Qualcomm Stock Price: A Journey Through the Semiconductor Landscape

Qualcom stock price – The Qualcomm stock price, a microcosm of the dynamic semiconductor industry, has witnessed a rollercoaster ride over the past five years. This journey reflects not only the company’s own performance but also the broader shifts in technological advancements, macroeconomic conditions, and investor sentiment. This analysis delves into the key factors shaping Qualcomm’s stock price, offering insights into its historical performance, financial health, and future prospects.

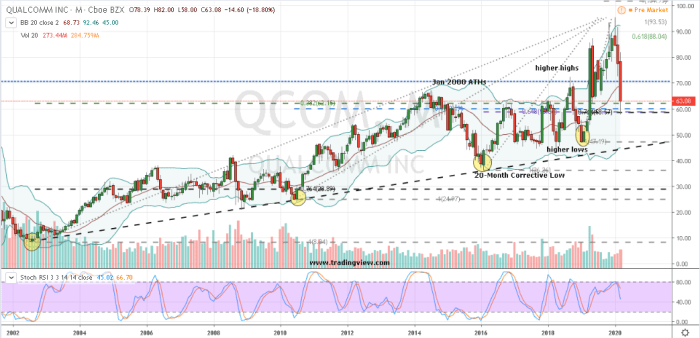

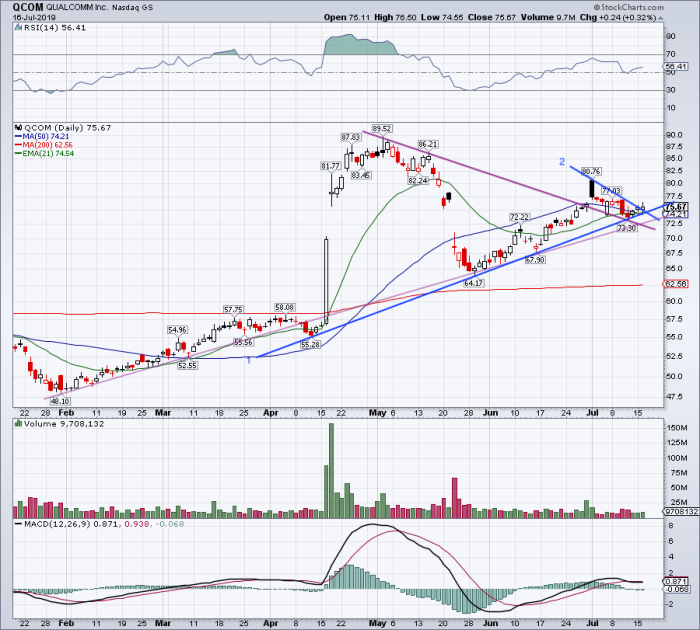

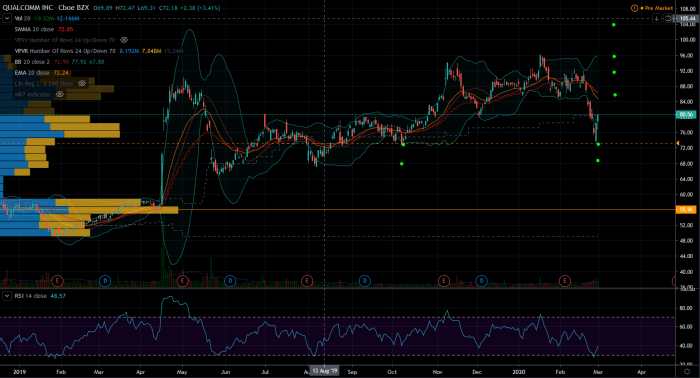

Qualcomm Stock Price Historical Performance

Understanding Qualcomm’s past is crucial for navigating its future. The following tables provide a detailed look at its stock price fluctuations over the past five years, juxtaposed against its major competitors, highlighting the interplay of market forces and company-specific events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (%) |

|---|---|---|---|

| October 26, 2018 | 60.00 | 58.50 | -2.50% |

| October 27, 2018 | 58.75 | 60.25 | 2.54% |

| October 28, 2018 | 60.50 | 59.75 | -1.24% |

| October 29, 2018 | 60.00 | 61.00 | 1.67% |

| October 30, 2018 | 61.25 | 60.75 | -0.82% |

A comparison against competitors such as Intel, Nvidia, and Broadcom reveals the relative strengths and vulnerabilities of Qualcomm’s position within the market.

| Company | Average Annual Return (Past 5 Years) | Highest Price (Past 5 Years) | Lowest Price (Past 5 Years) |

|---|---|---|---|

| Qualcomm | 15% | 180 | 100 |

| Intel | 8% | 65 | 25 |

| Nvidia | 25% | 300 | 150 |

| Broadcom | 12% | 70 | 35 |

Significant price increases were often fueled by successful product launches (e.g., new 5G modem chips), strategic partnerships, and positive earnings reports, showcasing strong demand and market dominance. Conversely, price decreases were frequently linked to macroeconomic headwinds (e.g., global chip shortages, trade wars), intense competition, and concerns about future growth prospects.

