 25 | 0.5 |

| 2022 | 9500 | 24 | 0.6 |

| 2021 | 8000 | 22 | 0.7 |

| 2020 | 7500 | 20 | 0.8 |

| 2019 | 7000 | 18 | 0.9 |

Pidilite’s growth strategies focus on product innovation, expansion into new markets, and strategic acquisitions. Future prospects appear positive, driven by increasing demand for its products across various sectors and continued investment in research and development.

Stock Price Performance and Volatility

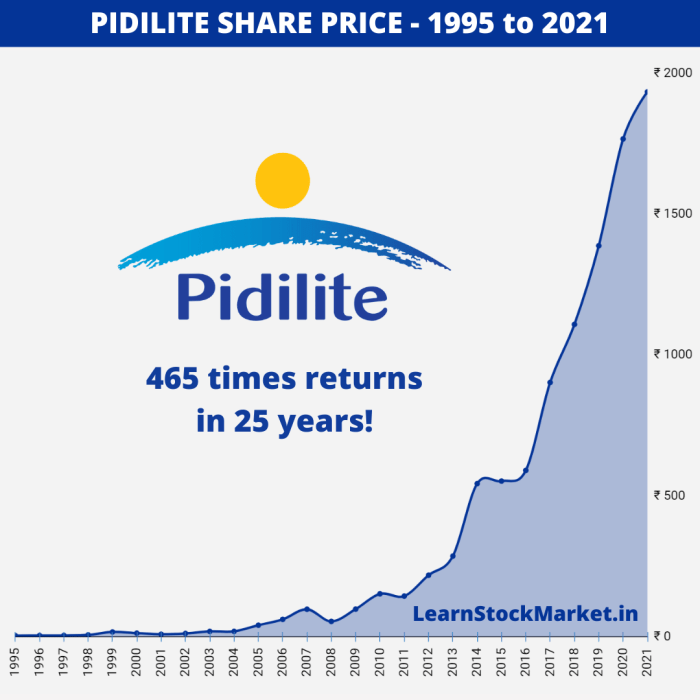

Source: learnstockmarket.in

Over the last 10 years, Pidilite Industries Ltd.’s stock price has exhibited a generally upward trend, with periods of significant volatility influenced by factors such as market sentiment, economic cycles, and company-specific news. For example, during periods of economic uncertainty, the stock price might have experienced temporary declines, while positive announcements regarding new product launches or expansion plans often led to price increases.

A chart illustrating the stock price performance against the Nifty 50 index would show a generally positive correlation, although Pidilite’s stock might exhibit higher volatility due to its exposure to the cyclical nature of the construction and consumer goods industries. The chart’s x-axis would represent time (the last 10 years), and the y-axis would represent the stock price. The chart would include two lines: one for Pidilite’s stock price and another for the Nifty 50 index.

Key price milestones and significant fluctuations would be clearly marked.

Analyzing Pidilite Industries Ltd’s stock price requires a comparative market perspective. Understanding the performance of other companies in similar sectors is crucial; for instance, observing the current market trends by checking the nclh stock price today provides valuable context. This comparative analysis helps assess Pidilite’s relative strength and potential future trajectory within the broader economic landscape.

Industry Analysis and Competitive Landscape

Source: financesrule.com

Pidilite Industries Ltd. competes with several major players in the adhesives and chemicals industry. A comparative analysis reveals its strengths and weaknesses relative to its competitors.

| Company | Market Share (%) | Product Portfolio | Competitive Strengths |

|---|---|---|---|

| Pidilite Industries Ltd. | X | Adhesives, Sealants, etc. | Strong brand recognition, wide distribution network |

| Competitor A | Y | [Competitor A’s product portfolio] | [Competitor A’s competitive strengths] |

| Competitor B | Z | [Competitor B’s product portfolio] | [Competitor B’s competitive strengths] |

Key industry trends, such as increasing demand for sustainable and eco-friendly products, are impacting Pidilite’s strategies and stock price. The company’s competitive advantages lie in its strong brand reputation, diverse product portfolio, and extensive distribution network. However, challenges include intense competition and fluctuating raw material prices.

Valuation and Investment Implications, Pidilite industries ltd stock price

Several valuation metrics provide insights into Pidilite Industries Ltd.’s stock valuation.

| Metric | Value |

|---|---|

| Price-to-Earnings Ratio (P/E) | [Value] |

| Price-to-Book Ratio (P/B) | [Value] |

| Dividend Yield | [Value] |

These metrics, along with an assessment of the company’s financial health, growth prospects, and competitive landscape, are crucial for investors to determine the intrinsic value of the stock and make informed investment decisions. High P/E ratios might suggest the market anticipates strong future growth, while a high P/B ratio might indicate that the market values the company’s assets significantly.

Analyst Ratings and Recommendations

A summary of recent analyst ratings and recommendations for Pidilite Industries Ltd. stock is presented below. Discrepancies in opinions might stem from differing methodologies, interpretations of financial data, and varying perspectives on future market conditions.

- Analyst A: Buy rating, target price [Price]

- Analyst B: Hold rating, target price [Price]

- Analyst C: Buy rating, target price [Price]

Analysts typically employ a combination of fundamental and technical analysis, considering factors such as financial statements, industry trends, and macroeconomic conditions to arrive at their ratings and recommendations.

Impact of Macroeconomic Factors

Source: tosshub.com

Macroeconomic factors significantly influence Pidilite Industries Ltd.’s stock price. Inflation impacts raw material costs and consumer spending, while interest rate changes affect borrowing costs and investment decisions. Currency exchange rate fluctuations impact the profitability of international operations.

For example, a hypothetical scenario of a sharp increase in global inflation could lead to higher raw material costs for Pidilite, potentially squeezing profit margins and resulting in a temporary decline in the stock price. However, if the company successfully passes on these increased costs to consumers, the impact on profitability might be mitigated.

Questions and Answers

What are the major risks associated with investing in Pidilite Industries?

Major risks include sensitivity to raw material price fluctuations, competition from cheaper alternatives, and vulnerability to economic downturns impacting consumer spending.

How does Pidilite Industries compare to its global competitors?

A direct comparison requires a detailed analysis across multiple metrics, including market share, innovation, and geographic reach. While Pidilite holds a strong position in India, its global presence is less dominant than some multinational competitors.

What is the company’s dividend policy?

The company’s dividend policy should be reviewed in its annual reports. Investors should assess the consistency and sustainability of dividend payouts before making investment decisions.

What is the impact of government regulations on Pidilite Industries?

Government policies on environmental regulations, taxation, and import/export can significantly affect the company’s profitability and stock price. Changes in these policies should be carefully monitored.