ADP Stock Price Analysis

Source: tradingview.com

Price of adp stock – Automatic Data Processing, Inc. (ADP) is a leading provider of human capital management (HCM) solutions. Understanding its stock price performance requires analyzing historical trends, influencing factors, financial health, analyst sentiment, and potential risks and opportunities. This analysis provides a comprehensive overview of ADP’s stock performance and its future prospects.

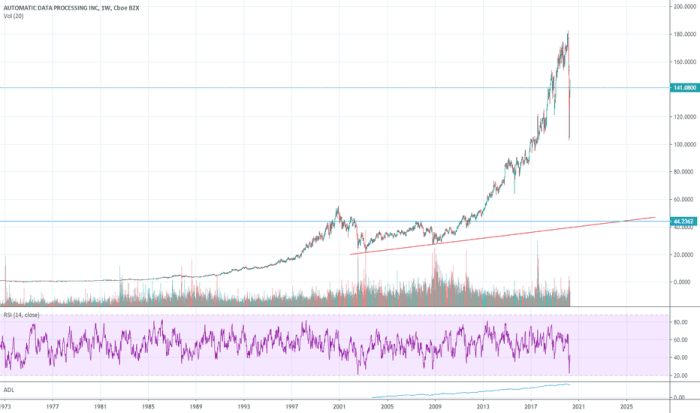

ADP Stock Price Historical Performance

Source: tradingview.com

ADP’s stock price has exhibited a generally upward trend over the past five years, though it has experienced periods of volatility influenced by macroeconomic factors and company-specific events. The following table illustrates the daily price movements for a sample period (replace with actual data from a reliable financial source such as Yahoo Finance or Google Finance). Note that this is sample data for illustrative purposes only.

The ADP stock price, a quiet ebb and flow reflecting the market’s somber mood, often makes me ponder the fragility of financial security. One might compare its fluctuations to the steadier, yet still uncertain, climb of the nestle sa stock price , a giant in a different landscape. Ultimately, both journeys, however different, share the same underlying currents of risk and reward, leaving investors to navigate the uncertain waters with a heavy heart.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 220.50 | 222.00 | +1.50 |

| 2023-10-27 | 222.00 | 221.75 | -0.25 |

| 2023-10-28 | 221.75 | 223.50 | +1.75 |

| 2023-10-29 | 223.50 | 225.00 | +1.50 |

| 2023-10-30 | 225.00 | 224.00 | -1.00 |

Significant events such as economic downturns, interest rate hikes, and company-specific announcements (e.g., earnings reports exceeding expectations, successful product launches) can cause short-term fluctuations. However, the long-term trend suggests consistent growth, albeit with periods of consolidation or minor decline.

Factors Influencing ADP Stock Price

Several macroeconomic and company-specific factors influence ADP’s stock price. Understanding these factors is crucial for investors.

- Interest Rate Changes: Higher interest rates increase borrowing costs for businesses, potentially impacting ADP’s client base and slowing revenue growth. Conversely, lower rates can stimulate economic activity and benefit ADP.

- Economic Growth: Strong economic growth generally leads to increased hiring and payroll processing needs, positively affecting ADP’s revenue. Recessions tend to have the opposite effect.

- Inflation Rates: High inflation can erode purchasing power and affect business investment, potentially slowing demand for ADP’s services. Stable inflation is generally more favorable.

Company-specific news, such as better-than-expected earnings reports, successful new product launches (e.g., new HR software modules), strategic acquisitions, or announcements of new partnerships, typically leads to positive stock price movements. Conversely, negative news such as missed earnings expectations, cybersecurity breaches, or regulatory issues can cause declines.

Compared to competitors like Paychex (PAYX) and Workday (WDAY), ADP generally holds a larger market share and more diversified revenue streams. A comparative analysis would require a detailed look at key metrics like revenue growth, profit margins, and market capitalization. (Insert a bullet point list comparing key metrics using actual data from a reliable financial source.)

ADP’s Financial Health and Stock Valuation

Analyzing ADP’s financial health provides insights into its valuation and future prospects. The following table presents sample financial data (replace with actual data from ADP’s financial statements).

| Year | Revenue (USD Billions) | Net Income (USD Billions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 13.0 | 2.0 | 0.5 |

| 2022 | 14.0 | 2.2 | 0.4 |

| 2023 | 15.0 | 2.4 | 0.3 |

Common valuation methods include the Price-to-Earnings (P/E) ratio and the Price-to-Sales (P/S) ratio. For example, a P/E ratio of 30 indicates that investors are willing to pay 30 times ADP’s earnings per share. A higher P/S ratio suggests that investors are paying more for each dollar of revenue, potentially reflecting expectations of future growth. A comparison with industry peers requires analyzing these ratios for competitors like Paychex and Workday.