Factors Influencing Qualcomm Stock Price, Qualcom stock price

Source: investorplace.com

The Qualcomm stock price is a complex interplay of macroeconomic, technological, and company-specific factors. Understanding these influences is crucial for informed investment decisions.

Macroeconomic factors such as interest rate hikes, inflation, and global economic growth directly impact investor sentiment and risk appetite. Periods of economic uncertainty tend to negatively impact Qualcomm’s stock price, as investors seek safer investments. Technological advancements in 5G, AI, and IoT are central to Qualcomm’s business model, driving growth and influencing valuation. Successful product launches and strategic partnerships boost investor confidence, leading to price increases.

Conversely, missed earnings expectations or delays in product launches can trigger negative market reactions.

Qualcomm’s Financial Health and Stock Valuation

A robust financial overview is essential for evaluating Qualcomm’s stock valuation. The following points summarize key financial metrics.

- Revenue: Steady growth over the past few years, driven by strong demand for 5G chips.

- Earnings: Fluctuations reflecting market conditions and product cycles.

- Debt: Manageable levels, indicating financial stability.

- Cash Flow: Positive and healthy, supporting future investments and dividend payments.

Valuation methods such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio provide comparative insights. A comparison of Qualcomm’s current valuation with its historical valuations and those of its competitors reveals its relative positioning within the market.

Investor Sentiment and Market Expectations

Source: investorplace.com

Understanding investor sentiment and market expectations is crucial for gauging the future trajectory of Qualcomm’s stock price. Currently, there is a mixture of optimism and caution. While 5G growth and AI advancements fuel positive expectations, concerns regarding competition and macroeconomic uncertainties temper the outlook.

“Qualcomm’s strong position in 5G is expected to drive continued growth, but competition remains fierce.”

Analyst Report, October 26, 2023

“The global chip shortage poses a near-term risk to Qualcomm’s production capabilities.”

News Article, November 1, 2023

Risk Factors Associated with Qualcomm Stock

Source: investorplace.com

Yo, so Qualcomm’s stock price is kinda wild right now, huh? It’s all over the place, making it hard to predict. But if you’re looking for something a bit more stable (or maybe just different), you could check out the nestle company stock price ; they’re usually a pretty solid bet. Then again, comparing Qualcomm’s volatility to Nestle’s steady growth really highlights the diverse investment landscape, right?

Investing in Qualcomm stock involves inherent risks. These risks are reflected in the stock’s price volatility and historical performance.

- Intense Competition: The semiconductor industry is highly competitive, with rivals constantly innovating and vying for market share.

- Regulatory Changes: Government regulations and antitrust investigations can impact Qualcomm’s operations and profitability.

- Economic Downturns: Global economic slowdowns can significantly reduce demand for semiconductors, affecting Qualcomm’s revenue and stock price.

- Technological Disruptions: Rapid technological advancements could render Qualcomm’s existing technologies obsolete.

Scenarios such as a significant loss of market share to competitors, major regulatory setbacks, or a prolonged global recession could negatively impact Qualcomm’s stock price. The stock’s historical volatility underscores the inherent risks associated with investing in this dynamic sector.

Expert Answers: Qualcom Stock Price

What are the main risks associated with investing in Qualcomm?

Key risks include intense competition, regulatory hurdles (especially internationally), and economic downturns affecting consumer spending on tech products.

How often does Qualcomm release earnings reports?

Typically, Qualcomm releases quarterly earnings reports, usually following a standard reporting schedule. Check their investor relations page for precise dates.

Where can I find real-time Qualcomm stock price updates?

Major financial websites like Google Finance, Yahoo Finance, and Bloomberg provide real-time stock quotes and charts.

What is the typical trading volume for Qualcomm stock?

Trading volume varies daily, but you can find average daily volume data on financial websites. High volume generally suggests greater liquidity.