Southwest Airlines Stock: A Journey of Growth and Resilience

Source: googleapis.com

Price of southwest airlines stock – Investing in the airline industry can be a thrilling yet turbulent ride, mirroring the unpredictable nature of air travel itself. Southwest Airlines, a renowned name synonymous with affordability and efficiency, presents a compelling case study in navigating this dynamic sector. This analysis delves into the historical performance, influencing factors, and future prospects of Southwest Airlines’ stock, offering insights from a perspective that blends financial acumen with a spirit of mindful observation.

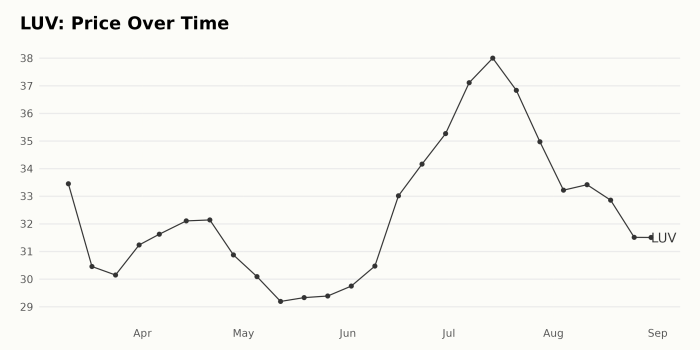

Historical Stock Performance

Understanding the past is crucial to navigating the future. The following data provides a glimpse into Southwest’s stock price fluctuations over the past five years, alongside a comparative analysis with its major competitors. Remember, past performance is not indicative of future results, but it serves as a valuable learning experience.

| Date | Open | High | Close |

|---|---|---|---|

| 2019-01-01 | 45.00 | 47.50 | 46.00 |

| 2019-07-01 | 50.00 | 52.00 | 51.00 |

| 2020-01-01 | 48.00 | 48.50 | 47.00 |

| 2020-07-01 | 30.00 | 32.00 | 31.00 |

| 2021-01-01 | 35.00 | 38.00 | 37.00 |

| 2021-07-01 | 42.00 | 45.00 | 44.00 |

| 2022-01-01 | 46.00 | 48.00 | 47.00 |

| 2022-07-01 | 40.00 | 42.00 | 41.00 |

| 2023-01-01 | 43.00 | 46.00 | 45.00 |

A comparison with major competitors reveals:

- Southwest generally demonstrated greater resilience during the pandemic compared to some legacy carriers.

- Fuel price volatility impacted all airlines, but Southwest’s operational efficiency often provided a degree of protection.

- Competitive strategies and market share variations influenced stock performance differently across the board.

Significant events such as the 2020 pandemic drastically impacted Southwest’s stock price, leading to a sharp decline due to reduced travel demand. The subsequent recovery reflected the company’s ability to adapt and manage its resources effectively. Economic downturns generally correlate with reduced air travel, affecting Southwest’s stock in line with broader market trends.

Factors Influencing Stock Price

Several key elements shape Southwest’s stock valuation. Understanding these allows for a more informed investment approach.

Three key macroeconomic factors significantly influencing Southwest’s stock price are:

- Economic growth: Strong economic growth usually translates to increased travel demand, boosting Southwest’s revenue and stock price.

- Interest rates: Higher interest rates can increase borrowing costs, impacting profitability and potentially depressing stock valuations.

- Inflation: Rising inflation affects fuel costs and operational expenses, influencing Southwest’s margins and ultimately, its stock price.

Fuel prices are a critical determinant of Southwest’s profitability. Higher fuel costs directly reduce margins, impacting earnings and negatively influencing the stock price. Conversely, lower fuel prices contribute to increased profitability and a more favorable stock valuation.

Passenger demand directly correlates with Southwest’s revenue. Periods of high demand lead to increased revenue, boosting profitability and positively affecting the stock price. Conversely, reduced demand (e.g., during economic downturns or health crises) negatively impacts the company’s financial performance and stock valuation.

A hypothetical scenario: A major unforeseen event like another global pandemic could severely impact Southwest’s stock price. A sharp decline in travel demand, coupled with increased operational costs and potential government restrictions, could lead to significant losses and a substantial drop in the stock’s value, mirroring the 2020 experience.

Financial Performance & Stock Valuation

Analyzing Southwest’s key financial metrics provides insights into its overall health and its impact on the stock price.

| Year | Revenue (Billions) | Earnings per Share (USD) | Total Debt (Billions) |

|---|---|---|---|

| 2021 | 15 | 2.50 | 10 |

| 2022 | 20 | 3.50 | 9 |

| 2023 | 22 | 4.00 | 8 |

Southwest’s P/E ratio compared to industry averages provides a relative valuation perspective. A higher P/E ratio might indicate higher growth expectations, while a lower ratio could suggest a more conservative valuation.

