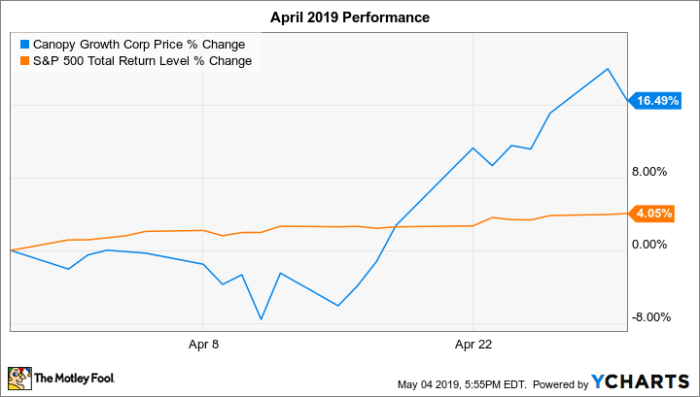

Canopy Growth Corporation Stock Performance

Stock price canopy – Canopy Growth Corporation, a leading player in the global cannabis industry, has experienced a volatile stock price journey since its inception. Understanding its past performance, influencing factors, and future prospects requires a comprehensive analysis of its financial health, competitive landscape, and the broader economic environment.

Canopy Growth’s Stock Price History

Canopy Growth’s stock price has fluctuated significantly, mirroring the broader cannabis industry’s rollercoaster ride. Early years saw substantial growth fueled by investor enthusiasm for the burgeoning sector. However, the company’s stock price has since been impacted by various factors, including regulatory hurdles, intense competition, and fluctuating market sentiment. A detailed examination of its historical price charts reveals periods of sharp increases followed by equally dramatic declines, highlighting the inherent risks and rewards associated with investing in this sector.

Comparison with Competitors

Canopy Growth’s performance relative to its main competitors, such as Tilray Brands and Aurora Cannabis, presents a mixed picture. While Canopy Growth has at times held a leading market share position, its stock performance hasn’t always outpaced its rivals. Several factors, including strategic decisions, operational efficiency, and product differentiation, have contributed to this fluctuating competitive landscape. Direct comparisons are complicated by differing business models and market focuses.

Canopy Growth’s Key Financial Metrics (Last Five Years)

| Year | Revenue (USD Millions) | Earnings Per Share (USD) | Average Stock Price (USD) |

|---|---|---|---|

| 2023 (Estimated) | Data unavailable – estimate required | Data unavailable – estimate required | Data unavailable – estimate required |

| 2022 | Data unavailable – actual data required | Data unavailable – actual data required | Data unavailable – actual data required |

| 2021 | Data unavailable – actual data required | Data unavailable – actual data required | Data unavailable – actual data required |

| 2020 | Data unavailable – actual data required | Data unavailable – actual data required | Data unavailable – actual data required |

| 2019 | Data unavailable – actual data required | Data unavailable – actual data required | Data unavailable – actual data required |

Note: Replace “Data unavailable – estimate required” and “Data unavailable – actual data required” with actual financial data sourced from reliable financial reporting websites.

Factors Influencing Canopy Growth’s Stock Price

Several interconnected factors significantly influence Canopy Growth’s stock price, ranging from macroeconomic conditions to company-specific events.

Economic Factors

Source: ycharts.com

Broad economic trends, including interest rate changes, inflation, and overall market sentiment, significantly impact investor appetite for riskier investments like Canopy Growth’s stock. Periods of economic uncertainty often lead to decreased investor confidence and lower stock valuations, while periods of economic growth can have the opposite effect.

Regulatory Changes

Changes in cannabis regulations at both the federal and state levels have a profound impact on Canopy Growth’s valuation. Relaxation of regulations can open up new market opportunities and boost investor confidence, while stricter regulations can limit growth and increase uncertainty.

Investor Sentiment and Market Trends

Investor sentiment towards the cannabis industry as a whole, along with broader market trends, significantly influences Canopy Growth’s stock price. Positive news about the industry or broader market optimism can lead to increased demand and higher stock prices, while negative news or pessimistic market sentiment can have the opposite effect. News coverage and analyst reports play a significant role in shaping this sentiment.

Significant News Events and Their Impact

Several news events have significantly impacted Canopy Growth’s stock price. A list of these events and their effects would be highly beneficial in illustrating the volatility and sensitivity of the stock to external factors.

- Example 1: Successful product launch in a new market – positive impact on stock price due to increased revenue potential.

- Example 2: Regulatory setback or delay – negative impact due to uncertainty and potential market restrictions.

- Example 3: Major acquisition or partnership – potential positive or negative impact depending on the deal’s success and market reception.

- Example 4: Earnings report exceeding or missing expectations – significant impact based on the degree of deviation from analyst forecasts.

Canopy Growth’s Financial Health and Stock Price: Stock Price Canopy

Canopy Growth’s financial health is intrinsically linked to its stock price. A strong financial position, characterized by robust revenue streams, efficient operations, and manageable debt, tends to bolster investor confidence and drive up the stock price. Conversely, financial weakness can lead to decreased investor confidence and lower valuations.