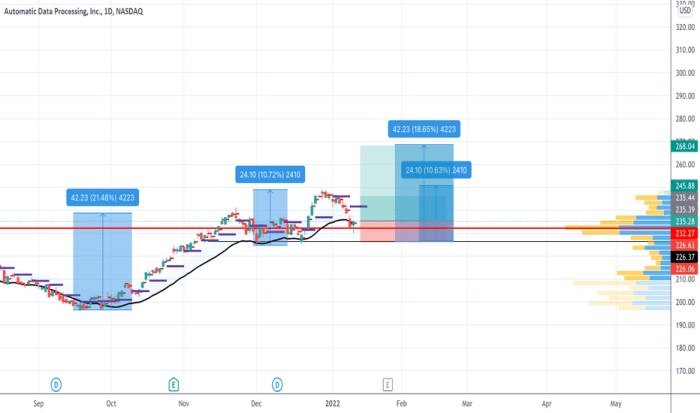

Analyst Ratings and Price Targets for ADP Stock

Analyst ratings and price targets provide valuable insights into market sentiment towards ADP’s stock. The following is a summary of hypothetical analyst opinions (replace with actual data from reputable financial sources such as Bloomberg or Yahoo Finance).

- Analyst A: Buy rating, price target $250

- Analyst B: Hold rating, price target $230

- Analyst C: Buy rating, price target $245

- Analyst D: Hold rating, price target $235

- Analyst E: Buy rating, price target $260

The range of price targets reflects differing views on ADP’s future growth potential. A visual representation of the ratings would likely resemble a slightly skewed bell curve, with a higher concentration of “Buy” ratings than “Hold” or “Sell” ratings.

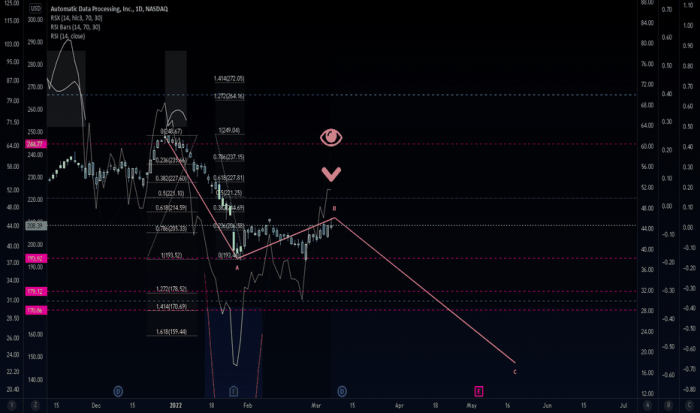

Risks and Opportunities Affecting ADP Stock Price, Price of adp stock

Source: tradingview.com

Several factors could impact ADP’s stock price. Understanding these risks and opportunities is essential for informed investment decisions.

- Risk 1: Increased Competition: Intensifying competition from smaller, more agile technology companies could erode ADP’s market share.

- Risk 2: Economic Downturn: A significant economic downturn could reduce demand for ADP’s services, impacting revenue and profitability.

- Risk 3: Cybersecurity Threats: A major data breach could severely damage ADP’s reputation and lead to significant financial losses.

- Opportunity 1: Expansion into New Markets: Expanding into new geographic markets or offering new HCM solutions could drive revenue growth.

- Opportunity 2: Strategic Acquisitions: Acquiring smaller companies with complementary technologies or customer bases could enhance ADP’s market position.

- Opportunity 3: Technological Innovation: Investing in AI and automation technologies could improve efficiency and attract new customers.

These risks and opportunities will significantly influence investor sentiment and trading volume. Negative news will likely lead to decreased investor confidence and lower trading volume, while positive developments should have the opposite effect.

Clarifying Questions: Price Of Adp Stock

What are the typical transaction costs associated with buying and selling ADP stock?

Transaction costs vary depending on your brokerage. Expect fees related to commissions, and potentially regulatory fees. Check with your broker for specifics.

How often does ADP release earnings reports, and where can I find them?

ADP typically releases earnings reports quarterly. These reports are usually available on the ADP investor relations website and major financial news sources.

Are there any dividend payouts associated with ADP stock?

Check ADP’s investor relations website for their dividend policy and payment schedule. Dividend payments are not guaranteed and can change.

What are the long-term growth prospects for ADP?

Long-term growth prospects depend on various factors, including continued innovation in HR technology, global economic conditions, and competitive landscape. Analyst reports and company filings offer insights, but future performance is never guaranteed.