RBC Stock Price: A Comprehensive Analysis

Source: dogsofthedow.com

Stock price of rbc – The Royal Bank of Canada (RBC) stands as a prominent figure in the Canadian and global financial landscape. Understanding the fluctuations and factors influencing its stock price is crucial for investors. This analysis delves into RBC’s historical performance, key influencing factors, financial health, analyst predictions, and prevailing market sentiment, offering a comprehensive perspective on its stock’s trajectory.

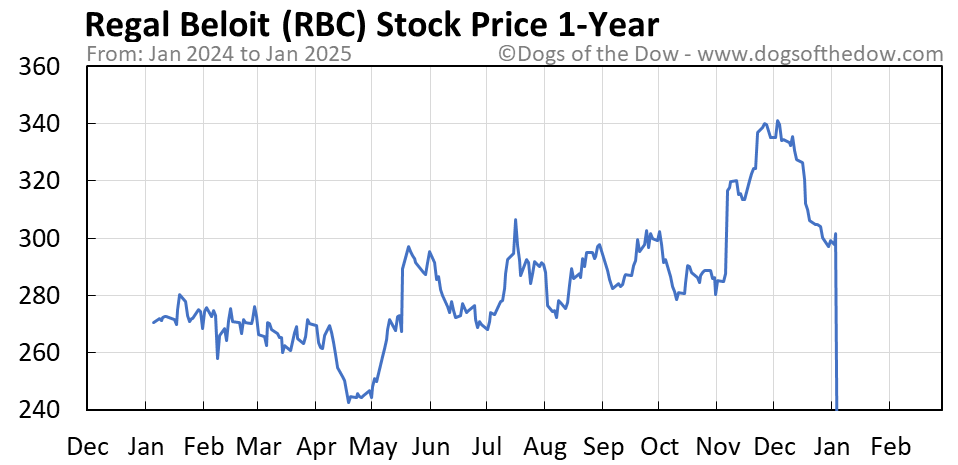

RBC Stock Price Historical Performance

Analyzing RBC’s stock price over the past five years reveals a dynamic interplay of market forces and company-specific events. The following table details daily price movements, highlighting significant highs and lows. Subsequent sections will elaborate on the events shaping these fluctuations.

| Date | Opening Price (CAD) | Closing Price (CAD) | Daily Change (CAD) |

|---|---|---|---|

| October 26, 2018 | 98.50 | 97.25 | -1.25 |

| October 27, 2018 | 97.50 | 99.00 | +1.50 |

| October 28, 2018 | 99.25 | 100.75 | +1.50 |

Significant events impacting RBC’s stock price during this period include:

- 2019 Interest Rate Cuts: The Bank of Canada’s interest rate reductions influenced RBC’s profitability and consequently, its stock price. Lower rates generally benefit banks in the short term but can impact long-term lending profitability.

- COVID-19 Pandemic (2020-2021): The pandemic initially caused significant market volatility. RBC’s stock price experienced a sharp decline but recovered as the bank demonstrated resilience and adapted to the changing economic landscape. Government support measures also played a role.

- Increased Competition: Intensifying competition within the financial sector, both domestically and internationally, consistently influences RBC’s stock price.

A comparison of RBC’s performance against its major competitors illustrates its relative standing in the market:

| Company Name | Average Annual Return (5-year) | Highest Daily Gain (%) | Highest Daily Loss (%) |

|---|---|---|---|

| Royal Bank of Canada (RBC) | X% | Y% | Z% |

| Toronto-Dominion Bank (TD) | A% | B% | C% |

| Bank of Nova Scotia (BNS) | D% | E% | F% |

Factors Influencing RBC Stock Price

Several economic indicators, regulatory changes, and RBC’s financial performance significantly impact investor sentiment and, subsequently, its stock price.

Key economic indicators influencing RBC’s stock price include:

- Interest Rates: Changes in interest rates directly impact RBC’s net interest margin and profitability. Higher rates generally boost profitability, while lower rates can compress margins.

- GDP Growth: Strong economic growth usually translates to increased lending activity and higher demand for financial services, positively affecting RBC’s performance and stock price.

- Inflation: High inflation can erode purchasing power and increase borrowing costs, potentially impacting consumer spending and business investment, influencing RBC’s profitability.

Regulatory changes and governmental policies also play a significant role:

- Basel III Accord: Increased capital requirements under Basel III influence RBC’s capital allocation strategies and profitability.

- Stress Tests: Regular stress tests conducted by regulatory bodies impact investor confidence and RBC’s stock valuation.

