Understanding Stock Prices: A Psychological Approach to Investing

Stock price formula – Investing in the stock market can feel overwhelming, like navigating a complex maze. Understanding stock prices is the first step towards navigating this maze successfully. This guide will demystify stock prices, providing a framework for informed decision-making. We’ll explore the psychological aspects of investing alongside the fundamental principles, aiming to build your confidence and empower your investment journey.

Factors Influencing Stock Prices

Source: slidetodoc.com

Numerous factors influence a stock’s price, creating a dynamic and often unpredictable market. These factors can be broadly categorized into fundamental factors (company performance, economic conditions) and technical factors (market sentiment, trading volume). Understanding this interplay is crucial for a comprehensive understanding of stock price movements.

- Company Performance: Strong earnings, revenue growth, and innovative products generally drive stock prices higher.

- Economic Conditions: Broad economic trends, such as inflation, interest rates, and recessionary fears, significantly impact stock prices.

- Market Sentiment: Investor confidence and overall market mood play a significant role, often leading to irrational exuberance or panic selling.

- Industry Trends: Disruptive technologies, regulatory changes, and competitive pressures within an industry can significantly affect the stocks of companies within that industry.

- Geopolitical Events: Global events, such as wars or political instability, can cause significant market volatility.

Market Capitalization vs. Stock Price

While often confused, market capitalization and stock price are distinct concepts. Market capitalization represents the total value of a company’s outstanding shares, calculated by multiplying the stock price by the number of outstanding shares. The stock price, on the other hand, reflects the price of a single share.

Understanding a stock price formula requires considering numerous factors, including intrinsic value and market sentiment. A key example of applying such a formula can be seen when analyzing the power grid stock price , where factors like regulatory changes and energy demand heavily influence the final calculated price. Ultimately, the accuracy of any stock price formula depends on the reliability and comprehensiveness of the input data.

Components of a Stock’s Value

A stock’s value is a complex interplay of various factors, reflecting the present value of future earnings and growth potential. Intrinsic value, representing a company’s true worth, is a key component, but market sentiment and speculation also play a role.

- Future Earnings: Investors assess the company’s projected future earnings to determine its long-term value.

- Growth Potential: The company’s potential for expansion and market share growth is a critical factor in determining its value.

- Risk Profile: Higher risk generally necessitates a higher potential return, influencing the stock’s price.

- Market Sentiment: Investor confidence and speculation can significantly inflate or deflate a stock’s price relative to its intrinsic value.

Valuation Methods Comparison

| Valuation Method | Formula | Interpretation | Limitations |

|---|---|---|---|

| P/E Ratio | Market Price per Share / Earnings per Share | Shows how much investors are willing to pay for each dollar of earnings. | Can be misleading if earnings are manipulated or volatile. |

| PEG Ratio | P/E Ratio / Earnings Growth Rate | Adjusts the P/E ratio for the company’s growth rate. | Relies on accurate earnings growth projections, which can be difficult to predict. |

| Price-to-Book Ratio | Market Price per Share / Book Value per Share | Compares the market value of a company to its net asset value. | Book value may not accurately reflect a company’s true worth, especially for companies with significant intangible assets. |

| Dividend Yield | Annual Dividend per Share / Market Price per Share | Represents the return on investment from dividends. | Companies may cut or eliminate dividends, impacting the yield. |

Intrinsic Value vs. Market Price

Understanding the difference between intrinsic value and market price is fundamental to successful investing. Intrinsic value represents a company’s true worth, based on its fundamental financial strength and future prospects. Market price, on the other hand, reflects the current trading price of the stock, influenced by supply and demand, market sentiment, and speculation.

