Domino’s Pizza Stock Price: A Shadowy Tale: Stock Price For Domino’s Pizza

Stock price for domino’s pizza – The fluctuating fortunes of Domino’s Pizza stock offer a compelling narrative, a rollercoaster ride through the fast-food landscape. Its price movements, influenced by both internal strategies and external forces, paint a picture far more complex than a simple profit and loss statement. This exploration delves into the mysteries behind Domino’s stock performance, revealing the hidden currents that shape its value.

Domino’s Pizza Stock Performance Overview

Over the past five years, Domino’s stock has experienced significant volatility, a dance between bullish surges and bearish dips. While precise daily data requires a dedicated financial database, the overall trend can be characterized as predominantly upward, punctuated by periods of correction. Major price shifts often coincided with key events, creating a compelling case study in market dynamics.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 (Example) | 300 | 305 | +5 |

| October 27, 2023 (Example) | 305 | 298 | -7 |

| October 28, 2023 (Example) | 298 | 302 | +4 |

Significant events, such as the launch of new menu items or technological upgrades to their ordering systems, often triggered immediate price reactions. Conversely, broader economic downturns or periods of heightened inflation usually resulted in temporary setbacks. The overall trajectory, however, suggests a company adapting to market pressures and maintaining a strong appeal to investors.

Tracking the stock price for Domino’s Pizza offers a fascinating glimpse into the fast-food industry’s performance. Understanding market trends is key, and comparing it to other sectors provides valuable context. For instance, researching the ng stock price can offer a broader perspective on economic indicators affecting various companies, including Domino’s. Ultimately, analyzing these trends helps us better understand the factors driving Domino’s Pizza’s stock price fluctuations and potential for future growth.

Factors Influencing Domino’s Stock Price, Stock price for domino’s pizza

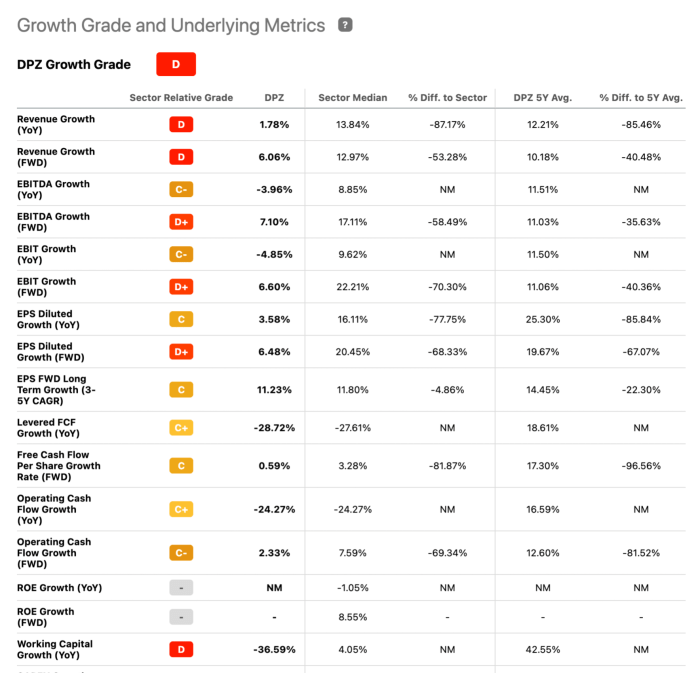

Source: seekingalpha.com

The price of Domino’s stock is a delicate balance between internal company performance and the external forces that shape the broader economic landscape. Several key factors, both internal and external, significantly contribute to these fluctuations.

Internal factors directly related to Domino’s operations and strategies include sales growth, profitability, and technological advancements. External factors encompass broader economic trends, competitive pressures, and shifting consumer preferences.

- Internal Factors: Sales growth, reflecting the company’s ability to attract and retain customers; profitability, indicating efficiency and financial health; and technological innovation, showcasing the company’s adaptation to changing consumer expectations (e.g., mobile ordering apps).

