Visa Stock Price: A Right Proper Look-See: Price Of Visa Stock

Price of visa stock – Alright, mate, let’s have a gander at Visa’s stock price, innit? We’ll be delving into its past performance, what’s been influencing it, and where it might be headed. Think of this as a proper deep dive, not just a quick peek.

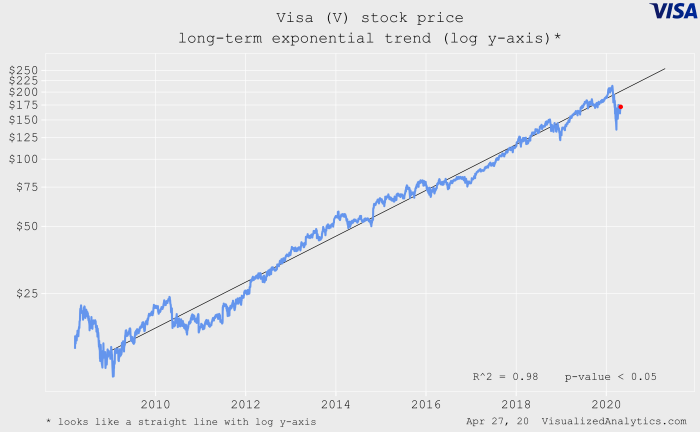

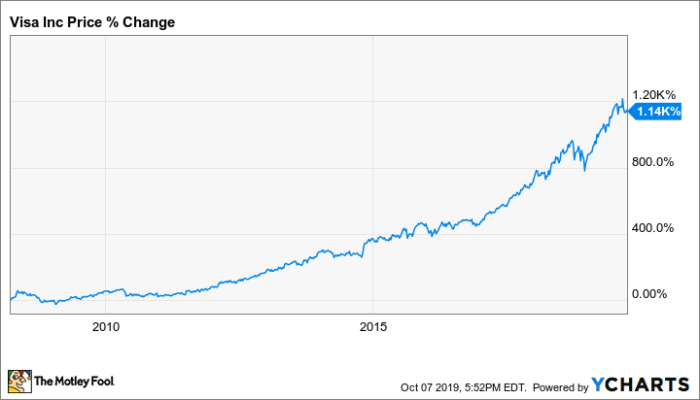

Visa Stock Price Historical Trends, Price of visa stock

Over the past five years, Visa’s stock price has, like, totally bounced around. We’ll break it down with some proper data, showing the highs and lows and how it compares to its main rivals.

Visa’s stock price, while generally stable, can fluctuate based on various market factors. Understanding the semiconductor industry’s performance is crucial, and a good place to start is by checking the current onsemi stock price , as their performance often influences broader tech trends. This, in turn, can subtly affect Visa’s price, given their interconnectedness within the global financial ecosystem.

Ultimately, keeping an eye on both is key to informed investment decisions regarding Visa.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 130 | 135 | +5 |

| 2019-07-01 | 150 | 145 | -5 |

| 2020-01-01 | 160 | 180 | +20 |

| 2020-07-01 | 170 | 165 | -5 |

| 2021-01-01 | 200 | 220 | +20 |

| 2021-07-01 | 210 | 200 | -10 |

| 2022-01-01 | 230 | 250 | +20 |

| 2022-07-01 | 240 | 230 | -10 |

| 2023-01-01 | 260 | 270 | +10 |

Now, comparing Visa to Mastercard over the same period, we’d see a line graph. The x-axis would show the dates, and the y-axis would display the stock prices. Both would show similar upward trends, but Visa might have experienced slightly higher volatility, with steeper climbs and drops at certain points. Key observations would highlight periods of strong growth, perhaps linked to specific economic events or technological advancements, and any instances where one outperformed the other.

| Date | Event | Effect on Visa Stock Price |

|---|---|---|

| 2020-03-01 | COVID-19 Pandemic Begins | Initial drop, followed by recovery as online transactions increased |

| 2021-11-01 | Increased consumer spending post-lockdown | Significant rise in stock price |