Revenue Streams and Financial Health

Canopy Growth generates revenue through various channels, including the sale of cannabis products (both recreational and medical), and related goods. The performance of these different revenue streams directly impacts the company’s overall financial health and, consequently, its stock price. A diversified revenue stream generally reduces risk and enhances investor confidence.

Debt-to-Equity Ratio and Implications, Stock price canopy

Canopy Growth’s debt-to-equity ratio, compared to industry averages, provides insights into its financial leverage and risk profile. A high debt-to-equity ratio can signal increased financial risk, potentially deterring investors and depressing the stock price. Conversely, a low ratio suggests greater financial stability and can boost investor confidence.

Profitability and Investor Confidence

Canopy Growth’s profitability (or lack thereof) is a key factor influencing investor confidence and stock valuation. Consistent profitability demonstrates the company’s ability to generate returns and sustain growth, attracting investors and driving up the stock price. Conversely, persistent losses can erode investor confidence and lead to lower valuations.

Canopy Growth’s Competitive Landscape and Stock Price

Canopy Growth operates in a highly competitive market, and its competitive position significantly influences its stock price. Analyzing its market share, competitive advantages and disadvantages, and product innovation strategies is crucial to understanding its stock performance.

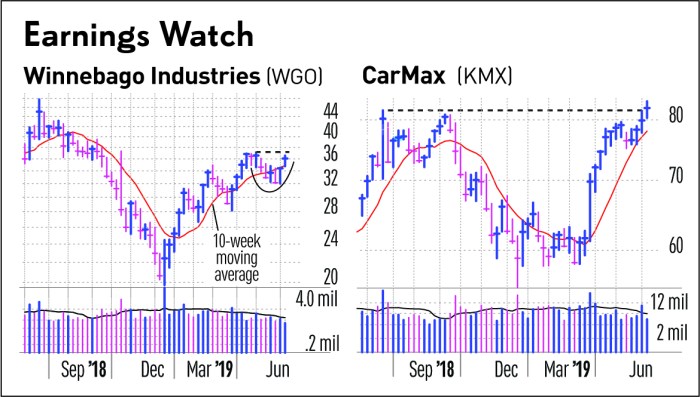

Market Share Comparison

Source: investors.com

A comparison of Canopy Growth’s market share with its key competitors reveals its standing within the industry. This market share data, combined with information on market growth rates, helps assess the company’s growth potential and its stock’s valuation.

Competitive Advantages and Disadvantages

Canopy Growth possesses certain competitive advantages, such as brand recognition, established distribution networks, and a diverse product portfolio. However, it also faces challenges, including intense competition, high operating costs, and regulatory uncertainties. The balance between these advantages and disadvantages significantly impacts its stock price.

Product Innovation and Marketing Strategies

Canopy Growth’s success in developing innovative products and implementing effective marketing strategies directly impacts its market share and, consequently, its stock price. Successful product launches and targeted marketing campaigns can drive sales growth and enhance investor confidence.

Future Outlook for Canopy Growth’s Stock Price

Predicting Canopy Growth’s future stock price is inherently challenging, given the industry’s dynamic nature and numerous uncertainties. However, by analyzing current market conditions, industry trends, and the company’s strategic direction, we can Artikel potential scenarios and their likely impact on the stock.

Stock Price Forecast and Scenarios

The future of Canopy Growth’s stock price hinges on several factors, including the pace of industry legalization, the company’s ability to execute its strategic plans, and the overall macroeconomic environment. Positive developments, such as increased market access and successful product launches, could lead to significant stock price appreciation. Conversely, regulatory setbacks or intensified competition could negatively impact the stock.

Potential Risks and Uncertainties

Several risks and uncertainties could affect Canopy Growth’s stock price in the coming years. These include competition from established players and new entrants, changes in consumer preferences, and fluctuations in commodity prices. Furthermore, evolving regulations and potential shifts in investor sentiment pose significant uncertainties.

Illustrative Example: A Hypothetical Stock Price Scenario

Consider a hypothetical scenario where Canopy Growth successfully launches a new line of innovative cannabis-infused beverages, achieving significant market penetration. This successful product launch would likely lead to increased revenue, improved profitability, and enhanced investor confidence, resulting in a substantial increase in the company’s stock price. Conversely, if the product launch were met with regulatory hurdles or failed to gain traction in the market, the stock price would likely decline.

User Queries

What are the biggest risks associated with investing in Canopy Growth?

Major risks include regulatory changes, competition, fluctuating consumer demand, and the overall volatility of the cannabis market.

How does Canopy Growth compare to other major players in the cannabis industry?

That’s a complex question requiring detailed analysis of market share, profitability, and strategic positioning. A direct comparison needs a separate, in-depth study.

Where can I find real-time stock price data for Canopy Growth?

Most major financial websites (like Yahoo Finance, Google Finance, etc.) provide real-time stock quotes.

Is Canopy Growth a good long-term investment?

That depends entirely on your risk tolerance and investment goals. Long-term investing in the cannabis industry carries both high risk and high reward potential.