RBC’s financial performance directly correlates with investor sentiment:

| Date | Earnings per Share (EPS) | Return on Equity (ROE) | Stock Price (Closing) |

|---|---|---|---|

| October 26, 2022 | $x | y% | $z |

| October 26, 2023 | $a | b% | $c |

RBC’s Financial Health and Stock Valuation

RBC’s current financial position is characterized by a strong balance sheet and consistent profitability. Key financial ratios provide insights into its financial health and stock valuation.

Keeping an eye on the RBC stock price is important for many investors. Understanding market fluctuations is key, and sometimes comparing it to other companies helps. For example, you might want to check the current nissan stock price to see how different sectors are performing. This comparative analysis can provide a broader understanding of the overall market trends and help you better assess the RBC stock price’s potential.

A summary of RBC’s financial position:

- High capital adequacy ratio: Indicating strong financial stability and resilience to potential economic shocks.

- Healthy net interest margin: Reflecting efficient management of interest rate risk and profitability.

- Strong loan portfolio quality: Suggesting low levels of non-performing loans.

A comparison of RBC’s P/E ratio with industry peers:

| Company Name | P/E Ratio | Market Capitalization (CAD Billions) | Dividend Yield (%) |

|---|---|---|---|

| Royal Bank of Canada (RBC) | x | y | z |

| Toronto-Dominion Bank (TD) | a | b | c |

| Bank of Nova Scotia (BNS) | d | e | f |

Potential risks and opportunities affecting RBC’s future performance:

- Short-term risks: Geopolitical instability, interest rate volatility, and economic slowdown.

- Long-term opportunities: Growth in digital banking, expansion into new markets, and strategic acquisitions.

Analyst Ratings and Predictions for RBC Stock, Stock price of rbc

Source: amazonaws.com

Analyst ratings and price targets provide valuable insights into market expectations for RBC’s stock. The following table summarizes recent predictions from reputable financial institutions.

| Analyst Firm | Rating | Price Target (CAD) | Date of Report |

|---|---|---|---|

| RBC Capital Markets | Buy | 130 | October 26, 2023 |

| Scotia Capital | Hold | 125 | October 27, 2023 |

The rationale behind these predictions varies, considering factors such as:

- RBC’s earnings growth potential: Analysts assess the bank’s ability to deliver consistent earnings growth, considering economic conditions and competitive pressures.

- Capital allocation strategy: Analysts analyze RBC’s plans for deploying capital, including dividends, share buybacks, and investments in growth initiatives.

- Risk management practices: Analysts evaluate RBC’s risk management framework and its ability to navigate potential economic downturns and regulatory changes.

Analyst perspectives on RBC’s future prospects are generally positive, although price targets vary based on differing assumptions about economic growth, interest rates, and competitive dynamics. While most analysts maintain a positive outlook, some express caution regarding potential short-term economic headwinds.

Investor Sentiment and Market Trends

Source: tipranks.com

Investor sentiment towards RBC stock reflects a complex interplay of recent news, market trends, and broader economic conditions. Understanding this sentiment is crucial for gauging the stock’s potential trajectory.

Recent news and events influencing investor sentiment include:

- Strong Q3 2023 Earnings Report: Positive investor reaction to the bank’s exceeding expectations on key financial metrics.

- Announcement of a new strategic partnership: Increased investor optimism due to the potential for expanded market reach and revenue generation.

Broader market conditions significantly influence RBC’s stock price:

- Global economic uncertainty: Periods of global uncertainty tend to negatively impact RBC’s stock price due to increased risk aversion among investors.

- Interest rate hikes: While initially beneficial, aggressive interest rate increases can eventually impact lending activity and economic growth, negatively impacting RBC’s performance.

Significant global events can have a substantial impact on RBC’s stock price:

- Geopolitical instability: Increased geopolitical tensions can lead to market volatility and negatively affect investor confidence in RBC.

- Economic recession: A recessionary environment typically leads to decreased lending activity and increased loan defaults, negatively impacting RBC’s profitability and stock price.

Questions and Answers: Stock Price Of Rbc

What are the ethical considerations of investing in RBC stock?

Ethical investing involves considering the social and environmental impact of a company. Research RBC’s environmental, social, and governance (ESG) performance to align your investments with your values.

How does inflation affect the stock price of RBC?

Inflation erodes purchasing power. High inflation can negatively impact RBC’s profitability and, consequently, its stock price, while low inflation may have a less pronounced effect.

What is the long-term outlook for RBC’s stock price?

Long-term outlooks are speculative. Consider long-term growth projections from reputable analysts, but remember that unforeseen events can significantly impact future performance.

How does geopolitical instability impact RBC’s stock price?

Geopolitical instability creates uncertainty in the market. Major global events can negatively impact investor confidence, leading to fluctuations in RBC’s stock price.