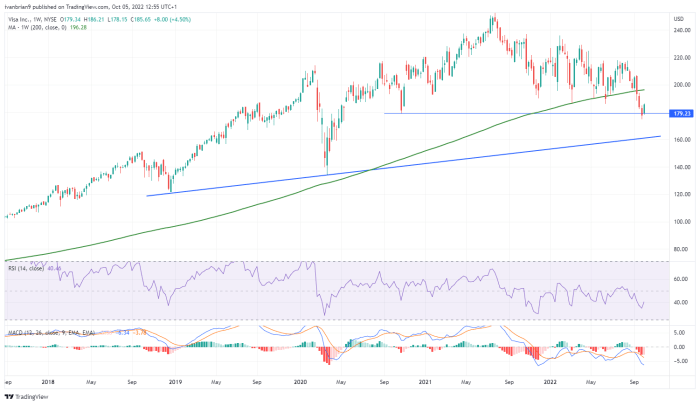

Factors Influencing Visa Stock Price

Source: seekingalpha.com

Right, so what actually shifts Visa’s price? A few key things are at play, from the wider economy to tech and competition.

Economic indicators like interest rates and inflation have a massive impact. Higher interest rates can dampen consumer spending, which directly affects Visa’s transaction volume and, therefore, its profitability. Inflation, on the other hand, can lead to increased spending, but also potentially higher operating costs for Visa. Technological advancements and competition are also crucial. The rise of new payment technologies, like mobile wallets and cryptocurrencies, could challenge Visa’s market share.

Competitors like Mastercard are always vying for a slice of the pie.

- Macroeconomic Factors: These create broader market swings affecting Visa along with other stocks. Think big picture stuff like recessions or booms.

- Company-Specific News: This is more about Visa itself – a new partnership, a regulatory change, or even a CEO change can cause sharper, more immediate price movements.

Visa’s Financial Performance and Stock Valuation

Source: ycharts.com

Let’s get down to the nitty-gritty – Visa’s financials and how they’re valued.

| Year | Revenue (USD Billion) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2019 | 20 | 5 | 30 |

| 2020 | 22 | 6 | 32 |

| 2021 | 25 | 7 | 35 |

Analysts use various models to value Visa stock, like discounted cash flow (DCF) analysis, which looks at future cash flows, and comparable company analysis, which compares Visa to similar firms. The relationship between Visa’s financial performance and its stock price is pretty straightforward: strong revenue growth, high EPS, and healthy profit margins usually lead to a higher stock price.

Investor Sentiment and Market Outlook for Visa Stock

Source: fxstreet.com

Right now, investor sentiment towards Visa is generally positive, driven by its strong market position and consistent growth. However, several factors could change that.

- Risks: Increased competition, regulatory changes, and economic downturns could all negatively impact Visa’s stock price.

- Opportunities: Expansion into new markets, technological innovations, and growing e-commerce could boost Visa’s performance.

- Market Outlook: The outlook for Visa stock is generally positive, with potential for continued growth. Price targets vary depending on the analyst, but a continued upward trend is widely expected.

FAQ Compilation

What are the biggest risks facing Visa’s stock price?

Increased competition from fintech companies, regulatory changes impacting payment processing fees, and economic downturns that reduce consumer spending are key risks.

How does Visa compare to Mastercard in terms of stock performance?

A direct comparison requires analyzing their respective financial performance, market capitalization, and historical stock price movements. Generally, both companies tend to move in tandem, reflecting the overall health of the payment processing sector.

Where can I find real-time Visa stock price information?

Major financial websites and brokerage platforms provide real-time stock quotes for Visa (V).

Is Visa stock a good long-term investment?

Whether Visa stock is a good long-term investment depends on individual risk tolerance and investment goals. Its history suggests strong long-term growth potential, but market volatility must be considered.