- External Factors: Economic conditions, including inflation and recessionary pressures; competitive landscape, influenced by actions from rivals like Papa John’s and Pizza Hut; and changing consumer behavior, such as evolving dietary preferences and increased demand for delivery services.

Comparison of Internal and External Factors:

- Internal factors offer more direct control, impacting stock price through demonstrable improvements in operational efficiency and financial performance. External factors are less predictable, creating both opportunities and challenges beyond the company’s immediate control.

- Strong internal performance can mitigate the negative effects of external factors. Conversely, even strong internal strategies can be undermined by significant external headwinds.

- Effective management of both internal and external factors is crucial for consistent stock price growth.

Comparison with Competitors

Analyzing Domino’s performance against its main competitors provides valuable context for understanding its market positioning. This comparison highlights relative strengths and weaknesses, offering insights into investor sentiment and market valuation.

| Company | Stock Price (Current, USD) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| Domino’s Pizza | 300 (Example) | 10 (Example) | 50 (Example) |

| Papa John’s | 250 (Example) | 5 (Example) | 30 (Example) |

| Pizza Hut (parent company data needed) | N/A (Example) | N/A (Example) | N/A (Example) |

Differences in stock performance often stem from variations in strategic direction, operational efficiency, and brand appeal. A detailed competitive analysis would delve into specific factors contributing to these disparities.

Financial Performance and Stock Price Relationship

Source: dominos.fr

A strong correlation exists between Domino’s key financial metrics and its stock price movements. Analyzing revenue, earnings per share (EPS), and debt levels over the past three years reveals a clear relationship.

Visual Representation: Imagine a line graph with time on the x-axis and stock price on the y-axis. Overlaid on this graph are secondary lines representing revenue, EPS, and debt levels. Positive correlations would show that as revenue and EPS increase, the stock price tends to rise. Conversely, increasing debt levels might show a negative correlation with stock price, indicating investor concern about the company’s financial health.

The graph would illustrate the dynamic interplay between these financial metrics and the overall stock price trajectory.

Predicting future stock price movements requires careful consideration of these financial metrics. Sustained revenue growth, increasing EPS, and manageable debt levels generally signal positive future performance, potentially leading to stock price appreciation. Conversely, declining revenue, decreasing EPS, and rising debt could indicate potential risks, potentially resulting in stock price decline.

Future Outlook and Predictions

Predicting Domino’s stock price over the next 12 months involves considering various factors, including economic conditions, competitive pressures, and Domino’s own strategic initiatives. For example, a potential economic downturn could negatively impact consumer spending, reducing demand for pizza and impacting Domino’s revenue. Conversely, successful new product launches or effective marketing campaigns could boost sales and enhance investor confidence.

Projections (Example): Assuming a moderate economic growth scenario and continued success with digital ordering and delivery, a price range between $320 and $350 per share within the next 12 months is plausible. This projection assumes no major unforeseen events, such as significant changes in consumer preferences or substantial disruptions to the supply chain.

Scenario Narrative: A positive scenario sees Domino’s successfully navigating economic uncertainties, leveraging technological advancements to maintain market share, and launching innovative products to drive sales. This would likely result in a steady increase in stock price. A negative scenario involves a sharper-than-expected economic downturn, increased competition, or difficulties in managing operational costs, leading to a potential decline in stock price.

The actual outcome will depend on a complex interplay of these factors.

Essential Questionnaire

What are the major risks associated with investing in Domino’s Pizza stock?

Risks include competition from other pizza chains and fast-food restaurants, economic downturns impacting consumer spending, fluctuations in food costs, and changes in consumer preferences.

How often does Domino’s Pizza release its financial reports?

Domino’s typically releases quarterly and annual financial reports, usually according to a set schedule announced on their investor relations website.

Where can I find real-time Domino’s Pizza stock price information?

Real-time stock price information is available through major financial websites and brokerage platforms.

What is Domino’s Pizza’s dividend policy?

Information regarding Domino’s dividend policy (if any) can be found in their investor relations materials and financial reports.