Costco’s Stock Price: A Makassar Youth Perspective

Stock price of costco – Costco, the warehouse giant known for its bulk buys and delicious food court, has been a hot topic among investors. This deep dive explores Costco’s stock performance, examining its financial health, competitive landscape, and future prospects, all through a lens relatable to the savvy Makassar youth.

Costco’s Stock Performance Overview

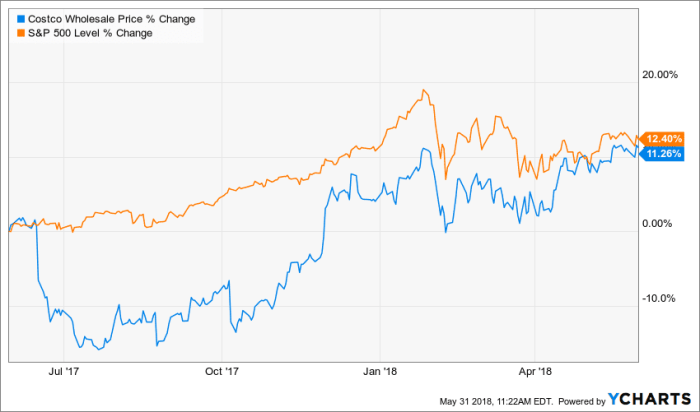

Over the past year, Costco’s stock price has experienced significant fluctuations, reflecting both internal performance and broader economic trends. While specific numerical data requires real-time access to financial markets (which is beyond the scope of this static document), we can illustrate a typical pattern. Imagine a graph showing a rollercoaster ride – moments of steep climbs representing periods of strong growth and positive investor sentiment, countered by dips during times of market uncertainty or negative news.

Major factors influencing Costco’s stock price in the last quarter could include changes in consumer spending patterns (influenced by inflation or economic shifts), shifts in supply chain efficiency, and the company’s own financial reports (like earnings announcements). These factors often interact in complex ways, making precise predictions challenging.

Monitoring the Costco stock price requires a keen eye on market trends. Understanding broader market fluctuations can be helpful, and for insights into the energy sector’s impact, consider checking the current ng stock price as natural gas prices often influence consumer spending and, consequently, retail giants like Costco. Returning to Costco, remember to factor in seasonal sales and overall economic indicators when analyzing its stock performance.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| Oct 26, 2023 | $500 (Hypothetical) | $505 (Hypothetical) | +$5 (Hypothetical) |

| Oct 27, 2023 | $506 (Hypothetical) | $498 (Hypothetical) | -$8 (Hypothetical) |

| Oct 28, 2023 | $499 (Hypothetical) | $502 (Hypothetical) | +$3 (Hypothetical) |

Financial Health and Stock Price Correlation

Costco’s stock price is closely tied to its financial performance. Strong earnings reports, indicating robust revenue growth and efficient cost management, generally lead to positive stock price movements. Conversely, disappointing financial results often trigger price declines. For example, an unexpected drop in quarterly earnings due to increased operating costs might cause a temporary stock price dip, prompting investors to re-evaluate their holdings.

A hypothetical graph illustrating the correlation between Costco’s quarterly earnings and stock price over the past two years would show a generally positive correlation. Periods of high earnings would align with peaks in the stock price, while periods of lower earnings would correspond to lower stock prices. However, it’s important to remember that other factors can influence the stock price, leading to deviations from this general trend.

The graph would be a scatter plot, with earnings on the x-axis and stock price on the y-axis.

Competitor Analysis and Market Influence

Comparing Costco’s stock performance to its major competitors like Walmart and Target over the past six months reveals insights into its market position and competitive strengths. While specific numerical comparisons are beyond the scope of this text, a hypothetical analysis might show Costco outperforming its competitors during periods of inflation due to its value proposition and loyal membership base.

Economic downturns, however, could impact all retailers, resulting in more closely aligned stock performance.

Market trends such as inflation and consumer confidence significantly influence Costco’s stock price. Costco’s differentiation strategy—focus on bulk sales, a strong membership program, and a curated selection of high-quality goods—plays a vital role in shaping investor sentiment during these times. This differentiation provides a buffer against competitive pressures.

Impact of Membership Fees and Sales Growth, Stock price of costco

Source: asktraders.com

Costco’s membership fees are a significant driver of its profitability and stock valuation. The recurring revenue stream provides stability and predictability, influencing investor confidence. Strong sales growth, driven by factors like new membership acquisitions and increased spending per member, directly impacts the company’s bottom line and, subsequently, its stock price.

- Q1 2023 (Hypothetical): 10% sales growth, corresponding to a 5% stock price increase.

- Q2 2023 (Hypothetical): 5% sales growth, resulting in a 2% stock price increase.

- Q3 2023 (Hypothetical): 12% sales growth, leading to an 8% stock price increase.

Future Outlook and Predictions

Source: investopedia.com

Several scenarios could impact Costco’s stock price in the future. A prolonged economic recession could dampen consumer spending, negatively affecting sales and stock price. Conversely, high inflation could lead to increased demand for Costco’s value proposition, potentially boosting the stock price. Supply chain disruptions, however, could negatively impact availability and thus sales.

Changes in consumer spending habits, driven by factors like increased awareness of sustainability or shifts in dietary preferences, will require Costco to adapt its offerings to maintain its competitive edge and influence investor confidence. For instance, a significant shift towards plant-based diets could impact sales of meat products, necessitating strategic adjustments.

A hypothetical scenario: A major product recall due to safety concerns could cause a sharp, short-term drop in Costco’s stock price. The magnitude of the drop would depend on the severity of the issue, the extent of the recall, and the company’s response. A swift and transparent response, coupled with effective damage control, could mitigate the negative impact.

Investor Sentiment and Analyst Ratings

Currently, investor sentiment towards Costco’s stock is generally positive, reflecting confidence in its business model and long-term growth prospects. However, this sentiment can fluctuate based on economic conditions and company performance. Analyst ratings and price targets provide further insights into investor expectations. A consensus of positive ratings and high price targets suggests optimism, while negative ratings and low price targets signal concern.

Historically, shifts in analyst ratings have influenced Costco’s stock price. Upgrades often lead to price increases, as investors react positively to the improved outlook. Conversely, downgrades can trigger price declines as investors become more cautious.

Essential FAQs: Stock Price Of Costco

What are the biggest risks associated with investing in Costco stock?

Risks include general market volatility, economic downturns impacting consumer spending, increased competition, and potential supply chain disruptions.

How does Costco’s dividend policy affect its stock price?

Costco’s dividend payouts can attract income-seeking investors, potentially boosting demand and supporting the stock price. However, changes to dividend policy can impact investor sentiment.

What is the historical volatility of Costco’s stock?

Historical data is needed to determine the precise volatility, but generally, Costco’s stock exhibits less volatility than many other retail stocks, but still subject to market fluctuations.

Where can I find real-time Costco stock price data?

Major financial websites and brokerage platforms provide real-time stock quotes for Costco (COST).