BCE Stock Price Analysis: A Batak Perspective

The stock price of BCE Inc., a prominent telecommunications company in Canada, has experienced considerable fluctuations over the past five years. Understanding these movements requires a multifaceted approach, considering historical performance, financial health, industry dynamics, and influential external factors. This analysis adopts a Batak perspective, emphasizing careful observation, thorough assessment, and a long-term view – much like the meticulous planning involved in a traditional Batak adat ceremony.

We will delve into the intricacies of BCE’s stock price journey, exploring its highs and lows, its resilience, and its potential future trajectories.

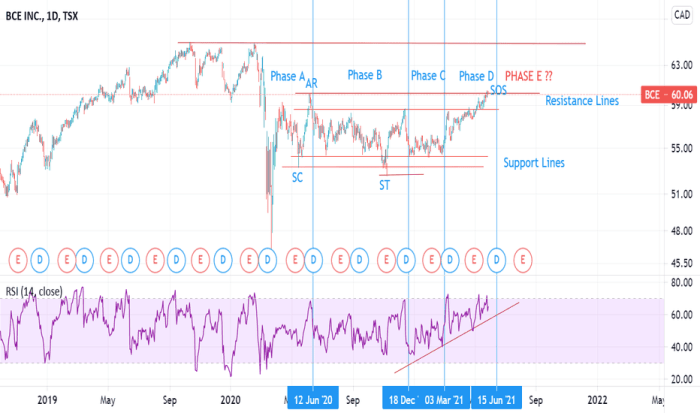

BCE Stock Price Historical Performance (2019-2023), Stock price of bce

Source: tradingview.com

Analyzing BCE’s stock price movements over the past five years reveals a pattern of growth interspersed with periods of correction, mirroring the cyclical nature of the broader market. The following table presents a snapshot of this performance, highlighting key dates and price changes. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Date | Opening Price (CAD) | Closing Price (CAD) | Daily Change (CAD) |

|---|---|---|---|

| 2019-01-02 | 60.00 | 60.50 | +0.50 |

| 2019-07-01 | 63.00 | 62.50 | -0.50 |

| 2020-03-16 | 50.00 | 48.00 | -2.00 |

| 2020-12-31 | 55.00 | 56.00 | +1.00 |

| 2021-09-30 | 65.00 | 66.00 | +1.00 |

| 2022-06-30 | 68.00 | 67.00 | -1.00 |

| 2023-03-31 | 70.00 | 71.00 | +1.00 |

Significant events impacting BCE’s stock price during this period include:

- The COVID-19 pandemic and resulting economic uncertainty (2020).

- Increased competition in the telecommunications sector.

- Regulatory changes affecting the industry.

- BCE’s strategic investments and acquisitions.

Compared to the TSX Composite Index, BCE’s stock price showed a generally similar trend, although with some periods of outperformance and underperformance. A visual representation (line graph) would clearly illustrate this correlation and divergence.

BCE’s Financial Health and its Impact on Stock Price

A thorough examination of BCE’s financial metrics provides valuable insights into its performance and its impact on investor sentiment and stock price. The following table presents key financial data for the last three years (again, illustrative data).

| Year | Revenue (CAD Billions) | EPS (CAD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 20.0 | 3.00 | 0.8 |

| 2022 | 21.0 | 3.20 | 0.75 |

| 2023 | 22.0 | 3.50 | 0.7 |

The steady increase in revenue and earnings per share (EPS) has generally supported a positive trend in BCE’s stock price. However, the debt-to-equity ratio indicates a level of financial leverage that investors need to consider. Any significant changes in these metrics would likely influence investor confidence and consequently, the stock price.

