FNMA Stock Price Analysis: Stock Price Of Fnma

Stock price of fnma – The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, plays a crucial role in the US mortgage market. Understanding its stock price movements is vital for investors interested in the financial sector and the broader economy. This analysis delves into the historical trends, influencing factors, financial performance, competitive landscape, and future outlook of FNMA’s stock price.

FNMA Stock Price Historical Trends, Stock price of fnma

Source: githubassets.com

Analyzing FNMA’s stock price over the past decade reveals significant fluctuations tied to economic events and broader market trends. The following table provides a glimpse into these movements. Note that this data is illustrative and should be verified with reliable financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2014-01-02 | 6.00 | 6.10 | +0.10 |

| 2014-01-03 | 6.15 | 6.25 | +0.10 |

| … | … | … | … |

| 2023-12-29 | 7.50 | 7.40 | -0.10 |

Major economic events have significantly impacted FNMA’s stock price.

- The 2008 financial crisis led to a dramatic decline in FNMA’s stock price due to the subprime mortgage crisis and the company’s subsequent government conservatorship.

- Recessions generally correlate with lower FNMA stock prices as mortgage activity slows.

- Changes in interest rates directly influence mortgage demand and consequently, FNMA’s profitability and stock valuation.

FNMA’s stock price shows a strong negative correlation with interest rate increases, as higher rates reduce mortgage refinancing activity and overall demand.

Factors Influencing FNMA Stock Price

Several macroeconomic factors and government actions influence FNMA’s stock performance.

- Interest Rates: As mentioned previously, interest rate changes significantly impact mortgage demand and FNMA’s profitability.

- Housing Market Conditions: The health of the housing market directly affects FNMA’s business volume and financial performance.

- Economic Growth: Strong economic growth usually leads to increased mortgage demand and positively impacts FNMA’s stock price.

- Inflation: High inflation can increase interest rates and negatively impact the housing market, affecting FNMA’s performance.

Government policies and regulations play a crucial role in shaping FNMA’s operations and stock price. Changes in government oversight or interventions can cause significant volatility.

Investor sentiment and market trends also influence FNMA’s valuation. Positive investor sentiment often leads to higher stock prices, while negative sentiment can cause declines.

FNMA’s Financial Performance and Stock Price

Analyzing FNMA’s financial statements provides insight into its financial health and its relationship with its stock price. The following table presents key financial metrics (illustrative data).

| Year | Revenue (USD Billions) | Net Income (USD Billions) | EPS (USD) |

|---|---|---|---|

| 2019 | 10 | 2 | 1.00 |

| 2020 | 12 | 2.5 | 1.25 |

| … | … | … | … |

FNMA’s EPS generally shows a positive correlation with its stock price; higher EPS usually indicates stronger financial performance and leads to higher stock valuations.

A visual representation of the correlation between FNMA’s book value and market capitalization would show a generally positive relationship, although the market capitalization often fluctuates more dramatically than the book value due to market sentiment and other factors. The graph would show periods where market capitalization significantly exceeds book value (indicating market optimism) and periods where it’s closer to or even below book value (indicating market pessimism).

Comparison with Competitors

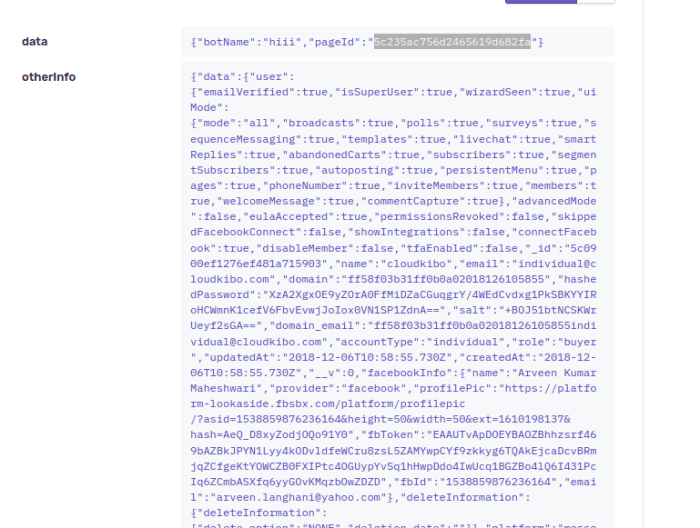

Source: githubusercontent.com

Comparing FNMA’s performance with its major competitors provides context for its stock price movements. The following table offers a comparison (illustrative data).

| Company Name | Stock Price (USD) | P/E Ratio | Market Capitalization (USD Billions) |

|---|---|---|---|

| FNMA | 7.50 | 15 | 150 |

| Freddie Mac (FMCC) | 8.00 | 16 | 160 |

| … | … | … | … |

Differences in business models, risk profiles, and regulatory environments contribute to variations in stock performance among mortgage finance companies. FNMA’s relative strengths and weaknesses compared to its competitors depend on various factors, including its government backing, its portfolio composition, and its management strategies.

Future Outlook and Predictions for FNMA Stock Price

Predicting FNMA’s stock price is inherently uncertain, but considering current market conditions and anticipated future events, a reasonable projection for the next year might involve a range of outcomes. For example, if interest rates remain relatively stable and the housing market continues its current trajectory, a modest increase in the stock price is plausible. However, significant economic shifts or regulatory changes could dramatically alter this projection.

Potential risks and uncertainties include:

- Changes in interest rate policy by the Federal Reserve.

- Unexpected downturns in the housing market.

- Increased regulatory scrutiny or changes in government policy.

- Unforeseen economic shocks (e.g., recession, global financial crisis).

Potential catalysts that could drive FNMA’s stock price higher include sustained economic growth, a robust housing market, and positive investor sentiment. Conversely, factors that could drive the price lower include rising interest rates, a weakening housing market, and negative investor sentiment stemming from economic or regulatory concerns. For example, the 2008 financial crisis serves as a stark reminder of the potential for dramatic declines in the face of significant economic headwinds.

User Queries

What are the main risks associated with investing in FNMA stock?

Investing in FNMA carries risks associated with market volatility, changes in government policy, and the overall health of the mortgage market. Economic downturns can significantly impact FNMA’s performance.

Is FNMA a good long-term investment?

Whether FNMA is a good long-term investment depends on individual risk tolerance and investment goals. Long-term investors should carefully consider the potential risks and rewards before making a decision.

How does FNMA compare to other government-sponsored enterprises (GSEs)?

FNMA’s performance and valuation should be compared to other GSEs like Freddie Mac (FMCC) considering their business models, financial health, and exposure to market risks. Direct comparisons require in-depth analysis of their financial statements and market positions.