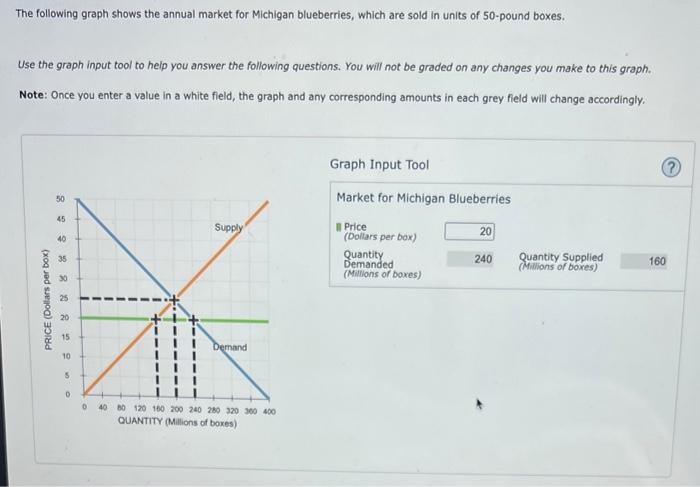

Intrinsic Value Calculation and Comparison with Market Price

Source: cheggcdn.com

Calculating intrinsic value involves various methods, including discounted cash flow (DCF) analysis and asset-based valuation. Comparing this calculated intrinsic value with the current market price can reveal potential investment opportunities. If the market price is significantly below the intrinsic value, it might signal an undervalued stock. Conversely, a market price significantly above the intrinsic value might indicate an overvalued stock.

Investment Opportunities from Discrepancies

Discrepancies between intrinsic and market price create investment opportunities. When the market price is below the intrinsic value, investors can potentially profit by buying at a discount and holding the stock until the market price reflects its true worth. Conversely, a high market price relative to intrinsic value might signal a good time to sell or avoid investing.

Hypothetical Scenario

Imagine Company X, with a calculated intrinsic value of $50 per share based on its strong financials and growth potential. However, due to temporary negative market sentiment, the market price drops to $35 per share. This discrepancy presents a potential buying opportunity for investors who believe the market will eventually recognize the company’s true worth. If the market price rises back to $50, investors would realize a significant profit.

Financial Statements and Stock Price

Financial statements provide crucial insights into a company’s financial health and performance, directly influencing its stock price. Analyzing these statements allows investors to assess a company’s profitability, solvency, and liquidity, all of which are critical in determining its intrinsic value and, consequently, its stock price.

Key Financial Statements and Their Relation to Stock Price

The income statement reveals a company’s profitability over a period, the balance sheet shows its financial position at a specific point in time, and the cash flow statement tracks its cash inflows and outflows. Analyzing key metrics from these statements helps investors understand the company’s financial health and growth prospects, directly impacting their assessment of the stock’s value.

- Income Statement: Metrics like revenue, net income, and earnings per share (EPS) directly impact investor perception of profitability and future growth.

- Balance Sheet: Metrics like assets, liabilities, and equity provide insights into a company’s financial strength and solvency.

- Cash Flow Statement: Metrics like operating cash flow and free cash flow indicate a company’s ability to generate cash, crucial for reinvestment and dividend payments.

Examples of Impact of Financial Statement Changes on Stock Price

For example, a significant increase in revenue and net income is typically associated with a rise in stock price, reflecting positive investor sentiment. Conversely, a decline in profitability often leads to a decrease in stock price. Unexpected losses or a significant increase in debt can trigger substantial stock price drops.

Key Financial Ratios for Stock Valuation

Source: corporatefinanceinstitute.com

- Price-to-Earnings Ratio (P/E): Compares a company’s stock price to its earnings per share.

- Price-to-Sales Ratio (P/S): Compares a company’s stock price to its revenue per share.

- Price-to-Book Ratio (P/B): Compares a company’s market capitalization to its book value.

- Return on Equity (ROE): Measures a company’s profitability relative to its shareholders’ equity.

- Debt-to-Equity Ratio: Indicates the proportion of a company’s financing that comes from debt versus equity.

Market Sentiment and Stock Price

Market sentiment, encompassing investor confidence and overall market mood, significantly impacts stock prices. News events, economic data releases, and even social media trends can influence investor psychology, leading to price fluctuations that may not always reflect a company’s fundamental value.

Impact of News Events on Stock Prices

Positive news, such as a successful product launch or a strong earnings report, often leads to a rise in stock price. Conversely, negative news, such as a product recall or a lawsuit, can trigger a decline. The speed and magnitude of these reactions can be amplified by market sentiment.

Investor Sentiment and Stock Prices, Stock price formula

Investor sentiment is a powerful force. Periods of optimism and confidence can drive stock prices higher, even if underlying fundamentals don’t fully justify the increase. Conversely, fear and pessimism can lead to widespread selling, even if a company’s fundamentals remain strong. This is often referred to as market psychology.