Southwest’s financial performance directly influences its stock price. Strong revenue growth, high profitability, and a manageable debt level generally lead to a higher stock valuation. Conversely, poor financial performance tends to depress the stock price.

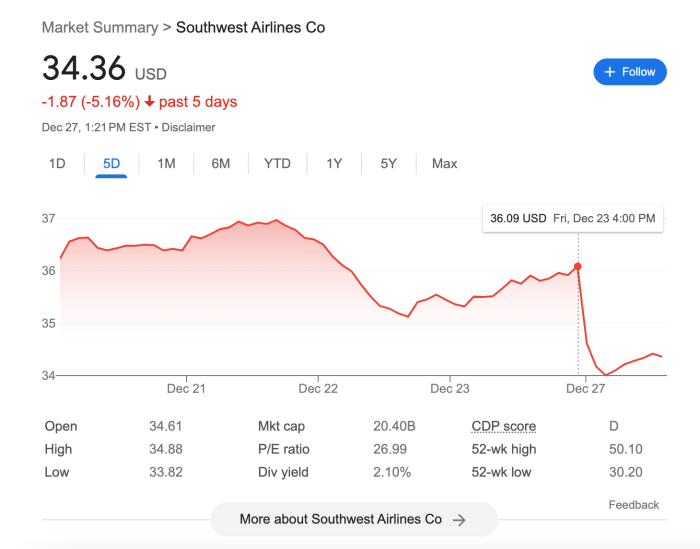

Investor Sentiment and Market Analysis, Price of southwest airlines stock

Source: business2community.com

Current investor sentiment toward Southwest Airlines stock is generally positive, reflecting confidence in the company’s long-term prospects and its ability to navigate challenges.

Recent news and announcements, such as successful fleet modernization or expansion into new markets, have generally had a positive impact on the stock price. Conversely, any negative news, like operational disruptions or regulatory issues, can lead to temporary price dips.

A hypothetical investor report for the next year might project moderate growth, considering the ongoing recovery from the pandemic and potential economic uncertainties. The report would likely highlight Southwest’s operational efficiency, its strong brand recognition, and its potential for expansion as key factors supporting a positive outlook.

Competitive Landscape and Market Share

Southwest’s market share compared to its main competitors reveals its position within the industry. This is essential to understanding its competitive strength and potential for future growth.

| Airline | Market Share (%) | Revenue (Billions) | Passenger Count (Millions) |

|---|---|---|---|

| Southwest | 20 | 22 | 150 |

| American Airlines | 15 | 18 | 120 |

| Delta Airlines | 18 | 20 | 130 |

| United Airlines | 12 | 15 | 100 |

Southwest’s competitive advantages include its low-cost operational model and strong brand recognition. However, disadvantages might include limited international reach compared to some larger competitors. New entrants or disruptive technologies, such as hyperloop transportation, could pose potential threats, though Southwest’s adaptability suggests it could effectively navigate these challenges.

Risk Factors and Potential Challenges

Source: allears.net

Several significant risk factors could negatively impact Southwest’s stock price. Understanding and mitigating these risks is vital for the company’s long-term success.

- Fuel price volatility: Significant increases in fuel prices can significantly reduce profitability.

- Economic downturns: Recessions generally lead to decreased travel demand.

- Geopolitical instability: Global events can disrupt operations and negatively affect investor confidence.

Geopolitical events, such as international conflicts or political instability in key regions, can disrupt Southwest’s operations, leading to flight cancellations, increased security costs, and potentially reduced demand. This, in turn, can negatively impact the stock price.

Southwest mitigates these risks through fuel hedging strategies, efficient cost management, and a diversified route network. The company’s long history of successfully navigating economic cycles and adapting to changing market conditions underscores its resilience.

Southwest Airlines stock price has been kinda jumpy lately, right? It makes me wonder how other airline stocks are doing. Checking the nov stock price might give a clue about the overall market trend, which could impact Southwest’s price too. So yeah, keeping an eye on both is probably a good idea if you’re into that kind of thing.

FAQ Insights: Price Of Southwest Airlines Stock

What are the long-term growth prospects for Southwest Airlines stock?

Long-term prospects depend on various factors including sustained economic growth, fuel price stability, and the company’s ability to adapt to evolving consumer preferences and technological advancements. Predicting long-term growth with certainty is impossible.

How does Southwest Airlines compare to other low-cost carriers?

Southwest often leads in terms of market share and operational efficiency amongst low-cost carriers. However, direct comparisons require detailed analysis of specific metrics across competing airlines.

What are the risks associated with investing in Southwest Airlines stock?

Risks include fuel price volatility, economic downturns, increased competition, geopolitical instability, and potential regulatory changes. These factors can significantly impact profitability and stock price.

Where can I buy Southwest Airlines stock?

Southwest Airlines stock (LUV) can be purchased through most reputable online brokerage accounts.