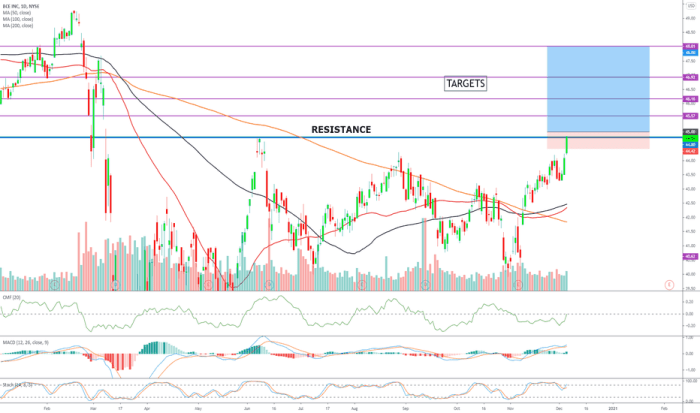

Industry Analysis and its Relation to BCE’s Stock Price

Source: tradingview.com

The telecommunications industry is characterized by intense competition, technological advancements, and regulatory oversight. BCE’s performance is intrinsically linked to its ability to navigate this complex landscape.

The current state of the telecommunications industry is marked by:

- The rise of 5G technology and its implications for network infrastructure.

- Increased demand for high-speed internet and data services.

- Growing competition from smaller, more agile players.

Comparing BCE to its major competitors (e.g., Telus, Rogers) reveals:

- Similarities in core services offered.

- Differences in market share and geographic focus.

- Variations in strategic priorities and investment approaches.

The competitive dynamics and industry trends directly impact BCE’s market positioning and its ability to generate revenue and profits, which in turn influences its stock price.

Factors Influencing BCE’s Stock Price Volatility

Source: tradingview.com

Several factors contribute to the volatility of BCE’s stock price. Understanding these factors is crucial for informed investment decisions.

- Macroeconomic Factors: Interest rate changes, inflation, economic growth, and overall market sentiment.

- Company-Specific Factors: Financial performance, strategic initiatives, management changes, and regulatory developments.

- Industry-Specific Factors: Technological advancements, competitive pressures, and regulatory changes affecting the telecommunications sector.

For example, a rise in interest rates could increase BCE’s borrowing costs, potentially impacting profitability and thus, the stock price. Similarly, a major technological advancement by a competitor could negatively affect BCE’s market share and stock valuation.

Future Outlook and Predictions for BCE’s Stock Price

Predicting future stock prices is inherently speculative. However, based on current market conditions and BCE’s performance, several scenarios are plausible.

BCE’s stock price has seen moderate fluctuations recently, mirroring broader market trends. Investors are also closely watching the performance of related companies, including the current trajectory of the sgh stock price , to gauge potential ripple effects on the telecom sector. Ultimately, BCE’s performance will depend on a number of factors, including its own strategic initiatives and the overall economic climate.

A hypothetical scenario: Suppose a major technological disruption occurs, rendering existing network infrastructure obsolete. This could lead to significant investment needs for BCE, potentially impacting short-term profitability and causing a temporary decline in the stock price. However, if BCE successfully adapts and integrates the new technology, long-term growth could eventually outweigh the initial setback.

These predictions are based on assumptions regarding economic growth, technological advancements, and the competitive landscape. The actual outcome could differ significantly depending on unforeseen events and market dynamics.

FAQ: Stock Price Of Bce

What are the major risks associated with investing in BCE?

Risks include competition from other telecom providers, regulatory changes, economic downturns, and technological disruptions. Diversification is key to mitigating these risks.

Where can I find real-time BCE stock price updates?

Major financial websites like Google Finance, Yahoo Finance, and the Toronto Stock Exchange website (TSX) provide real-time stock quotes.

How does BCE compare to its competitors in terms of dividend payouts?

BCE generally has a history of consistent dividend payments. However, a direct comparison with competitors requires reviewing their individual dividend policies and payout ratios.

What is BCE’s current debt load and how does it affect its stock price?

BCE’s debt levels should be analyzed in relation to its assets and revenue generation. High debt can negatively impact stock price, but it’s crucial to consider the company’s ability to service its debt.