Speculation and Market Psychology

Speculation plays a significant role in stock price movements. Investors may buy or sell stocks based on anticipated future price movements rather than on fundamental analysis. This speculative behavior can create price bubbles or crashes, independent of a company’s intrinsic value.

Market Trends and Stock Price Fluctuations

Broad market trends, such as bull markets (periods of rising prices) and bear markets (periods of falling prices), influence individual stock prices. During a bull market, even relatively weak stocks may experience price increases, while during a bear market, even strong stocks can decline.

Technical Analysis and Stock Price

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. Unlike fundamental analysis, which assesses a company’s intrinsic value, technical analysis uses charts and indicators to spot trends and potential trading opportunities.

Basic Principles of Technical Analysis

Technical analysts believe that past price movements can predict future movements. They use various charts and indicators to identify trends, support levels (price points where buying pressure is expected to outweigh selling pressure), and resistance levels (price points where selling pressure is expected to outweigh buying pressure).

Common Technical Indicators

- Moving Averages: Calculate the average price over a specific period, smoothing out price fluctuations and identifying trends.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Identifies changes in momentum by comparing two moving averages.

Charting Techniques in Technical Analysis

Various charting techniques are used, including line charts, bar charts, and candlestick charts. Each technique presents price data differently, offering unique perspectives on price trends and patterns. Candlestick charts, for example, provide detailed information on the opening, closing, high, and low prices for each period.

Interpreting Candlestick Charts

Consider a “hammer” candlestick pattern: a small body with a long lower wick (shadow) and a short or no upper wick. This pattern often signals a potential reversal from a downtrend, suggesting that buying pressure overcame selling pressure near the low of the period.

Fundamental Analysis and Stock Price

Fundamental analysis focuses on assessing a company’s intrinsic value based on its financial statements, business model, and competitive landscape. This approach aims to identify stocks that are undervalued by the market, offering potential investment opportunities.

Basic Principles of Fundamental Analysis

Fundamental analysts believe that a stock’s price should reflect its intrinsic value. They analyze a company’s financial statements, competitive position, management team, and industry trends to estimate its true worth. If the market price is below the estimated intrinsic value, it is considered undervalued.

Key Metrics Used in Fundamental Analysis

- Earnings Per Share (EPS): Measures a company’s profitability per share outstanding.

- Revenue Growth: Indicates the rate at which a company’s sales are increasing.

- Debt-to-Equity Ratio: Shows the proportion of a company’s financing that comes from debt.

- Return on Equity (ROE): Measures a company’s profitability relative to its shareholders’ equity.

Identifying Undervalued Stocks Using Fundamental Analysis

By comparing a company’s intrinsic value (calculated using various methods) to its market price, fundamental analysts identify potential undervalued stocks. A stock trading significantly below its intrinsic value presents a potential buying opportunity.

Steps in Conducting Fundamental Analysis

| Step | Action | Considerations | Output |

|---|---|---|---|

| 1. Company Research | Understand the company’s business model, industry, and competitive landscape. | Analyze industry reports, company websites, and news articles. | Comprehensive understanding of the company’s operations. |

| 2. Financial Statement Analysis | Analyze the income statement, balance sheet, and cash flow statement. | Calculate key financial ratios and assess profitability, liquidity, and solvency. | Key financial metrics and ratios. |

| 3. Valuation | Estimate the company’s intrinsic value using various valuation methods. | Consider different approaches like discounted cash flow analysis and comparable company analysis. | Estimated intrinsic value. |

| 4. Comparison and Investment Decision | Compare the estimated intrinsic value to the market price. | Consider risk tolerance and investment goals. | Investment decision (buy, hold, or sell). |

Essential Questionnaire: Stock Price Formula

What is the difference between a stock’s price and its value?

Price is what someone is willing to pay for a stock right now. Value is a more subjective assessment of a stock’s intrinsic worth, often based on its future earnings potential and asset base.

How often are stock prices updated?

Stock prices are constantly updated throughout the trading day, reflecting the ongoing buying and selling activity.

Can I use the stock price formula to predict future prices?

No single formula can perfectly predict future stock prices. Market forces are too complex and unpredictable. However, understanding the factors that influence price can improve your investment strategies.

What are some common mistakes investors make when evaluating stock prices?

Common mistakes include relying solely on price charts, ignoring fundamental analysis, and letting emotions drive investment decisions.